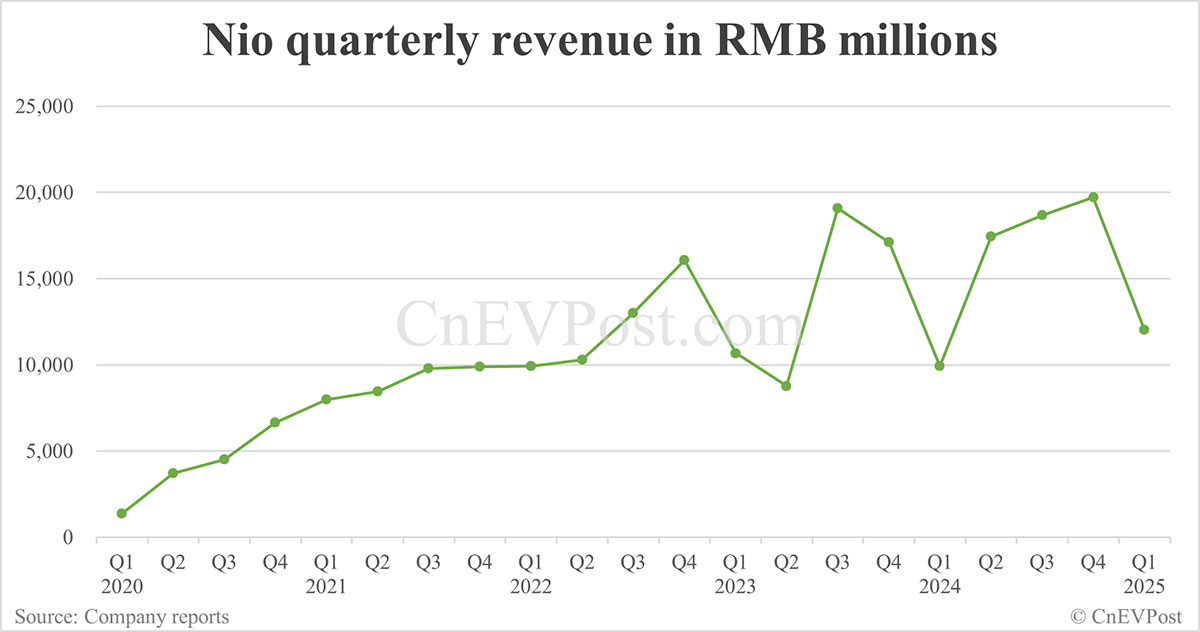

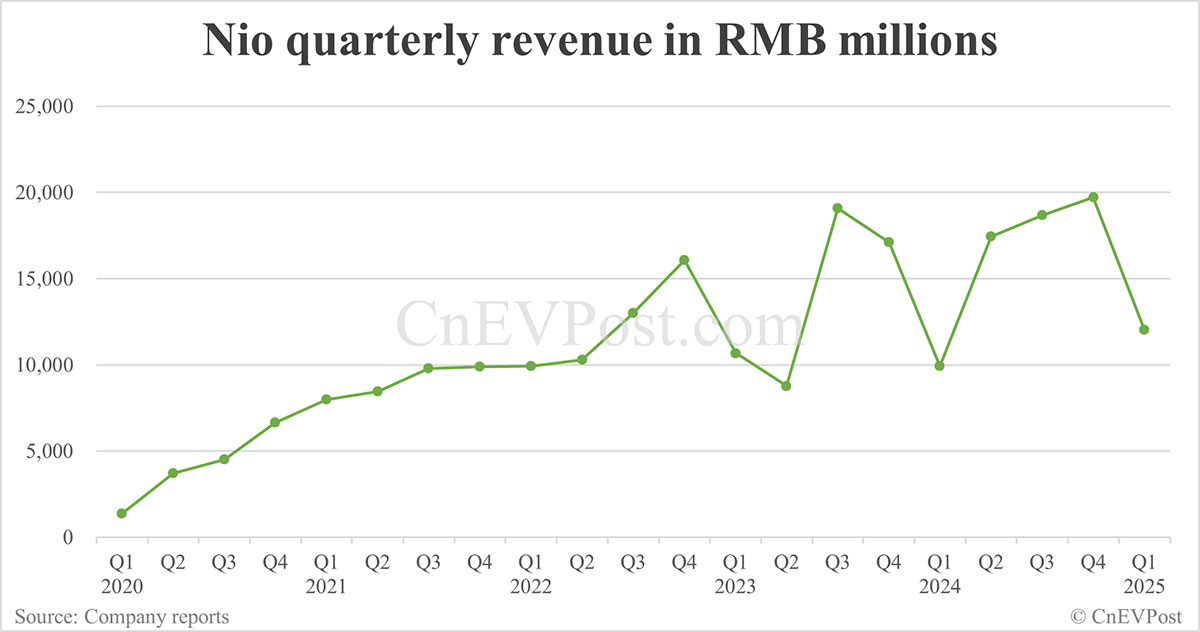

Analysis: Nio's 21% Q1 Revenue Growth – A Detailed Look

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Analysis: Nio's 21% Q1 Revenue Growth – A Detailed Look

NIO, a leading Chinese electric vehicle (EV) manufacturer, reported a robust 21% year-over-year revenue growth in its first quarter of 2024, reaching [Insert Actual Revenue Figure Here]. This significant jump, while impressive, presents a complex picture requiring deeper analysis beyond the headline numbers. Did this growth truly signal a sustained upward trajectory for the company, or are there underlying factors that temper the optimism? Let's delve into the details.

Key Factors Driving Q1 Revenue Growth:

-

Strong Vehicle Deliveries: NIO's Q1 success hinges largely on a substantial increase in vehicle deliveries. The company delivered [Insert Actual Delivery Figures Here] vehicles, representing a [Insert Percentage Increase Here]% increase compared to the same period last year. This surge can be attributed to several factors, including increased production capacity, the launch of new models, and a generally improving market sentiment for EVs in China.

-

New Model Success: The introduction of the [Mention Specific New Models and their impact] played a significant role in boosting sales. These models, known for their [Mention Key Features and Selling Points – e.g., advanced technology, competitive pricing], clearly resonated with consumers.

-

Expanding Infrastructure: NIO's commitment to building out its battery swap network and charging infrastructure is a crucial differentiator. This expanding network offers consumers greater convenience and alleviates range anxiety, a major factor influencing EV adoption. The continued investment in this area likely contributed to the strong sales figures.

-

Government Incentives: While not explicitly stated by NIO, the continued government support for the EV sector in China undoubtedly played a positive role in boosting overall market demand. These incentives make EVs more affordable and attractive to a wider range of consumers.

Challenges and Considerations:

While the 21% revenue growth is undoubtedly positive, several challenges remain:

-

Intense Competition: The Chinese EV market is incredibly competitive, with established players like BYD and newer entrants constantly vying for market share. Maintaining this growth rate will require NIO to continue innovating and adapting to the dynamic market landscape.

-

Global Economic Uncertainty: Global economic headwinds, including inflation and potential recessionary pressures, could impact consumer spending on luxury goods like EVs. NIO's success will depend on its ability to navigate these uncertainties.

-

Supply Chain Issues: While seemingly improving, supply chain disruptions remain a potential risk. Any significant disruptions could hamper production and negatively impact future revenue growth.

Looking Ahead:

NIO's Q1 results suggest a positive trajectory, but sustained success requires a multifaceted approach. The company's focus on technological innovation, expansion of its infrastructure, and strategic management of supply chain risks will be crucial in maintaining its growth momentum. Further analysis of future quarters will be necessary to determine whether this Q1 performance represents a sustained trend or a temporary surge.

What does this mean for investors?

NIO's strong Q1 performance offers a positive outlook for investors, but it's crucial to remember that the EV market remains volatile. Potential investors should conduct thorough due diligence and consider the inherent risks before making any investment decisions. Further research into NIO's future product roadmap and market strategies is recommended.

Keywords: NIO, Nio Q1 2024, Electric Vehicle, EV, Revenue Growth, China EV Market, Stock Market, Investment, Technology, Battery Swap, Charging Infrastructure, Competition, Supply Chain.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Analysis: Nio's 21% Q1 Revenue Growth – A Detailed Look. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Donald Trump And Scott Walker A Political Partnership Gone Wrong

Jun 04, 2025

Donald Trump And Scott Walker A Political Partnership Gone Wrong

Jun 04, 2025 -

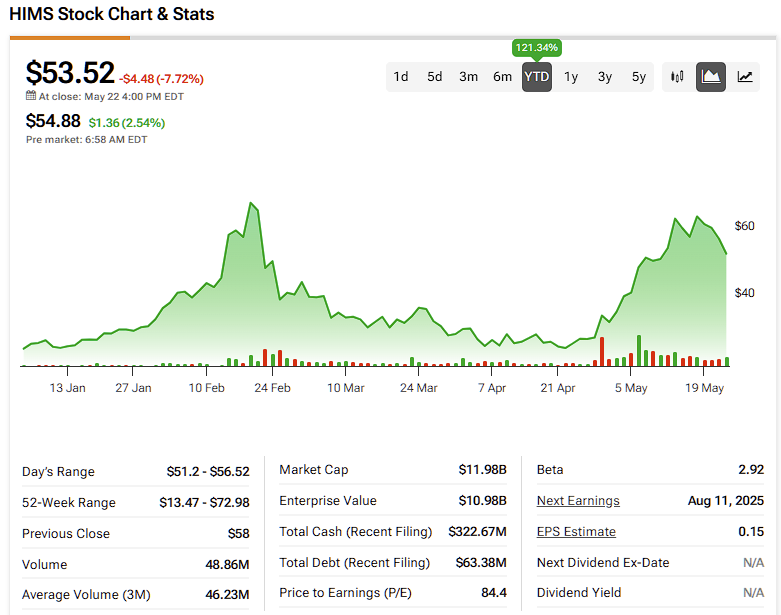

Hims And Hers Health Hims Stock A Potential Investment Opportunity

Jun 04, 2025

Hims And Hers Health Hims Stock A Potential Investment Opportunity

Jun 04, 2025 -

Billion Dollar Deal Subway Expands Its Restaurant Empire With Chicken Chain Purchase

Jun 04, 2025

Billion Dollar Deal Subway Expands Its Restaurant Empire With Chicken Chain Purchase

Jun 04, 2025 -

Significant Changes For India And Thailand Marquez Previews Friendly Match

Jun 04, 2025

Significant Changes For India And Thailand Marquez Previews Friendly Match

Jun 04, 2025 -

Successions Mountainhead Exploring The Influence Of Real World Tech Leaders

Jun 04, 2025

Successions Mountainhead Exploring The Influence Of Real World Tech Leaders

Jun 04, 2025