America's Economic Future: The High-Stakes Debate Over Clean Energy Taxes

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

America's Economic Future: The High-Stakes Debate Over Clean Energy Taxes

America stands at a crossroads. The urgent need to combat climate change clashes with concerns about economic competitiveness, sparking a fierce debate around clean energy taxes and their potential impact on the nation's future. Will investing in a green economy boost prosperity or cripple growth? The answer, experts argue, is far from simple.

The Push for Clean Energy: A Necessary Investment or Economic Burden?

The transition to clean energy is widely acknowledged as crucial for mitigating the effects of climate change. However, the path forward is fraught with economic complexities. Proponents of significant clean energy investments argue that the long-term benefits far outweigh the short-term costs. They point to the potential for job creation in renewable energy sectors, technological innovation, and a more sustainable and resilient economy. Furthermore, the economic consequences of inaction on climate change – from extreme weather events to disruptions in supply chains – are potentially far more devastating. The Inflation Reduction Act, for example, represents a significant step towards incentivizing clean energy adoption through tax credits and other financial mechanisms. [Link to relevant government website about the Inflation Reduction Act].

The Counterargument: Economic Concerns and the Burden on Taxpayers

Opponents of hefty clean energy taxes raise concerns about the potential impact on businesses, consumers, and the overall economy. They argue that increased taxes on carbon emissions or energy production could lead to higher prices for goods and services, stifle economic growth, and disproportionately affect low-income households. The potential for job losses in traditional energy sectors also fuels opposition, demanding a measured and gradual transition to avoid widespread economic disruption. Concerns about the competitiveness of American businesses in a global market are also frequently raised, particularly when comparing tax burdens with those in other countries.

Navigating the Middle Ground: Finding a Balanced Approach

The debate over clean energy taxes isn't simply about environmentalism versus economics; it's about finding a balanced approach that fosters both environmental sustainability and economic prosperity. Several key aspects need careful consideration:

-

Targeted Incentives: Instead of broad-based taxes, focusing on targeted incentives for clean energy technologies and research could stimulate innovation and growth without placing an undue burden on taxpayers.

-

Carbon Pricing Mechanisms: Implementing a well-designed carbon pricing system, such as a carbon tax or cap-and-trade program, could effectively incentivize emissions reductions while generating revenue that can be used to fund clean energy initiatives or offset other taxes. [Link to a reputable article on carbon pricing mechanisms].

-

Investing in Workforce Transition: A just transition plan is essential to support workers and communities affected by the shift away from fossil fuels. Retraining programs and investment in new industries are crucial for mitigating job losses and ensuring a smooth transition to a cleaner economy.

-

International Cooperation: Addressing climate change requires global collaboration. Harmonizing policies and regulations internationally can level the playing field for American businesses and prevent “carbon leakage,” where industries relocate to countries with less stringent environmental regulations.

The Road Ahead: A Crucial Decision for America's Future

The debate over clean energy taxes is far from over. It will continue to shape policy discussions and influence the economic trajectory of the United States for years to come. Finding a solution that balances environmental responsibility with economic viability requires careful consideration of all stakeholders and a commitment to evidence-based policymaking. The future of the American economy, and indeed the planet, depends on it. This ongoing conversation demands informed public discourse and a willingness to find common ground to ensure a sustainable and prosperous future for all Americans.

Call to Action: Stay informed about the latest developments in clean energy policy and participate in the conversation by contacting your elected officials and sharing your perspective. Learn more about the different approaches to clean energy taxation and the potential economic impacts by researching reputable sources.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on America's Economic Future: The High-Stakes Debate Over Clean Energy Taxes. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

No Cable Needed Watch Liberty Vs Aces Wnba Game For Free 2025

May 17, 2025

No Cable Needed Watch Liberty Vs Aces Wnba Game For Free 2025

May 17, 2025 -

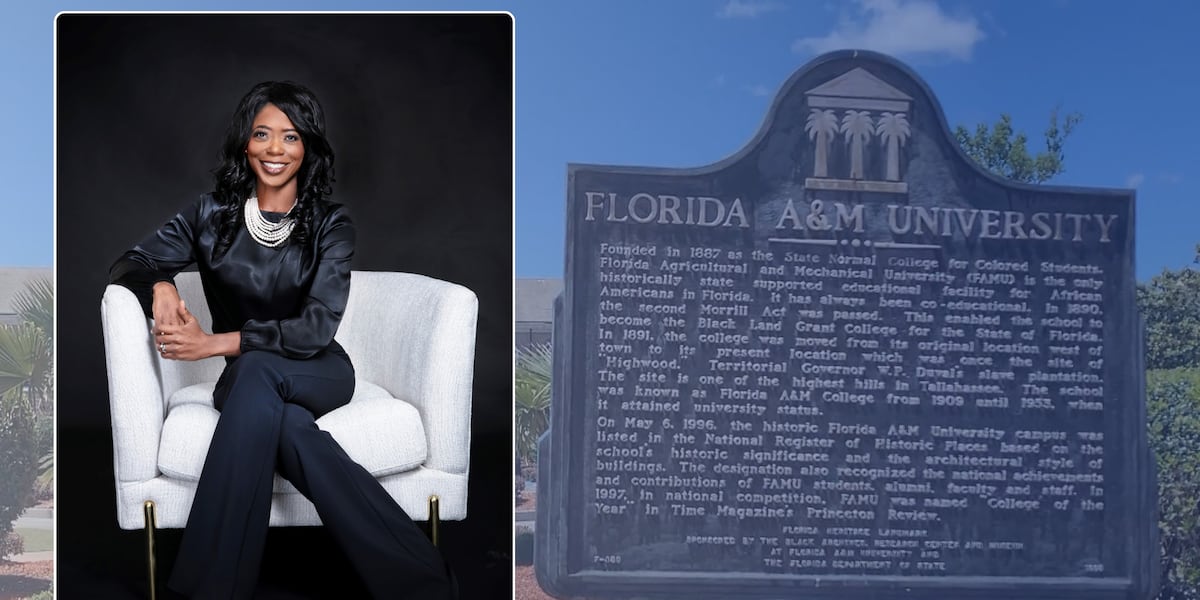

Marva Johnson Named Final Candidate For Florida A And M Universitys Top Post

May 17, 2025

Marva Johnson Named Final Candidate For Florida A And M Universitys Top Post

May 17, 2025 -

Manchester United Vs Chelsea Odds Best Bets And Premier League Predictions For Friday

May 17, 2025

Manchester United Vs Chelsea Odds Best Bets And Premier League Predictions For Friday

May 17, 2025 -

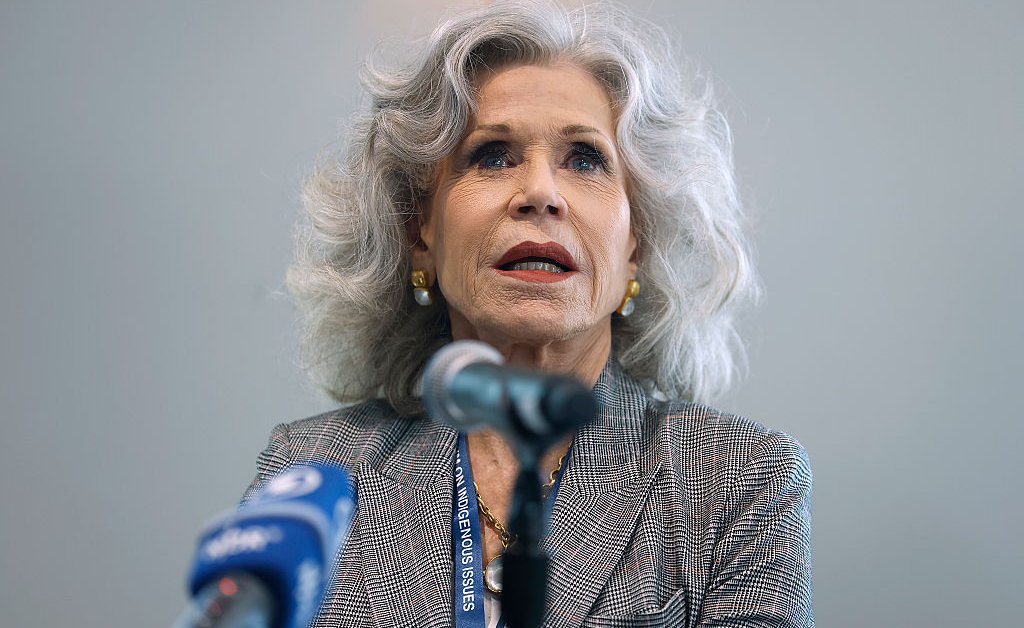

Jane Fondas Campaign To Save Ecuadors Amazon Challenges And Progress

May 17, 2025

Jane Fondas Campaign To Save Ecuadors Amazon Challenges And Progress

May 17, 2025 -

Deciphering 86 47 What Led To The Investigation Of James Comey

May 17, 2025

Deciphering 86 47 What Led To The Investigation Of James Comey

May 17, 2025