Alliant Energy (LNT): Strong Institutional Backing With 83% Ownership

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Alliant Energy (LNT): Institutional Investors Show Strong Confidence with 83% Ownership

Alliant Energy (LNT), a prominent player in the energy sector, is attracting significant attention due to the remarkably high level of institutional ownership. With a staggering 83% of shares held by institutions, Alliant Energy boasts a level of confidence from major investors rarely seen in the industry. This significant institutional backing signals a strong belief in the company's long-term growth potential and financial stability. But what exactly drives this high level of institutional interest? Let's delve deeper.

Why the Institutional Rush to Alliant Energy?

Several factors contribute to the robust institutional investment in Alliant Energy (LNT). These include:

-

Stable and Predictable Earnings: Alliant Energy operates in a regulated utility environment, providing a relatively stable and predictable revenue stream. This makes it an attractive option for investors seeking consistent returns, particularly institutions managing large portfolios. This predictable income stream mitigates some of the risks associated with more volatile sectors.

-

Commitment to Renewable Energy: Alliant Energy's commitment to renewable energy sources, such as wind and solar power, aligns with the growing global focus on sustainable energy solutions. This commitment resonates strongly with environmentally conscious institutional investors who are increasingly integrating ESG (Environmental, Social, and Governance) factors into their investment decisions. Their investments in renewable energy infrastructure represent a long-term strategy towards a sustainable future.

-

Strategic Acquisitions and Growth Initiatives: Alliant Energy has demonstrated a history of strategic acquisitions and growth initiatives, expanding its market reach and strengthening its overall position in the energy market. This proactive approach further enhances investor confidence in the company's future prospects. This includes significant investments in grid modernization and improvements, vital for a reliable energy future.

-

Strong Dividend Yield: Alliant Energy maintains a consistent dividend payout, attractive to income-seeking institutional investors. This reliable dividend stream provides a steady return on investment, contributing to the overall appeal for long-term holders.

The Impact of High Institutional Ownership

The high institutional ownership of Alliant Energy (LNT) translates to several key benefits:

-

Increased Market Stability: A large institutional presence tends to provide stability to the stock price, mitigating the impact of short-term market fluctuations. Large investors are less likely to engage in rapid trading, leading to a more stable share price.

-

Enhanced Corporate Governance: Institutions often actively engage in corporate governance, advocating for best practices and transparency. This scrutiny can contribute to improved corporate governance and long-term value creation.

-

Greater Liquidity: The high trading volume associated with institutional ownership generally leads to increased liquidity, making it easier for investors to buy and sell shares.

Looking Ahead:

Alliant Energy's strong institutional backing suggests a positive outlook for the company. Its commitment to renewable energy, stable earnings, and strategic growth initiatives position it well for continued success in the evolving energy landscape. While no investment is without risk, the significant institutional confidence in Alliant Energy (LNT) warrants careful consideration by investors.

Disclaimer: This article is for informational purposes only and should not be considered as financial advice. Always consult with a qualified financial advisor before making any investment decisions. For more information on Alliant Energy, please visit their . You can also research the company's financial performance through reputable financial news sources such as or .

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Alliant Energy (LNT): Strong Institutional Backing With 83% Ownership. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Ideal Thermostat Temperature For Summer Heatwaves Expert Advice

Jun 24, 2025

Ideal Thermostat Temperature For Summer Heatwaves Expert Advice

Jun 24, 2025 -

Live Updates Stock Futures Climb After Trumps Ceasefire Claim On Iran Israel

Jun 24, 2025

Live Updates Stock Futures Climb After Trumps Ceasefire Claim On Iran Israel

Jun 24, 2025 -

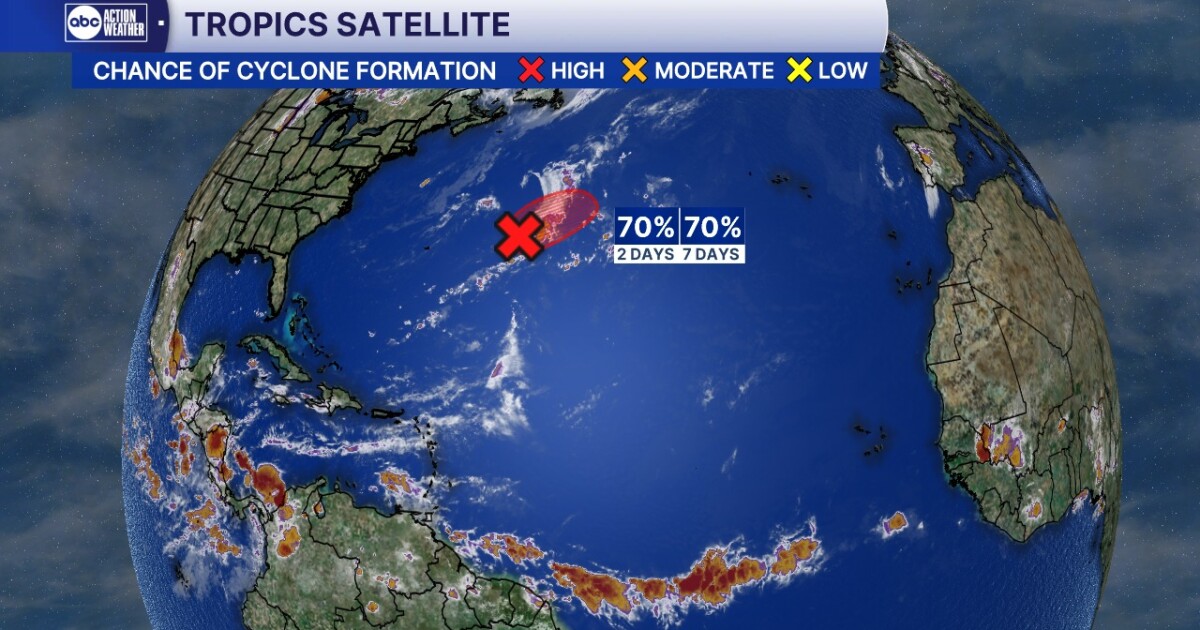

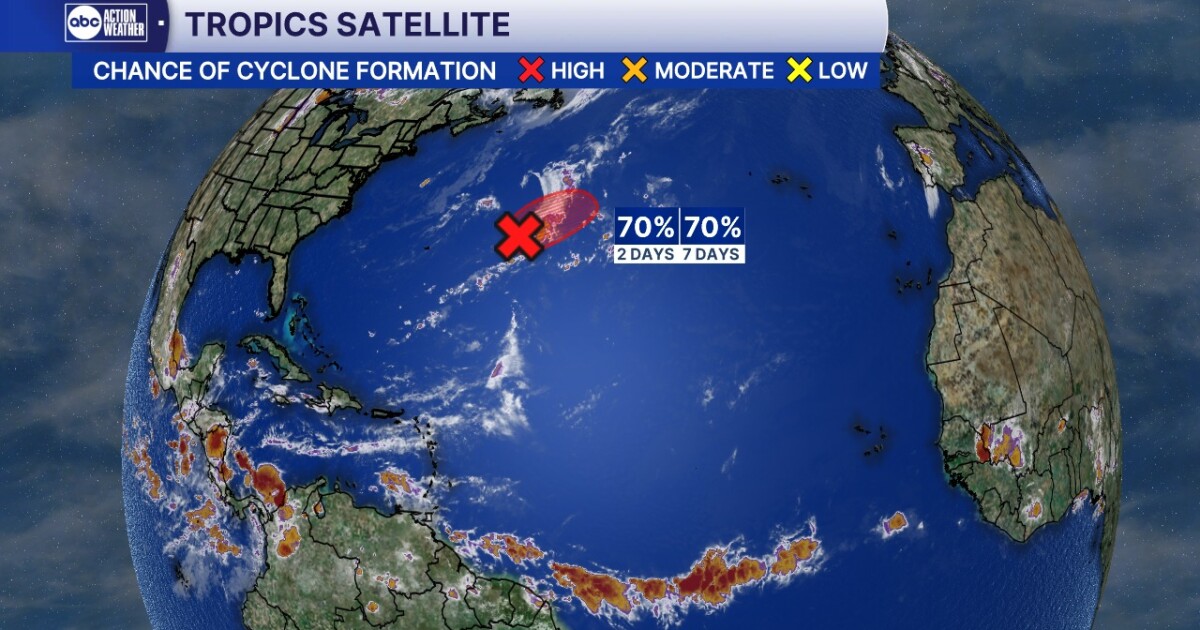

2025 Hurricane Season Begins Early Tropical Storm Andrea Forecast

Jun 24, 2025

2025 Hurricane Season Begins Early Tropical Storm Andrea Forecast

Jun 24, 2025 -

2025 Hurricane Season Update Tropical Storm Andrea Formation Imminent

Jun 24, 2025

2025 Hurricane Season Update Tropical Storm Andrea Formation Imminent

Jun 24, 2025 -

Rogers Second Big League Start Expectations And Key Observations

Jun 24, 2025

Rogers Second Big League Start Expectations And Key Observations

Jun 24, 2025