Alliant Energy (LNT) Stock: High Institutional Ownership Signals Stability

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Alliant Energy (LNT) Stock: High Institutional Ownership Signals Stability

Alliant Energy Corporation (LNT), a prominent player in the energy sector, has recently seen its stock attract significant attention from institutional investors. This high level of institutional ownership suggests a degree of confidence and stability in the company's future prospects, making it a compelling stock for investors to consider. But what does this truly mean for potential investors, and should you add LNT to your portfolio? Let's delve deeper.

What Does High Institutional Ownership Mean?

Institutional investors, such as mutual funds, pension funds, and hedge funds, manage vast sums of money. Their investment decisions are typically driven by rigorous due diligence and analysis. When a significant portion of a company's stock is held by these institutions, it generally indicates a level of confidence in the company's long-term viability and potential for growth. This is because these institutions are less likely to engage in short-term speculation and are more focused on sustained, long-term returns. Alliant Energy's high institutional ownership, therefore, can be seen as a positive indicator of its stability and future potential.

Alliant Energy's Strong Fundamentals

Beyond the high institutional ownership, Alliant Energy boasts a number of strong fundamental attributes that contribute to its attractiveness:

-

Diversified Portfolio: Alliant Energy operates across multiple segments, including electric and gas utilities, providing a degree of insulation against risks associated with reliance on a single energy source. This diversification is a key factor contributing to investor confidence.

-

Renewable Energy Focus: The company is actively investing in renewable energy sources, aligning with the growing global demand for sustainable energy solutions. This commitment to clean energy positions Alliant Energy favorably for long-term growth in a rapidly evolving market. Learn more about Alliant Energy's renewable energy initiatives on their . (This is a placeholder; replace with the actual URL if available).

-

Stable Earnings: Alliant Energy has historically demonstrated relatively stable earnings, a crucial factor for investors seeking dependable income streams. This consistent performance further bolsters institutional investor confidence.

Analyzing the Risk Factors

While the high institutional ownership and strong fundamentals paint a positive picture, it's crucial to consider potential risk factors:

-

Regulatory Changes: The energy sector is heavily regulated, and changes in regulations could impact Alliant Energy's profitability and operations. Investors need to be aware of and monitor potential regulatory shifts.

-

Economic Fluctuations: Economic downturns can impact energy demand, potentially affecting Alliant Energy's revenue streams. Understanding the cyclical nature of the energy market is vital for informed investment decisions.

Should You Invest in Alliant Energy (LNT)?

The high institutional ownership of Alliant Energy (LNT) stock, coupled with its strong fundamentals and commitment to renewable energy, presents a compelling case for investment. However, potential investors should always conduct thorough due diligence, considering the inherent risks associated with any investment, particularly in the volatile energy sector. Analyzing current market conditions, comparing LNT to competitors, and consulting with a financial advisor are crucial steps before making any investment decisions.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in the stock market involves risk, and you could lose money.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Alliant Energy (LNT) Stock: High Institutional Ownership Signals Stability. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

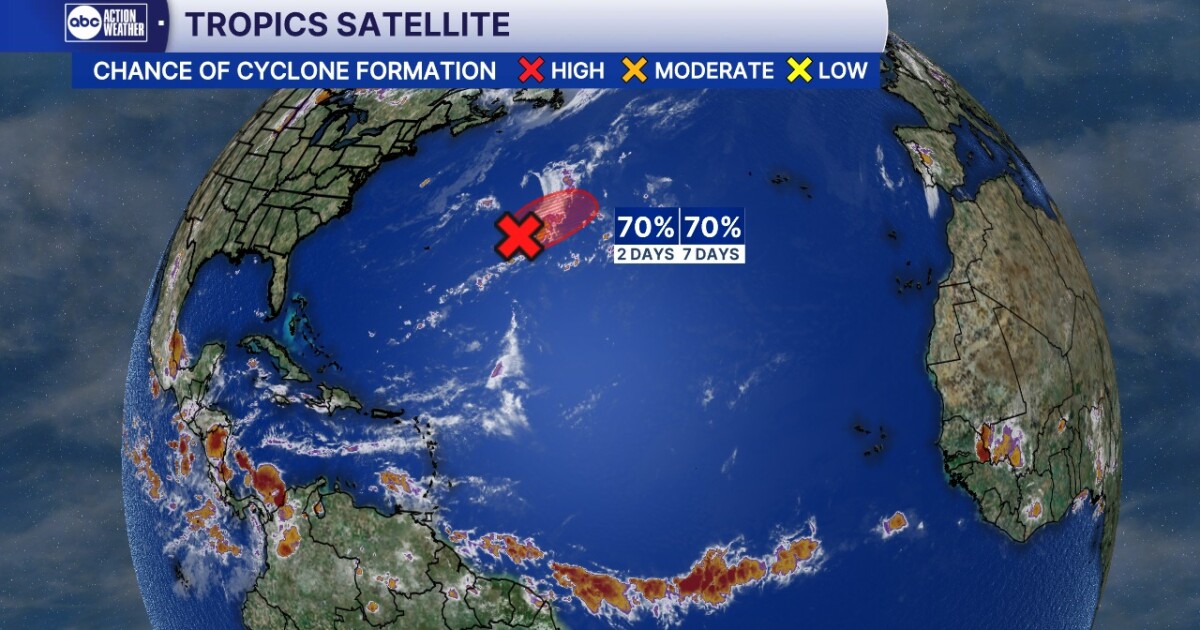

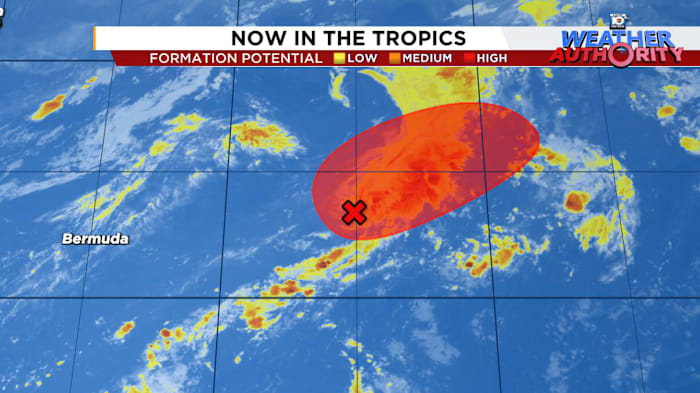

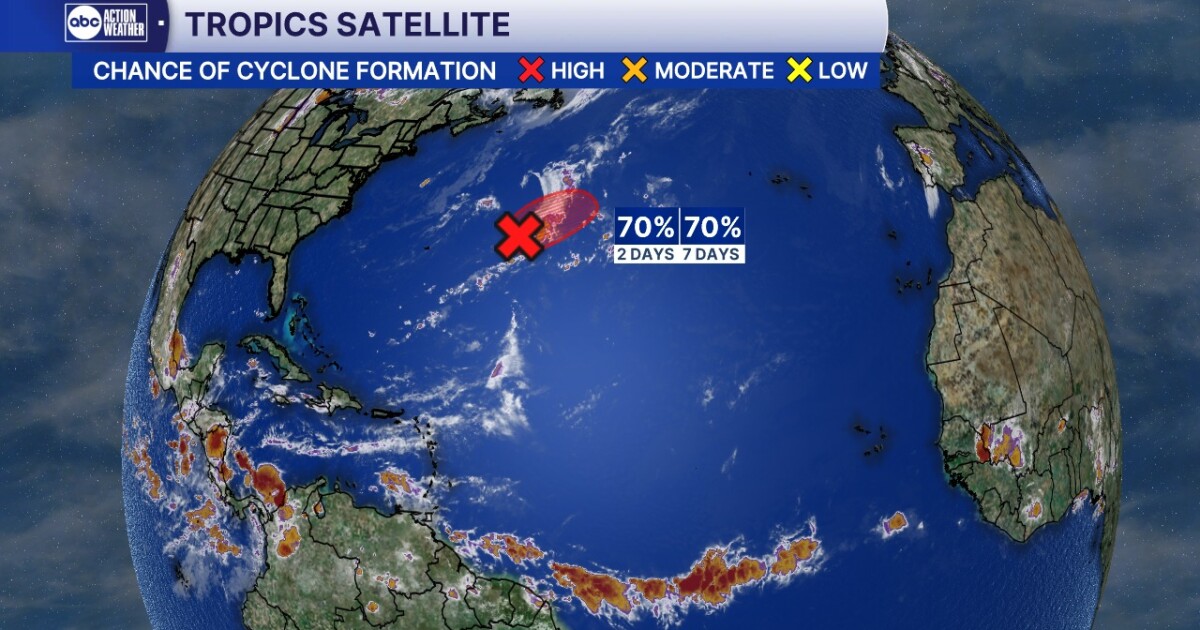

Is Tropical Storm Andrea The First Hurricane Of 2025 Latest Updates

Jun 24, 2025

Is Tropical Storm Andrea The First Hurricane Of 2025 Latest Updates

Jun 24, 2025 -

Rogers Back On The Mound Performance Analysis Of His Second Game

Jun 24, 2025

Rogers Back On The Mound Performance Analysis Of His Second Game

Jun 24, 2025 -

Under The Radar Spencer Schwellenbachs Rise To Cy Young Potential

Jun 24, 2025

Under The Radar Spencer Schwellenbachs Rise To Cy Young Potential

Jun 24, 2025 -

The Atlantic Speaks Unprecedented Ocean Event Imminent

Jun 24, 2025

The Atlantic Speaks Unprecedented Ocean Event Imminent

Jun 24, 2025 -

2025 Hurricane Season Begins Tropical Storm Andrea Forecast In Next 48 Hours

Jun 24, 2025

2025 Hurricane Season Begins Tropical Storm Andrea Forecast In Next 48 Hours

Jun 24, 2025