Alliant Energy (LNT): Analyzing The Significance Of High Institutional Ownership

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Alliant Energy (LNT): Why High Institutional Ownership Matters

Alliant Energy (LNT), a prominent player in the energy sector, boasts a significant level of institutional ownership. This isn't just a statistical anomaly; it speaks volumes about investor confidence and the company's long-term prospects. But what exactly does high institutional ownership mean, and why should individual investors take note? This article delves into the significance of Alliant Energy's institutional investor base and what it implies for future performance.

Understanding Institutional Investors

Before we analyze Alliant Energy's specific situation, let's clarify who institutional investors are. These aren't your average everyday investors. They are large-scale investors like mutual funds (e.g., Fidelity, Vanguard), pension funds, hedge funds, and insurance companies. They manage vast sums of money and conduct extensive due diligence before making investment decisions. Their actions often serve as a strong indicator of a company's financial health and growth potential.

Alliant Energy's Strong Institutional Backing

Alliant Energy's high institutional ownership isn't a secret. A significant portion of its outstanding shares are held by these sophisticated investors. This substantial presence reflects a collective belief in the company's strategy, management team, and future earnings potential. This confidence is further bolstered by Alliant Energy's consistent performance in delivering reliable energy services and its commitment to renewable energy sources. Their investment represents a vote of confidence in LNT's long-term viability.

The Implications of High Institutional Ownership for Alliant Energy (LNT)

Several key implications arise from Alliant Energy's high institutional ownership:

- Increased Market Stability: Large institutional investors tend to be long-term holders, reducing the volatility associated with short-term trading. This can lead to a more stable stock price for LNT.

- Enhanced Corporate Governance: Institutional investors often actively engage with company management, promoting better corporate governance practices and accountability. This can result in improved operational efficiency and strategic decision-making at Alliant Energy.

- Access to Capital: High institutional ownership can facilitate easier access to capital for future growth initiatives. This is particularly crucial for a company operating in the capital-intensive energy sector.

- Increased Analyst Coverage: Companies with significant institutional ownership often attract more attention from financial analysts, leading to increased research coverage and more accurate valuation assessments.

Factors Contributing to Alliant Energy's Institutional Appeal

Several factors likely contribute to the high level of institutional ownership in Alliant Energy:

- Dividend Growth: Alliant Energy has a history of providing consistent and growing dividend payouts, making it attractive to income-seeking investors.

- Renewable Energy Focus: The company's increasing investment in renewable energy projects aligns with the growing global demand for sustainable energy solutions. This positions them favorably for long-term growth.

- Regulatory Stability: Operating within a relatively stable regulatory environment provides predictability and reduces investment risk.

Risks to Consider

While high institutional ownership is generally positive, it's crucial to acknowledge potential risks:

- Market Sentiment: Even institutional investors can be susceptible to broader market trends. Negative market sentiment could lead to sell-offs, impacting the stock price.

- Concentration Risk: A high concentration of ownership in a few large institutions could potentially limit liquidity.

Conclusion:

Alliant Energy's (LNT) high institutional ownership is a strong positive indicator, suggesting confidence in the company's future prospects. While no investment is without risk, the combination of consistent dividend growth, focus on renewable energy, and strong corporate governance makes Alliant Energy a compelling investment opportunity. However, potential investors should conduct their own thorough due diligence before making any investment decisions. Always consult with a financial advisor before making significant investment choices. Stay informed about Alliant Energy’s progress by regularly reviewing their investor relations materials.

Keywords: Alliant Energy, LNT, Institutional Ownership, Stock Market, Energy Sector, Renewable Energy, Dividend Growth, Investment Analysis, Financial News, Stock Investment, Utility Stocks

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in the stock market involves risk, and you could lose money.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Alliant Energy (LNT): Analyzing The Significance Of High Institutional Ownership. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Spencer Schwellenbach The Braves Unsung Cy Young Contender

Jun 24, 2025

Spencer Schwellenbach The Braves Unsung Cy Young Contender

Jun 24, 2025 -

Us Intervention In The Middle East A Reversal Of Trumps Promises

Jun 24, 2025

Us Intervention In The Middle East A Reversal Of Trumps Promises

Jun 24, 2025 -

Handleys Concussion Orioles Roster Move And Call Up

Jun 24, 2025

Handleys Concussion Orioles Roster Move And Call Up

Jun 24, 2025 -

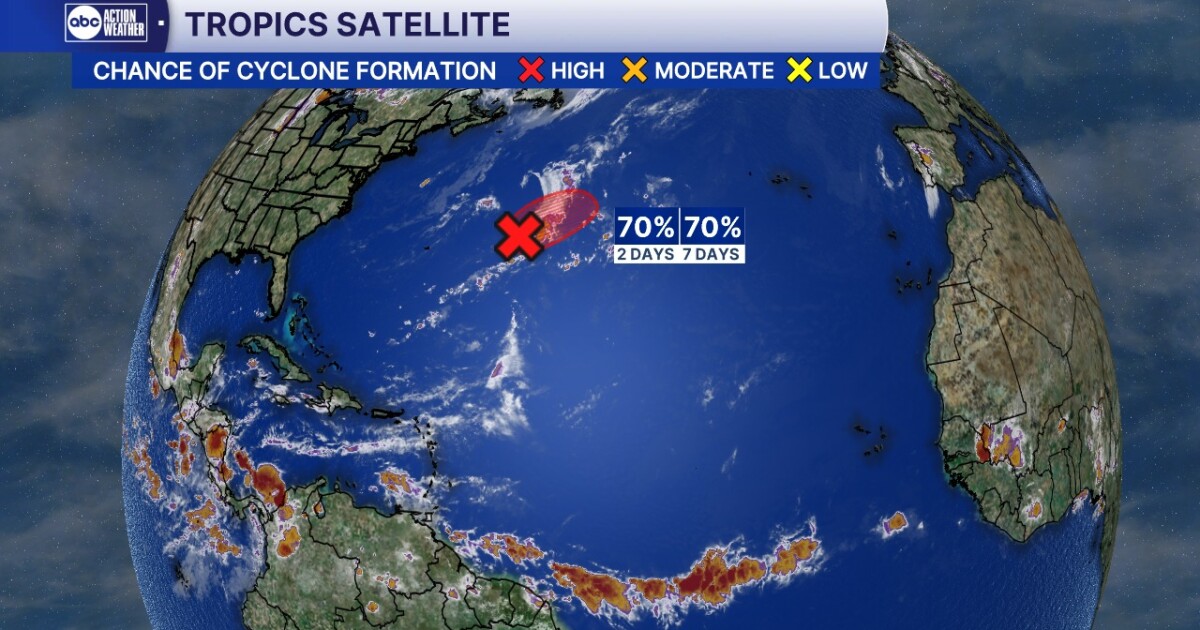

First Named Storm Of 2025 Tropical Storm Andrea Threatens

Jun 24, 2025

First Named Storm Of 2025 Tropical Storm Andrea Threatens

Jun 24, 2025 -

The Pressure Mounts Trevor Rogers Impact On Mike Elias Tenure With Baltimore

Jun 24, 2025

The Pressure Mounts Trevor Rogers Impact On Mike Elias Tenure With Baltimore

Jun 24, 2025