AAA Car Insurance: Rate Hikes Predicted For 2025

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

AAA Car Insurance: Rate Hikes Predicted for 2025 – What Drivers Need to Know

Are you prepared for a potential increase in your AAA car insurance premiums? Experts predict significant rate hikes for AAA and other car insurance providers in 2025, leaving many drivers scrambling to understand why and how to mitigate the impact. This article dives into the factors contributing to these predicted increases and offers advice on how to navigate this challenging financial landscape.

Why the Expected Increase in AAA Car Insurance Rates?

Several key factors are converging to create a perfect storm for higher car insurance premiums in 2025, particularly impacting AAA members.

-

Inflation and Increased Repair Costs: The rising cost of vehicle parts and labor is a major driver. Inflation continues to impact the entire automotive industry, making repairs more expensive and pushing insurance payouts higher. This directly translates to increased premiums for consumers.

-

Supply Chain Issues: The lingering effects of global supply chain disruptions continue to affect the availability of parts, leading to longer repair times and further increasing costs for insurance companies.

-

Higher Claim Frequency and Severity: With increased traffic congestion in many areas and distracted driving remaining a prevalent issue, the number and severity of car accidents are unfortunately increasing. This leads to more claims filed with insurance providers, adding pressure on rates.

-

Increased Use of Advanced Driver-Assistance Systems (ADAS): While ADAS features aim to improve safety, repairing these complex systems can be extremely costly, further impacting insurance claim payouts.

-

Natural Disasters and Extreme Weather: The increasing frequency and intensity of extreme weather events, such as hurricanes and floods, result in more significant damage to vehicles, leading to higher claim costs for insurers.

What Can AAA Members Do to Prepare?

Facing potential rate hikes can be unsettling, but proactive steps can help mitigate the impact:

-

Shop Around: Don't be afraid to compare quotes from other reputable car insurance providers. While you value your AAA membership, it's crucial to ensure you're getting the best rate possible. Use online comparison tools to streamline the process.

-

Review Your Coverage: Carefully examine your current coverage. Do you really need all the add-ons? Reducing unnecessary coverage can help lower your premium.

-

Improve Your Driving Record: Maintaining a clean driving record is one of the best ways to keep your insurance premiums low. Avoid speeding tickets and accidents.

-

Consider Bundling: If possible, bundle your car insurance with other insurance policies, such as homeowners or renters insurance, to potentially qualify for discounts.

-

Maintain a Good Credit Score: Your credit score can impact your insurance premiums. Work towards improving your credit score if necessary.

-

Install Anti-theft Devices: Installing anti-theft devices can often earn you a discount on your car insurance.

Looking Ahead:

The predicted rate hikes for AAA car insurance in 2025 underscore the importance of financial preparedness and proactive planning. By taking the steps outlined above, you can better manage your car insurance costs and navigate this challenging period with greater confidence. Stay informed about changes in the insurance market and don't hesitate to contact your AAA insurance representative to discuss your options. Remember, being proactive is key to managing your automotive expenses.

Keywords: AAA car insurance, car insurance rates, 2025 insurance predictions, car insurance increase, AAA insurance cost, auto insurance, insurance premiums, car insurance quotes, driving record, insurance discounts, inflation, supply chain, ADAS, extreme weather

(Note: This article provides general information and does not constitute financial advice. Always consult with a qualified financial advisor or your insurance provider for personalized guidance.)

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on AAA Car Insurance: Rate Hikes Predicted For 2025. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Alaskan Romantic Drama Dakota Fanning Jake Johnson And Cory Michael Smith Join Forces

Aug 07, 2025

Alaskan Romantic Drama Dakota Fanning Jake Johnson And Cory Michael Smith Join Forces

Aug 07, 2025 -

Top 10 Emergency Room Symptoms When To Seek Immediate Care

Aug 07, 2025

Top 10 Emergency Room Symptoms When To Seek Immediate Care

Aug 07, 2025 -

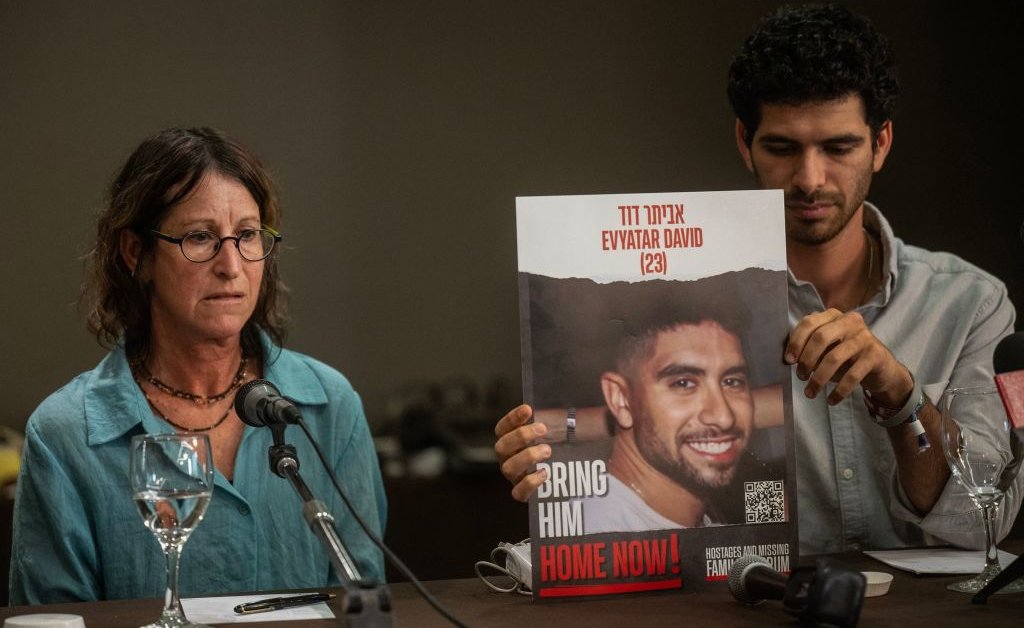

Concerns Rise As Hamas Releases Video Of Captured Israeli

Aug 07, 2025

Concerns Rise As Hamas Releases Video Of Captured Israeli

Aug 07, 2025 -

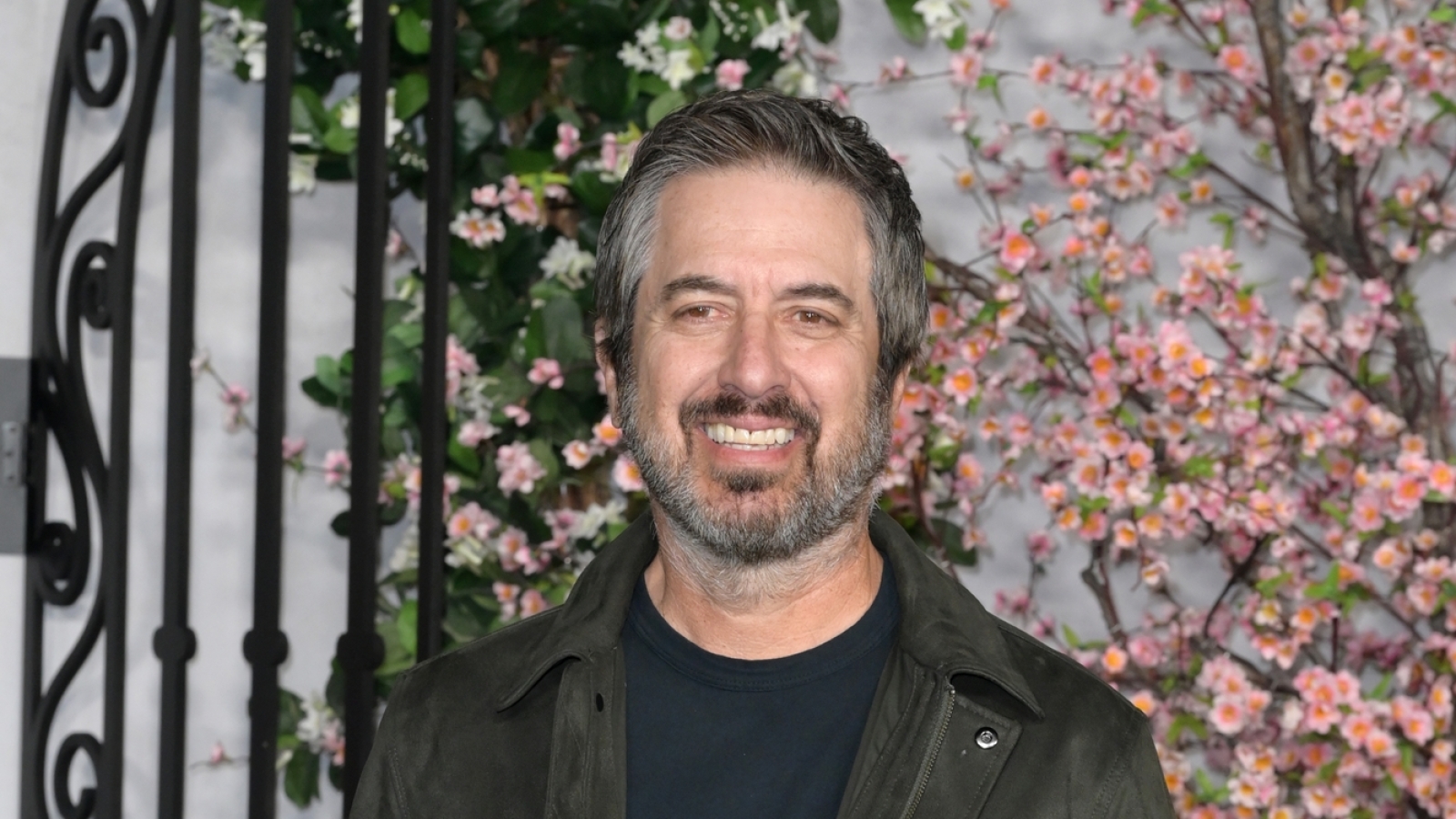

Everybody Loves Raymond Kevin Jamess Honest Take On The Shows Early Days And Rise To Fame

Aug 07, 2025

Everybody Loves Raymond Kevin Jamess Honest Take On The Shows Early Days And Rise To Fame

Aug 07, 2025 -

Platonic Season 2 Comedy Gold Or Missed Opportunity

Aug 07, 2025

Platonic Season 2 Comedy Gold Or Missed Opportunity

Aug 07, 2025

Latest Posts

-

Kevin James Everybody Loves Raymonds Unexpected Success

Aug 07, 2025

Kevin James Everybody Loves Raymonds Unexpected Success

Aug 07, 2025 -

From Cinema To Streaming Platonic Shows Comedys Tv Migration

Aug 07, 2025

From Cinema To Streaming Platonic Shows Comedys Tv Migration

Aug 07, 2025 -

Kevin James Evolution Rethinking Sitcom Characters After Everybody Loves Raymond

Aug 07, 2025

Kevin James Evolution Rethinking Sitcom Characters After Everybody Loves Raymond

Aug 07, 2025 -

Rodgers Delivers Brutal Truth To Steelers Receiver

Aug 07, 2025

Rodgers Delivers Brutal Truth To Steelers Receiver

Aug 07, 2025 -

How Ray Romanos Everybody Loves Raymond Changed Kevin Jamess Approach To Comedy

Aug 07, 2025

How Ray Romanos Everybody Loves Raymond Changed Kevin Jamess Approach To Comedy

Aug 07, 2025