$812 Million In Securities Submitted To Lincoln Financial's Enhanced Tender Offer ($45M Increase)

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Lincoln Financial's Enhanced Tender Offer Sees $812 Million in Securities Submitted, Exceeding Expectations

Lincoln Financial Group's (LNC) enhanced tender offer for its outstanding debt securities has concluded, exceeding initial projections with a remarkable $812 million in securities submitted. This figure represents a significant $45 million increase over the previously announced target, showcasing strong investor confidence and participation in the company's restructuring efforts. The successful tender offer positions Lincoln Financial for a stronger financial future, enabling them to optimize their capital structure and pursue strategic growth initiatives.

This news follows Lincoln Financial's announcement in [Insert Date of Original Announcement] of an enhanced tender offer, aiming to repurchase a substantial amount of their outstanding debt. The offer, which closed on [Insert Closing Date], provided investors with an attractive opportunity to tender their securities at a premium. The overwhelming response demonstrates market confidence in Lincoln Financial's long-term prospects and its management team's strategic vision.

Key Highlights of the Tender Offer:

- Total Securities Submitted: $812 million, exceeding the initial target by $45 million.

- Strong Investor Participation: The high level of participation indicates strong confidence in Lincoln Financial's future.

- Optimized Capital Structure: The successful tender offer allows Lincoln Financial to streamline its debt obligations and improve its financial flexibility.

- Strategic Growth Potential: The freed-up capital can be used to fund future growth initiatives and enhance shareholder value.

- Positive Market Sentiment: The successful tender offer reflects a positive market outlook for Lincoln Financial and the broader insurance sector.

What This Means for Lincoln Financial and Investors:

The success of this tender offer is a significant positive development for Lincoln Financial. By reducing its debt burden, the company improves its credit rating and reduces its financial risk. This improved financial stability allows Lincoln Financial to focus on its core business of providing financial protection and retirement solutions. Investors who tendered their securities received a premium price, generating attractive returns. For those who did not participate, the success of the tender offer suggests a positive outlook for the company's future performance and potentially a positive impact on the share price.

Looking Ahead for Lincoln Financial:

The company is now well-positioned to capitalize on growth opportunities in the insurance and retirement market. This increased financial flexibility could lead to strategic acquisitions, product enhancements, or increased investments in technology and innovation. Analysts will be watching closely to see how Lincoln Financial utilizes the freed-up capital to further enhance shareholder value. [Insert potential future announcements or planned actions from Lincoln Financial, if known].

Further Research and Resources:

- For detailed information on the tender offer, consult Lincoln Financial Group's official press releases and investor relations materials. [Link to Lincoln Financial Investor Relations page]

- Stay updated on Lincoln Financial’s performance by following reputable financial news sources. [Link to a reputable financial news source]

This successful tender offer underscores Lincoln Financial's commitment to optimizing its financial position and delivering long-term value to its shareholders. The substantial oversubscription indicates significant confidence in the company's future trajectory. The enhanced financial flexibility positions Lincoln Financial for continued success in the competitive financial services landscape.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on $812 Million In Securities Submitted To Lincoln Financial's Enhanced Tender Offer ($45M Increase). We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

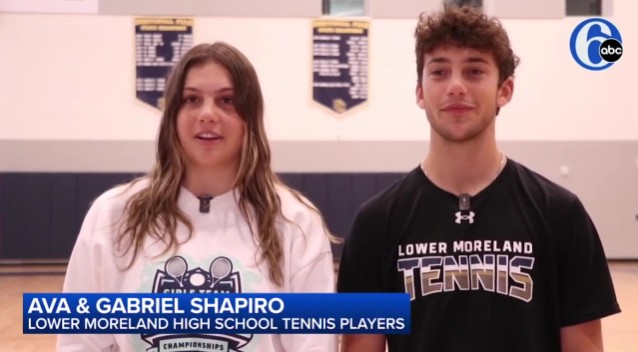

State Tennis Champions Lower Morelands Senior Twin Duo

May 29, 2025

State Tennis Champions Lower Morelands Senior Twin Duo

May 29, 2025 -

Fritzs Roland Garros Campaign Ends Early Altmaier Scores First Round Win

May 29, 2025

Fritzs Roland Garros Campaign Ends Early Altmaier Scores First Round Win

May 29, 2025 -

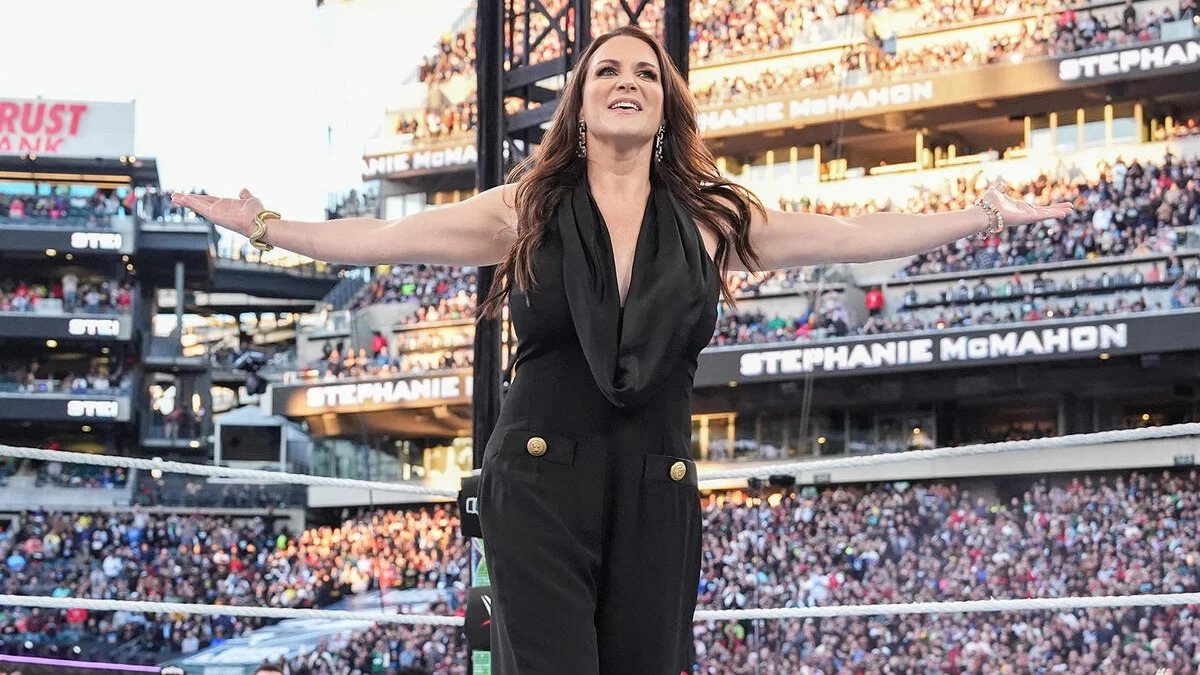

Stephanie Mc Mahon Reveals Tattoo Regret A Close Call Shes Grateful For

May 29, 2025

Stephanie Mc Mahon Reveals Tattoo Regret A Close Call Shes Grateful For

May 29, 2025 -

Climate Change What Does It Mean For Summer Bugs

May 29, 2025

Climate Change What Does It Mean For Summer Bugs

May 29, 2025 -

Cooler Weather Coming To Metro Detroit After A Day Of Mild Temperatures

May 29, 2025

Cooler Weather Coming To Metro Detroit After A Day Of Mild Temperatures

May 29, 2025