$55 Price Target For Oklo Inc. (OKLO): Wedbush's Positive Outlook

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

$55 Price Target for Oklo Inc. (OKLO): Wedbush's Positive Outlook Fuels Stock Surge

Oklo Inc. (OKLO), a leading developer of advanced nuclear fission technology, is experiencing a surge in its stock price following a bullish prediction from Wedbush Securities. The investment firm recently issued a price target of $55 for OKLO shares, significantly higher than the current market price, igniting investor optimism about the company's future prospects. This positive outlook comes as Oklo continues to make strides in its mission to revolutionize the nuclear energy sector with its innovative, safer, and more efficient reactor designs.

Wedbush's Rationale: A Vote of Confidence in Oklo's Technology

Wedbush's $55 price target reflects a strong belief in Oklo's potential to disrupt the energy market. Their analysis highlights several key factors contributing to their positive outlook:

-

Technological Innovation: Oklo's advanced reactor designs promise to address many of the concerns associated with traditional nuclear power plants, including waste management and safety. Their small modular reactor (SMR) technology is particularly noteworthy, offering increased flexibility and reduced deployment costs. This innovative approach is attracting significant attention from governments and energy companies seeking cleaner and more reliable energy sources.

-

Strong Regulatory Support: The growing global focus on decarbonization is creating a supportive regulatory environment for advanced nuclear technologies. Governments worldwide are increasingly recognizing the role that nuclear energy can play in achieving climate goals, leading to favorable policies and increased funding opportunities for companies like Oklo.

-

Strategic Partnerships: Oklo has been actively forging strategic partnerships with key players in the energy sector, further strengthening its position and accelerating its progress. These collaborations enhance its technological capabilities and expand its market reach. These partnerships signal a growing confidence in Oklo's technology and its potential for widespread adoption.

-

Market Demand for Clean Energy: The global demand for clean energy solutions is soaring, creating a significant opportunity for Oklo's advanced nuclear reactors. The increasing urgency to mitigate climate change is driving investments in cleaner energy sources, positioning Oklo for substantial growth in the coming years.

What This Means for Investors

The Wedbush price target represents a substantial upside potential for investors currently holding OKLO stock. However, it's crucial to remember that investing in the stock market always involves risk. While Wedbush's analysis is compelling, it's essential to conduct your own thorough research before making any investment decisions. Consider diversifying your portfolio to mitigate risk and consult with a financial advisor for personalized advice.

Oklo's Future Plans: Building on Momentum

Oklo is aggressively pursuing its development roadmap, working towards the deployment of its first commercial reactors. The company's ambitious plans include expanding its technological capabilities, securing further funding, and forging additional strategic partnerships. Their commitment to innovation and collaboration positions them well to capitalize on the growing demand for clean energy solutions.

Beyond the Price Target: A Deeper Look at the Nuclear Energy Landscape

The positive outlook for Oklo is not an isolated event. The broader nuclear energy sector is experiencing a resurgence of interest due to advancements in reactor technology and the urgent need to reduce carbon emissions. This renewed interest is driving investment and innovation within the industry, creating exciting opportunities for companies like Oklo that are at the forefront of this technological revolution. [Link to an article about the resurgence of nuclear energy].

Conclusion: A Promising Outlook, But Due Diligence Remains Crucial

Wedbush's $55 price target for Oklo Inc. (OKLO) is undoubtedly a positive sign, reflecting a strong belief in the company's innovative technology and its potential to revolutionize the nuclear energy sector. However, potential investors should approach this with careful consideration and conduct thorough due diligence before making any investment decisions. The future of OKLO, and indeed the broader nuclear energy sector, looks promising, but inherent market risks remain.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on $55 Price Target For Oklo Inc. (OKLO): Wedbush's Positive Outlook. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Emma Raducanu Vs Wang Xinyu Live Scores And French Open Match Highlights

May 27, 2025

Emma Raducanu Vs Wang Xinyu Live Scores And French Open Match Highlights

May 27, 2025 -

Top 3 Ai Stocks To Watch Could They Outperform Palantir

May 27, 2025

Top 3 Ai Stocks To Watch Could They Outperform Palantir

May 27, 2025 -

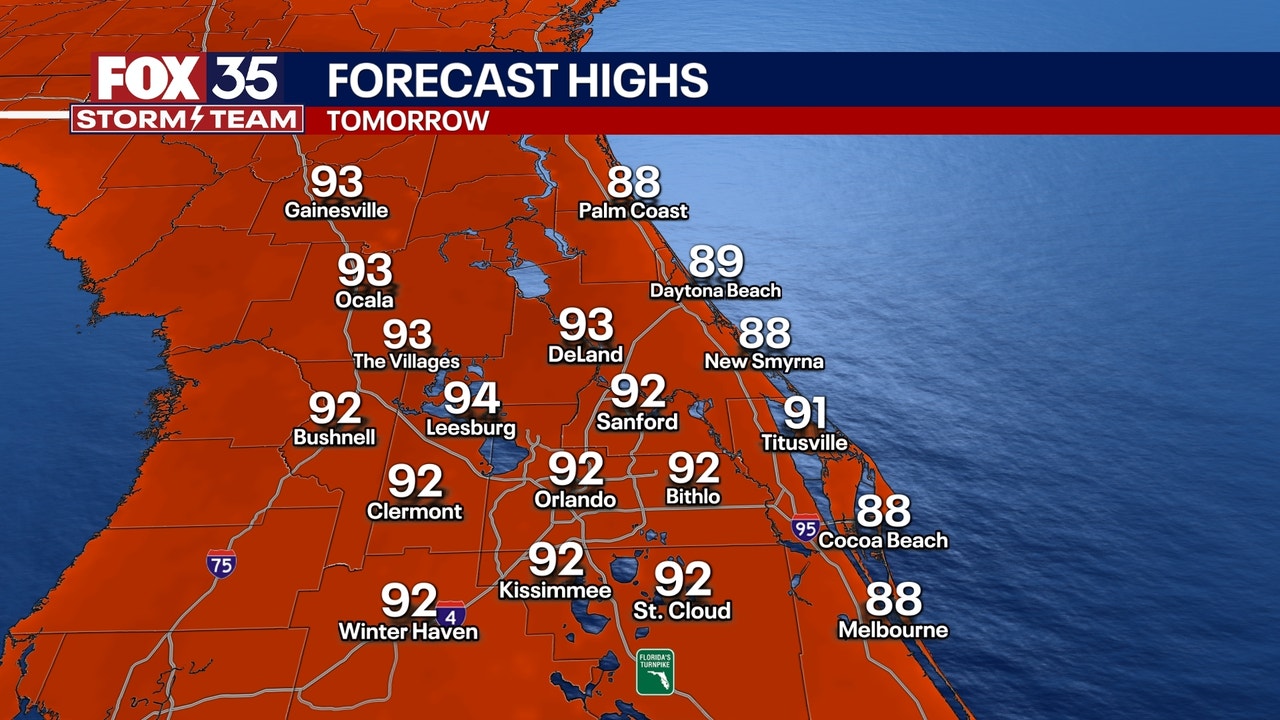

Summer Heat Grips Orlando Higher Humidity And Increased Risk Of Storms

May 27, 2025

Summer Heat Grips Orlando Higher Humidity And Increased Risk Of Storms

May 27, 2025 -

Investing In Ai 3 High Growth Stocks To Watch Beyond Palantir

May 27, 2025

Investing In Ai 3 High Growth Stocks To Watch Beyond Palantir

May 27, 2025 -

Nathan Fielders The Rehearsal Season 2 Finale A Deep Dive Into The Production

May 27, 2025

Nathan Fielders The Rehearsal Season 2 Finale A Deep Dive Into The Production

May 27, 2025