5 Ways The Trump Tax Cuts May Limit Healthcare

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

5 Ways the Trump Tax Cuts May Have Limited Healthcare Access

The 2017 Tax Cuts and Jobs Act, a cornerstone of the Trump administration's economic policy, significantly altered the US tax code. While proponents touted economic growth and job creation, critics pointed to potential negative consequences, particularly concerning healthcare access. This article explores five key ways the tax cuts may have limited healthcare availability for many Americans.

Understanding the Impact: Tax Cuts and Healthcare Funding

The Trump tax cuts drastically reduced the corporate tax rate, leading to increased corporate profits. However, concerns arose regarding the potential impact on healthcare funding. The cuts coincided with efforts to repeal and replace the Affordable Care Act (ACA), further fueling anxieties about healthcare access and affordability. While not directly cutting healthcare funding, the indirect consequences were significant.

1. Reduced Federal Revenue: A Strain on Healthcare Programs

The most direct impact stemmed from the substantial reduction in federal revenue. Lower corporate taxes meant less money flowing into the federal treasury, potentially limiting funding for crucial healthcare programs like Medicaid and Medicare. This budgetary strain could lead to cuts in services, increased wait times, and reduced access to care, particularly for vulnerable populations. [Link to a reputable source on the impact of the tax cuts on federal revenue]

2. Increased State Budgetary Pressures: Medicaid Cuts and Funding Gaps

Many states rely heavily on federal funding for Medicaid, their crucial healthcare program for low-income individuals and families. The reduced federal revenue stemming from the tax cuts placed significant pressure on state budgets. Faced with tighter resources, several states considered – and in some cases implemented – Medicaid cuts, reducing eligibility or benefits, directly impacting access to healthcare for millions. [Link to an article detailing state-level Medicaid cuts following the tax cuts]

3. Weakening of the ACA: Increased Uninsured Rates

The Trump administration's attempts to repeal and replace the ACA, coupled with the tax cuts, created uncertainty in the healthcare market. Reduced funding for ACA outreach and enrollment efforts, combined with increased healthcare costs (partially driven by the tax cuts' impact on the economy), could have contributed to an increase in the number of uninsured Americans. [Link to data on uninsured rates following the tax cuts]

4. Impact on Charitable Healthcare Organizations:

Many non-profit healthcare organizations rely on charitable donations and tax-deductible contributions. Changes in tax laws, influenced by the tax cuts, could have indirectly impacted their fundraising abilities, limiting their capacity to provide crucial services to underserved communities. The complexity of the new tax code also made it harder for some individuals to itemize, reducing their charitable contributions. [Link to a study examining the impact on non-profit healthcare organizations]

5. Long-Term Economic Consequences: Increased Inequality & Healthcare Access

The tax cuts' focus on corporate tax reductions, while potentially boosting the economy in the short-term for some, may have exacerbated existing economic inequalities. Increased income disparity could worsen healthcare access issues, as lower-income individuals and families might struggle even more to afford healthcare services, even with insurance. This widening gap in healthcare access is a significant long-term concern. [Link to an article discussing the link between income inequality and healthcare access]

Conclusion: A Complex Interplay of Factors

The relationship between the 2017 tax cuts and healthcare access is complex and multifaceted. While no single factor can be isolated as the sole cause, the indirect consequences of reduced federal revenue, increased budgetary pressures, and policy changes surrounding the ACA likely contributed to limitations in healthcare access for some segments of the US population. Further research is needed to fully understand the long-term implications. What are your thoughts on the connection between tax policy and healthcare access? Share your perspective in the comments below.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on 5 Ways The Trump Tax Cuts May Limit Healthcare. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Wiener Launches Congressional Campaign Targeting Pelosis Seat

Jul 04, 2025

Wiener Launches Congressional Campaign Targeting Pelosis Seat

Jul 04, 2025 -

Attorney Fees After A Car Accident What Your Insurance Pays

Jul 04, 2025

Attorney Fees After A Car Accident What Your Insurance Pays

Jul 04, 2025 -

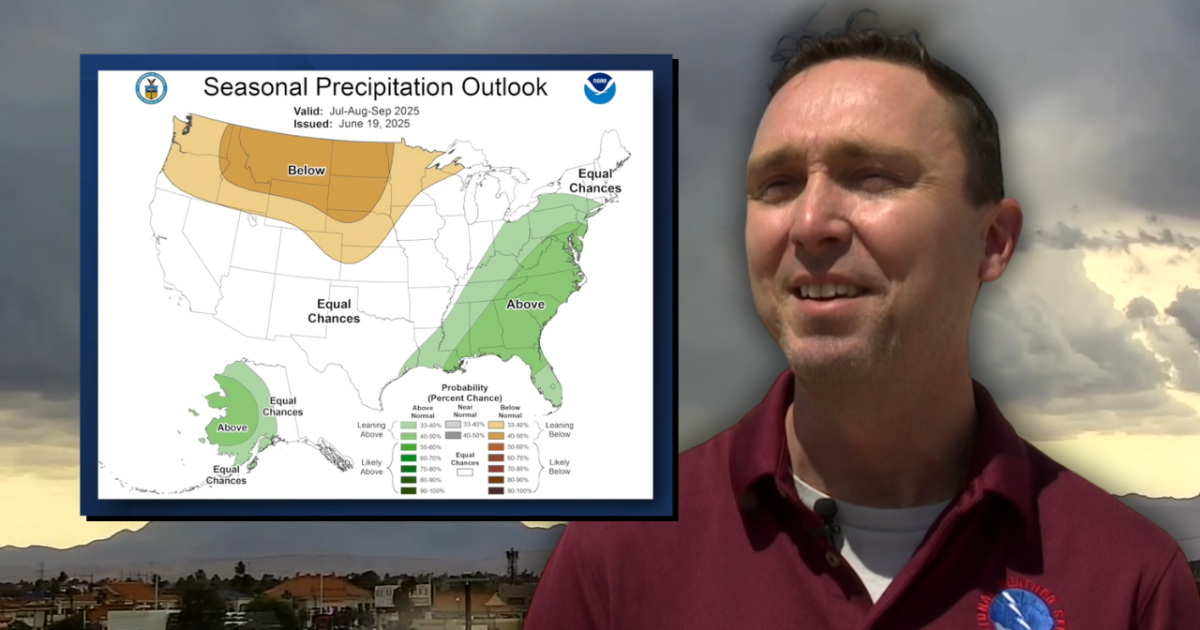

Experts Predict Southern Nevadas 2024 Monsoon Season What To Expect

Jul 04, 2025

Experts Predict Southern Nevadas 2024 Monsoon Season What To Expect

Jul 04, 2025 -

Major Car Crash Causes Heavy Congestion On Fremont Roads This Morning

Jul 04, 2025

Major Car Crash Causes Heavy Congestion On Fremont Roads This Morning

Jul 04, 2025 -

Bali Ferry Disaster Urgent Search For Survivors After Sinking

Jul 04, 2025

Bali Ferry Disaster Urgent Search For Survivors After Sinking

Jul 04, 2025

Latest Posts

-

El Arte Del Entrenador Equilibrio Entre El Juego Y La Audiencia

Sep 10, 2025

El Arte Del Entrenador Equilibrio Entre El Juego Y La Audiencia

Sep 10, 2025 -

Unexpected Health Benefits Of Becoming A Grandparent

Sep 10, 2025

Unexpected Health Benefits Of Becoming A Grandparent

Sep 10, 2025 -

Live Stream Details France Vs Iceland World Cup Qualifier Match Today

Sep 10, 2025

Live Stream Details France Vs Iceland World Cup Qualifier Match Today

Sep 10, 2025 -

France Vs Iceland 2026 World Cup Qualifying Live Stream And Tv Guide

Sep 10, 2025

France Vs Iceland 2026 World Cup Qualifying Live Stream And Tv Guide

Sep 10, 2025 -

Portugals World Cup Dream Can They Win It All

Sep 10, 2025

Portugals World Cup Dream Can They Win It All

Sep 10, 2025