$5 Billion+ Poured Into Bitcoin ETFs: Understanding The Recent Investment Boom

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

$5 Billion+ Poured into Bitcoin ETFs: Understanding the Recent Investment Boom

The cryptocurrency market has witnessed a significant surge in investment, with over $5 billion flowing into Bitcoin exchange-traded funds (ETFs) in recent months. This unprecedented influx of capital signifies a growing acceptance of Bitcoin as a legitimate asset class among institutional and retail investors alike. But what's driving this boom, and what does it mean for the future of Bitcoin and the broader crypto market?

The Allure of Bitcoin ETFs:

Bitcoin ETFs offer investors a convenient and regulated way to gain exposure to Bitcoin without directly holding the cryptocurrency. This is a major advantage for many investors who are hesitant about the complexities and risks associated with self-custody of Bitcoin. The regulated nature of ETFs also appeals to institutions with strict compliance requirements. This accessibility is a key factor in the recent investment boom.

Factors Fueling the Investment Surge:

Several factors are contributing to the massive investment in Bitcoin ETFs:

-

Increased Regulatory Clarity: The approval of Bitcoin ETFs in major markets like the United States has significantly boosted investor confidence. Previously, the regulatory uncertainty surrounding cryptocurrencies had deterred many institutional investors. The clearer regulatory landscape now makes investing in Bitcoin through ETFs a more attractive proposition.

-

Institutional Adoption: Large institutional investors, including pension funds and hedge funds, are increasingly allocating a portion of their portfolios to Bitcoin. The availability of ETFs provides a more manageable and transparent way for these institutions to gain Bitcoin exposure, contributing significantly to the $5 billion+ figure.

-

Inflation Hedge: Many investors view Bitcoin as a hedge against inflation. With global inflation remaining stubbornly high, the demand for assets that could potentially retain or increase their value during inflationary periods has increased, driving investment into Bitcoin.

-

Technological Advancements: The ongoing development and improvement of Bitcoin's underlying technology, including the Lightning Network for faster and cheaper transactions, continue to enhance its appeal as a store of value and a medium of exchange.

-

Growing Mainstream Acceptance: Bitcoin is no longer just a niche asset; it's gaining wider mainstream acceptance. This increased awareness and understanding are reflected in the rising investment in Bitcoin ETFs.

What Does This Mean for the Future?

The massive influx of capital into Bitcoin ETFs suggests a significant shift in the perception of Bitcoin among investors. This could lead to:

-

Increased Bitcoin Price Volatility: While the inflow of capital is positive, it could also lead to increased price volatility in the short term, as market sentiment swings.

-

Further Institutional Adoption: The success of Bitcoin ETFs could encourage even more institutional investors to allocate funds to Bitcoin.

-

Development of New Crypto Products: The growing popularity of Bitcoin ETFs may stimulate the development of other crypto-related investment products, further expanding the market.

Potential Risks:

Despite the positive outlook, investors should remain aware of the potential risks associated with Bitcoin:

-

Price Volatility: Bitcoin's price can fluctuate dramatically in short periods.

-

Regulatory Uncertainty: While regulatory clarity has improved, the regulatory landscape for cryptocurrencies remains constantly evolving.

-

Security Risks: Although ETFs mitigate some risks, investors should be mindful of the potential security risks associated with any investment.

Conclusion:

The investment boom in Bitcoin ETFs signifies a major turning point for Bitcoin and the broader crypto market. The increased regulatory clarity, institutional adoption, and growing mainstream acceptance are all contributing factors to this impressive growth. While potential risks remain, the long-term outlook for Bitcoin appears increasingly positive, driven by its growing popularity and the convenience offered by regulated investment vehicles like ETFs. Stay informed about market trends and consider seeking professional financial advice before making any investment decisions. This surge in investment is a significant development that warrants close attention from all market participants.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on $5 Billion+ Poured Into Bitcoin ETFs: Understanding The Recent Investment Boom. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Police Investigate Church Defacement Teens Suspected Of Urination And Defecation

May 21, 2025

Police Investigate Church Defacement Teens Suspected Of Urination And Defecation

May 21, 2025 -

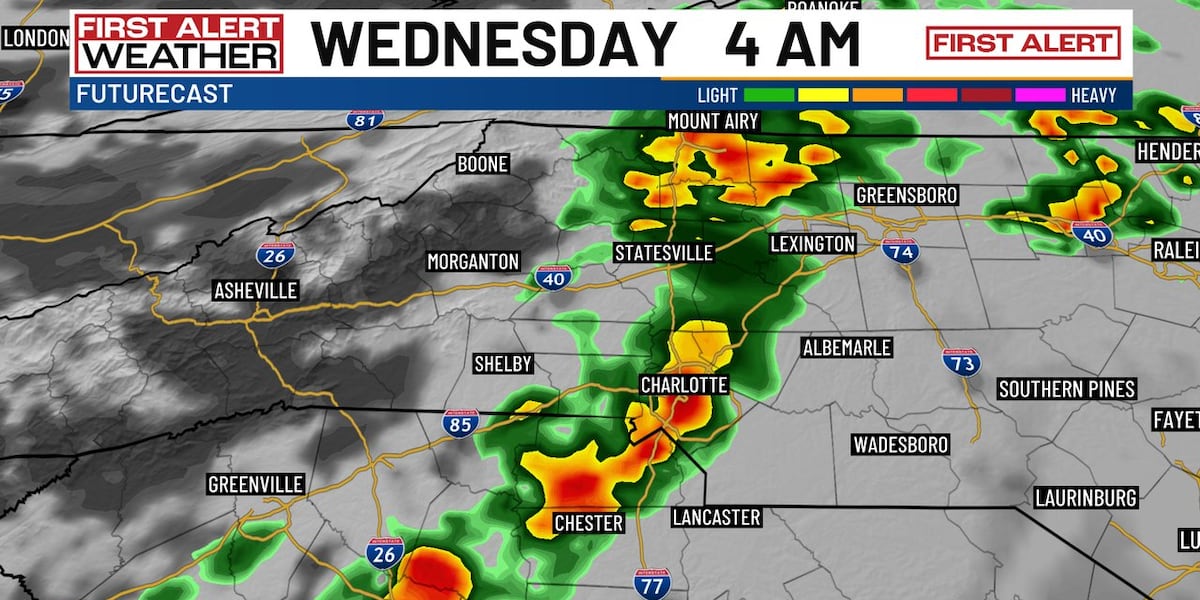

Overnight Storms And Temperature Plunge Forecast For Charlotte Area

May 21, 2025

Overnight Storms And Temperature Plunge Forecast For Charlotte Area

May 21, 2025 -

A J Perez The Backlash And Threats Following The Release Of The Brett Favre Untold Episode

May 21, 2025

A J Perez The Backlash And Threats Following The Release Of The Brett Favre Untold Episode

May 21, 2025 -

430 Skin Fan Reactions To Riots 2025 League Of Legends Hall Of Fame Choice

May 21, 2025

430 Skin Fan Reactions To Riots 2025 League Of Legends Hall Of Fame Choice

May 21, 2025 -

Investor Confidence Soars 200 Million Flows Into Ethereum Funds Following Pectra

May 21, 2025

Investor Confidence Soars 200 Million Flows Into Ethereum Funds Following Pectra

May 21, 2025