$5 Billion+ Poured Into Bitcoin ETFs: Understanding The Investor Confidence

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

$5 Billion+ Poured into Bitcoin ETFs: A Surge in Investor Confidence?

The cryptocurrency market has witnessed a significant influx of capital recently, with over $5 billion reportedly flowing into Bitcoin exchange-traded funds (ETFs) in just a few short months. This massive investment represents a considerable vote of confidence in Bitcoin's future, but what's driving this surge, and what does it mean for the broader crypto market? Let's delve into the factors contributing to this exciting development and analyze its potential implications.

The Rise of Bitcoin ETFs: A Catalyst for Mainstream Adoption?

The approval of Bitcoin ETFs by regulatory bodies like the SEC in the US has been a game-changer. Previously, many institutional and retail investors were hesitant to directly invest in Bitcoin due to perceived complexities and security concerns. ETFs offer a more accessible and regulated entry point, mirroring the ease of investing in traditional stock markets. This accessibility is a key driver behind the recent surge in investment. The ability to buy and sell Bitcoin through familiar brokerage accounts significantly lowers the barrier to entry for many investors.

Why are Investors Choosing Bitcoin ETFs Now?

Several factors are contributing to this wave of investment:

- Increased Regulatory Clarity: The approval of Bitcoin ETFs signals a degree of regulatory acceptance, reducing uncertainty and attracting institutional investors seeking regulated investment vehicles.

- Inflation Hedge Potential: With persistent inflationary pressures globally, many investors see Bitcoin as a potential hedge against inflation, similar to gold. Its limited supply and decentralized nature are key selling points.

- Growing Institutional Adoption: More and more institutional investors, including hedge funds and asset management firms, are allocating a portion of their portfolios to Bitcoin through ETFs, fueling the market’s growth.

- Technological Advancements: Continued development and improvements within the Bitcoin network, such as the Lightning Network, enhance scalability and transaction efficiency, addressing some previous criticisms.

- Market Sentiment: Positive market sentiment, fueled by news of ETF approvals and overall market stability, is further encouraging investment.

What Does This Mean for the Future of Bitcoin?

The influx of capital into Bitcoin ETFs suggests a growing belief in Bitcoin's long-term viability as a store of value and an asset class. This significant investment could potentially:

- Increase Bitcoin's Price: Increased demand usually translates to higher prices, though market volatility remains a factor.

- Boost Crypto Market Maturity: The increasing involvement of institutional investors lends credibility and contributes to the maturation of the cryptocurrency market.

- Drive Further Innovation: The success of Bitcoin ETFs could incentivize further innovation and the development of other crypto-related financial products.

Risks and Considerations:

While the current trend is positive, it's crucial to acknowledge the inherent risks associated with cryptocurrency investments:

- Volatility: Bitcoin's price remains highly volatile, and investors should be prepared for significant fluctuations.

- Regulatory Uncertainty: While regulatory clarity has improved, the regulatory landscape remains dynamic and could change rapidly.

- Security Risks: Although ETFs mitigate some security risks, investors should still be aware of potential security vulnerabilities.

Conclusion:

The injection of over $5 billion into Bitcoin ETFs marks a significant milestone for the cryptocurrency market. It signals a growing level of investor confidence and mainstream adoption, driven by increased regulatory clarity, inflation hedging potential, and growing institutional involvement. While risks remain, the current trend points towards a potentially bright future for Bitcoin and the broader crypto market. However, conducting thorough research and understanding the inherent risks before investing remains crucial. This substantial investment underscores the evolving landscape of digital assets and warrants close observation in the months and years to come. Stay informed and make informed decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on $5 Billion+ Poured Into Bitcoin ETFs: Understanding The Investor Confidence. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

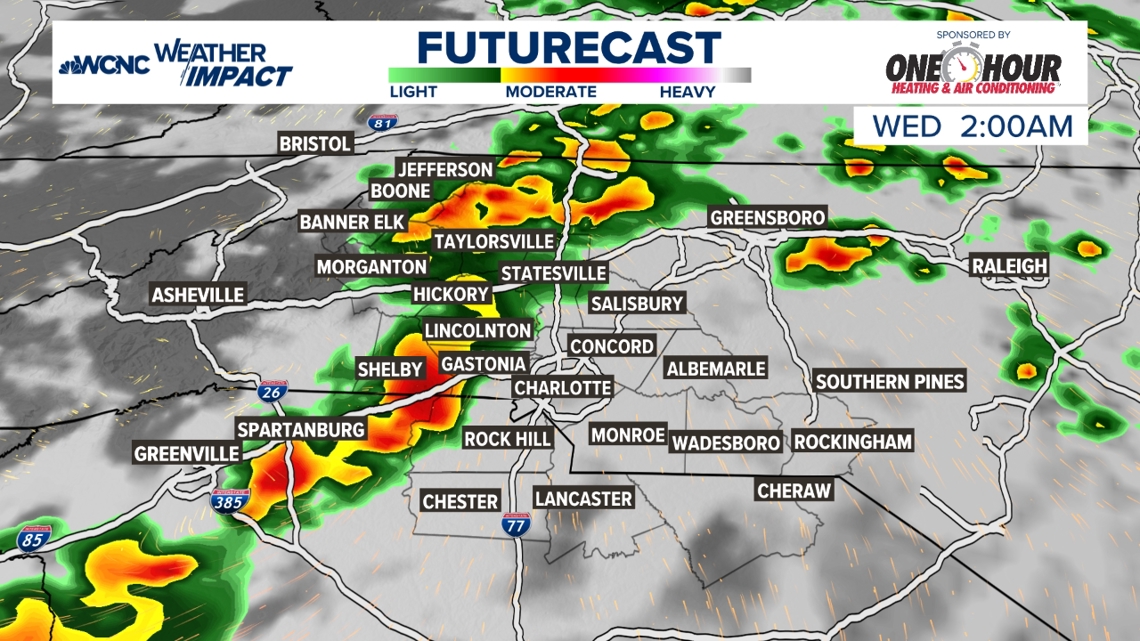

Few Strong Storms Predicted Late Tuesday Limited Risk

May 21, 2025

Few Strong Storms Predicted Late Tuesday Limited Risk

May 21, 2025 -

Post Pectra Upgrade 200 M Rush Into Ethereum Funds As Investor Interest Soars

May 21, 2025

Post Pectra Upgrade 200 M Rush Into Ethereum Funds As Investor Interest Soars

May 21, 2025 -

Ny Ag James Attacks Doj While Highlighting Trump Legal Fights

May 21, 2025

Ny Ag James Attacks Doj While Highlighting Trump Legal Fights

May 21, 2025 -

Heartbreak And Healing Ellen De Generes Comeback To Social Media

May 21, 2025

Heartbreak And Healing Ellen De Generes Comeback To Social Media

May 21, 2025 -

2025 League Of Legends Hall Of Famer Revealed Will The Skin Be Affordable

May 21, 2025

2025 League Of Legends Hall Of Famer Revealed Will The Skin Be Affordable

May 21, 2025