$5 Billion+ Poured Into Bitcoin ETFs: Understanding The Bold Bets

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

$5 Billion+ Poured into Bitcoin ETFs: Understanding the Bold Bets on the Future of Crypto

The cryptocurrency market is buzzing. Over $5 billion has flooded into Bitcoin exchange-traded funds (ETFs) since the first spot Bitcoin ETF, the Invesco Bitcoin Strategy ETF (BITO), launched in 2021. This massive influx of capital represents a significant vote of confidence in Bitcoin's future and marks a pivotal moment for the digital asset's mainstream adoption. But what's driving this surge, and what does it mean for investors? Let's delve into the bold bets being made.

The Rise of Bitcoin ETFs: A Gateway to Mainstream Investment

Prior to the approval of spot Bitcoin ETFs, accessing the cryptocurrency market for many traditional investors involved navigating complex exchanges and understanding the intricacies of digital wallets. This inherent complexity created a significant barrier to entry. Bitcoin ETFs, however, offer a far more accessible and regulated pathway. They allow investors to gain exposure to Bitcoin's price movements through a familiar and regulated investment vehicle—just like investing in any other stock. This simplicity has been a major catalyst for the recent surge in investment.

Why the $5 Billion+ Influx? Several Key Factors:

-

Increased Regulatory Clarity: The SEC's approval of several Bitcoin futures ETFs, and more recently, spot Bitcoin ETFs, has significantly boosted investor confidence. This regulatory clarity signals a greater level of legitimacy and reduces the perceived risk associated with Bitcoin investment. This increased regulatory scrutiny is crucial in building trust among institutional and retail investors alike.

-

Institutional Adoption: Large institutional investors, including pension funds and hedge funds, are increasingly allocating a portion of their portfolios to Bitcoin. The availability of ETFs provides a convenient and regulated vehicle for these large-scale investments, further contributing to the substantial inflow of capital.

-

Bitcoin's Perceived Value as a Hedge: Many see Bitcoin as a potential hedge against inflation and macroeconomic uncertainty. In times of economic instability, investors often seek alternative assets, and Bitcoin's decentralized nature and limited supply make it an attractive option for diversification.

-

Growing Retail Investor Interest: Retail investors are also contributing to the growth, driven by increased media coverage, improved understanding of cryptocurrencies, and the ease of access through ETF platforms. The lower barriers to entry have made Bitcoin more accessible to a wider range of investors.

Understanding the Risks:

While the influx of capital is impressive, it's crucial to acknowledge the inherent risks associated with Bitcoin investment. Bitcoin's price is highly volatile, subject to significant fluctuations driven by market sentiment, regulatory changes, and technological developments. Before investing in Bitcoin ETFs, it is vital to:

- Conduct thorough research: Understand the risks involved and assess your own risk tolerance.

- Diversify your portfolio: Don't put all your eggs in one basket. Bitcoin ETFs should be part of a broader investment strategy.

- Consult a financial advisor: Seek professional advice before making any significant investment decisions.

The Future of Bitcoin ETFs:

The $5 billion+ investment in Bitcoin ETFs represents a significant milestone, but it's likely just the beginning. As regulatory clarity increases and institutional adoption grows, we can expect further capital inflows into this burgeoning market segment. The future remains uncertain, but the current trend suggests a continued rise in the popularity and acceptance of Bitcoin ETFs as a legitimate investment vehicle. This influx of capital could ultimately contribute to Bitcoin's long-term price stability and solidify its place in the mainstream financial landscape. Stay tuned for further developments in this rapidly evolving space. What are your thoughts on the future of Bitcoin ETFs? Share your opinions in the comments below.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on $5 Billion+ Poured Into Bitcoin ETFs: Understanding The Bold Bets. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Billions Flow Into Bitcoin Etfs A Look At The Driving Forces

May 20, 2025

Billions Flow Into Bitcoin Etfs A Look At The Driving Forces

May 20, 2025 -

Ufc News Jon Jones Future In Jeopardy Following I M Done Statement And Aspinall Negotiations Halt

May 20, 2025

Ufc News Jon Jones Future In Jeopardy Following I M Done Statement And Aspinall Negotiations Halt

May 20, 2025 -

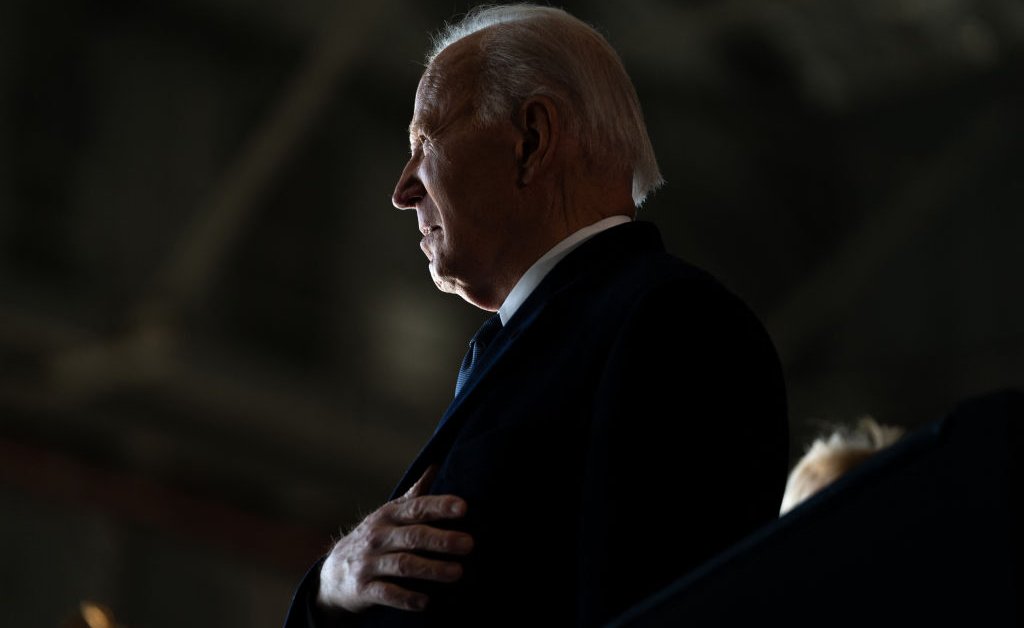

Bidens Cancer Diagnosis A Wave Of Political Support Pours In

May 20, 2025

Bidens Cancer Diagnosis A Wave Of Political Support Pours In

May 20, 2025 -

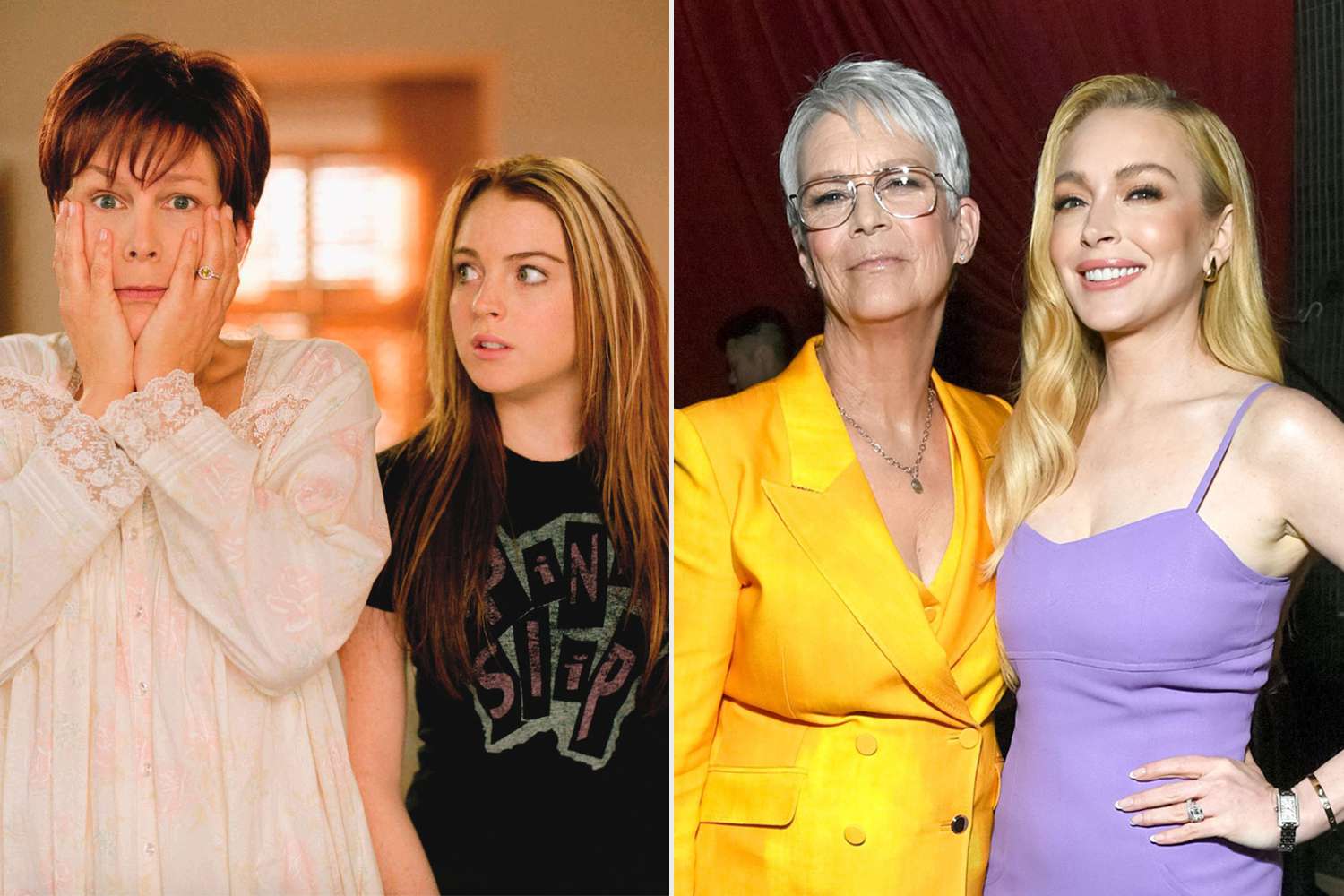

Exclusive Jamie Lee Curtis Reveals How She Stays Connected With Lindsay Lohan

May 20, 2025

Exclusive Jamie Lee Curtis Reveals How She Stays Connected With Lindsay Lohan

May 20, 2025 -

Trumps Tariff Standoff Walmart Faces Price Increase Pressure

May 20, 2025

Trumps Tariff Standoff Walmart Faces Price Increase Pressure

May 20, 2025