$5 Billion+ Poured Into Bitcoin ETFs: Implications For The Crypto Market

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

$5 Billion+ Poured into Bitcoin ETFs: A Bullish Signal for Crypto?

The cryptocurrency market is buzzing after a staggering influx of investment into Bitcoin exchange-traded funds (ETFs). Over $5 billion has poured into these vehicles in recent months, signaling a significant shift in institutional investor sentiment and potentially paving the way for broader cryptocurrency adoption. But what does this massive investment truly mean for the future of Bitcoin and the wider crypto market? Let's delve into the implications.

The Rise of Bitcoin ETFs: A Game Changer?

The approval of the first Bitcoin futures ETFs in the US marked a pivotal moment for the cryptocurrency industry. This opened the doors for institutional investors, previously hesitant due to regulatory uncertainty and perceived risks, to gain exposure to Bitcoin in a more regulated and accessible manner. The subsequent surge in investment into these ETFs underlines the growing confidence in Bitcoin as a legitimate asset class. This isn't just about speculation; it represents a growing acceptance by mainstream finance.

What's Driving this Investment Boom?

Several factors contribute to this massive inflow of capital:

- Regulatory Clarity: The gradual increase in regulatory clarity, albeit still evolving, has boosted investor confidence. The SEC's cautious yet progressive approach to approving Bitcoin-related products signals a move towards a more regulated and transparent cryptocurrency market.

- Institutional Adoption: Large institutional investors, including hedge funds and asset management firms, are increasingly allocating a portion of their portfolios to Bitcoin, driven by diversification strategies and the potential for high returns.

- Inflation Hedge: Bitcoin's perceived status as a hedge against inflation continues to attract investors seeking protection against economic uncertainty. In times of high inflation, Bitcoin's limited supply becomes an attractive alternative.

- Technological Advancements: Ongoing advancements in blockchain technology and the expanding Bitcoin ecosystem contribute to its long-term appeal. The Lightning Network, for example, enhances Bitcoin's scalability and transaction speed.

Implications for the Crypto Market:

The massive investment in Bitcoin ETFs has far-reaching implications for the broader cryptocurrency market:

- Increased Price Volatility: While this influx of capital can drive Bitcoin's price upward, it also potentially increases volatility. Significant price swings are inherent in the cryptocurrency market, and large-scale investment can exacerbate these fluctuations.

- Greater Mainstream Adoption: The growing acceptance of Bitcoin ETFs by institutional investors helps normalize Bitcoin as an asset class, potentially leading to wider mainstream adoption and increased liquidity.

- Ripple Effect on Altcoins: While Bitcoin often leads the market, increased investor confidence and interest in the crypto space may spill over into alternative cryptocurrencies (altcoins), potentially boosting their prices as well. However, this effect is not guaranteed and altcoins often move independently of Bitcoin.

- Regulatory Scrutiny: The significant influx of capital into the Bitcoin ETF market may also lead to increased regulatory scrutiny, potentially impacting future approvals and the overall regulatory landscape.

The Future of Bitcoin ETFs:

The future looks bright for Bitcoin ETFs, with more products likely to be approved and launched in the coming years. This trend is expected to further enhance liquidity and accessibility for investors seeking exposure to Bitcoin. However, it's crucial to remember that the cryptocurrency market remains inherently volatile, and investing in Bitcoin or Bitcoin ETFs carries substantial risk.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always conduct your own research and consult with a qualified financial advisor before making any investment decisions.

Call to Action: Stay informed about the latest developments in the cryptocurrency market by subscribing to our newsletter for regular updates and analysis. [Link to Newsletter Signup]

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on $5 Billion+ Poured Into Bitcoin ETFs: Implications For The Crypto Market. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Is A Homeland Security Reality Show For Citizenship In The Works

May 20, 2025

Is A Homeland Security Reality Show For Citizenship In The Works

May 20, 2025 -

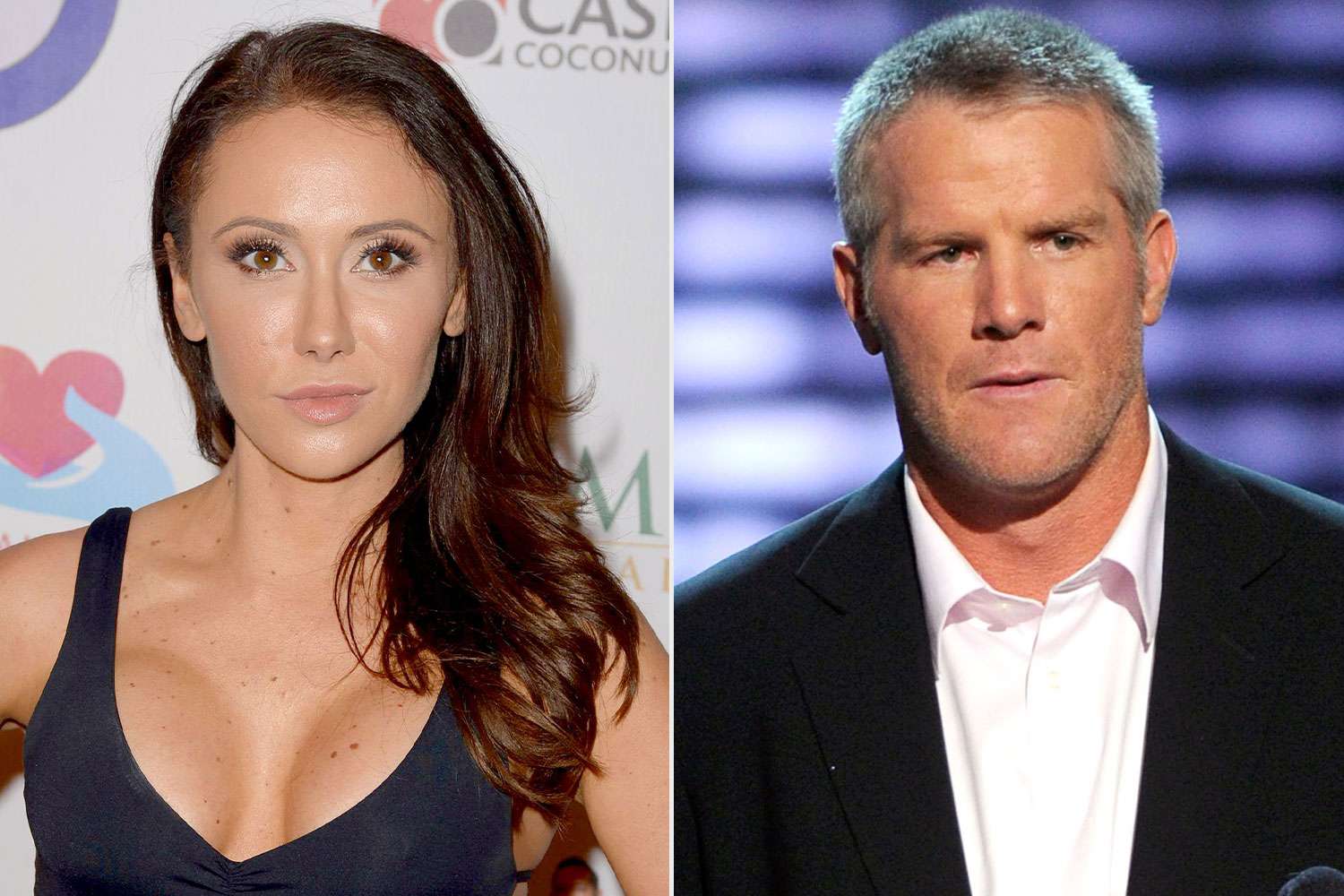

Dehumanized Jenn Sterger Details The Emotional Toll Of The Brett Favre Scandal

May 20, 2025

Dehumanized Jenn Sterger Details The Emotional Toll Of The Brett Favre Scandal

May 20, 2025 -

Jamie Lee Curtis On Lindsay Lohan Shes Always Kept It Real

May 20, 2025

Jamie Lee Curtis On Lindsay Lohan Shes Always Kept It Real

May 20, 2025 -

New Wwi Movie Featuring Daniel Craig Cillian Murphy And Tom Hardy Now Available

May 20, 2025

New Wwi Movie Featuring Daniel Craig Cillian Murphy And Tom Hardy Now Available

May 20, 2025 -

Spains Tourism Industry Faces Blow As 65 000 Rentals Blocked

May 20, 2025

Spains Tourism Industry Faces Blow As 65 000 Rentals Blocked

May 20, 2025