$5 Billion+ Poured Into Bitcoin ETFs: Bold Bets Fuel Market Rally

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

$5 Billion+ Poured into Bitcoin ETFs: Bold Bets Fuel Market Rally

The cryptocurrency market is buzzing after a massive influx of investment into Bitcoin exchange-traded funds (ETFs). Over $5 billion has poured into these funds in recent weeks, fueling a significant rally in Bitcoin's price and sparking intense debate about the future of digital assets in traditional finance. This surge represents a landmark moment, signifying growing institutional acceptance and a potential shift in the perception of Bitcoin as a viable investment asset.

The Institutional Stampede into Bitcoin ETFs

The unprecedented investment in Bitcoin ETFs reflects a growing confidence among institutional investors. This isn't just a trickle; it's a flood. Several factors contribute to this significant market movement:

- Regulatory Approvals: The recent approval of several Bitcoin ETFs in major markets, like the United States, has removed a significant barrier to entry for large institutional investors who previously hesitated due to regulatory uncertainty. This regulatory clarity provides a sense of security and legitimacy, encouraging further investment.

- Diversification Strategies: Many institutional investors see Bitcoin as a valuable tool for portfolio diversification, offering a hedge against inflation and traditional market volatility. With its relatively low correlation to other asset classes, Bitcoin is seen as an attractive addition to a well-diversified portfolio.

- Growing Institutional Adoption: Beyond ETFs, we're seeing a broader trend of institutional adoption of Bitcoin. Large corporations are adding Bitcoin to their treasury reserves, while financial institutions are increasingly offering Bitcoin-related services to their clients.

Market Rally and Price Surge

The massive influx of capital into Bitcoin ETFs has directly impacted Bitcoin's price, leading to a notable rally. While price volatility remains a characteristic of the cryptocurrency market, this sustained upward momentum suggests a growing underlying demand driven by institutional investment. This is a stark contrast to previous periods of volatility primarily driven by retail investor sentiment. Experts are closely monitoring the situation to determine the sustainability of this price surge.

Concerns and Future Outlook

Despite the positive momentum, some concerns remain. The long-term sustainability of the rally is a key question. While institutional investment provides a strong foundation, potential regulatory changes, macroeconomic factors, and the inherent volatility of the cryptocurrency market could influence future price movements.

The Future of Bitcoin and ETFs

The recent surge in Bitcoin ETF investment signifies a pivotal moment in the evolution of the cryptocurrency market. It points toward increased mainstream adoption and integration of digital assets into the traditional financial system. The coming months will be crucial in determining the long-term implications of this trend, and whether this marks a new era of stability and growth for Bitcoin. Further regulatory developments and institutional adoption will likely shape the future trajectory of both Bitcoin and the ETF market. This monumental shift opens the door to even greater participation in the crypto space, potentially revolutionizing the way we think about investing and digital assets.

Call to Action: Stay informed about the latest developments in the cryptocurrency market by following reputable news sources and engaging with expert analysis. Remember, investing in cryptocurrencies carries risk, and it's crucial to conduct thorough research before making any investment decisions. Consult with a financial advisor to determine the best investment strategy for your individual circumstances.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on $5 Billion+ Poured Into Bitcoin ETFs: Bold Bets Fuel Market Rally. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

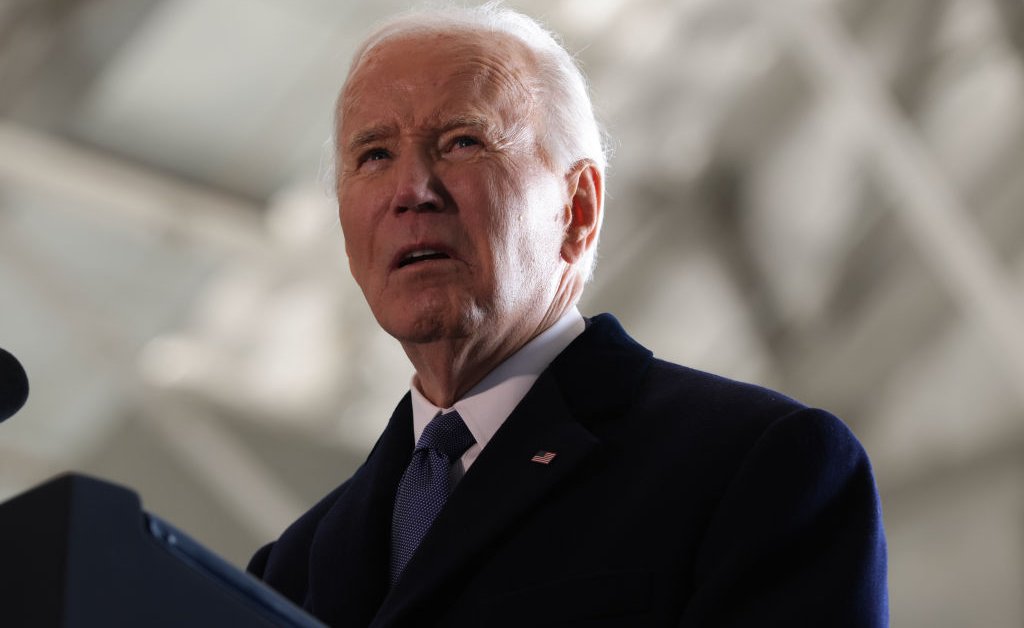

J D Vance Challenges Bidens Ability To Lead After Cancer Announcement

May 21, 2025

J D Vance Challenges Bidens Ability To Lead After Cancer Announcement

May 21, 2025 -

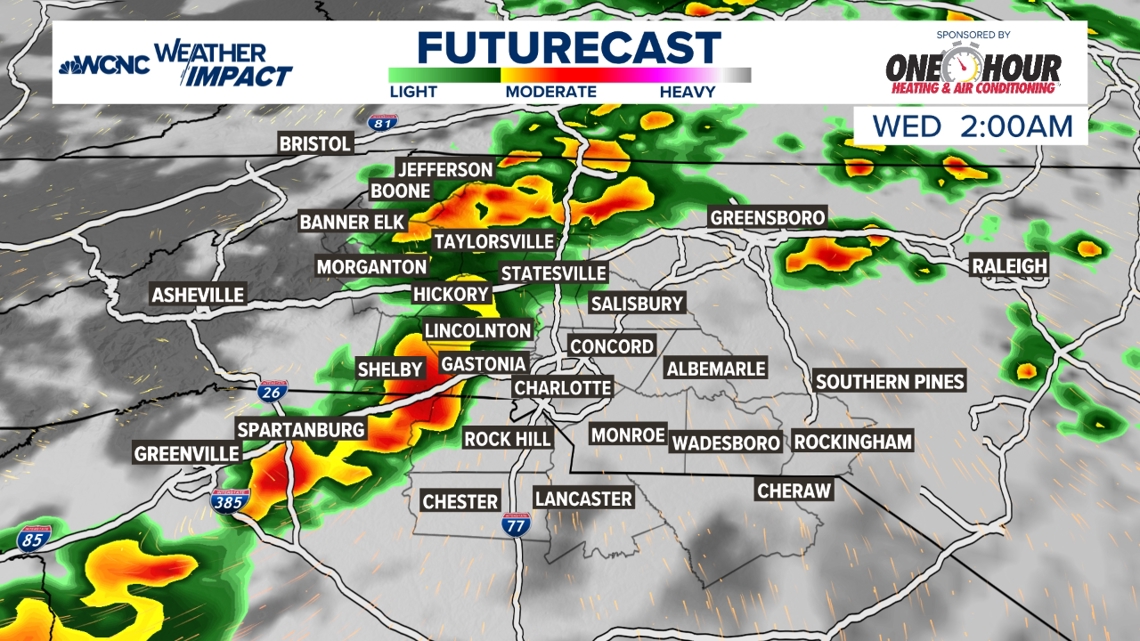

Tuesday Night Weather Slight Chance Of Strong Storms In Isolated Areas

May 21, 2025

Tuesday Night Weather Slight Chance Of Strong Storms In Isolated Areas

May 21, 2025 -

Rayman Returns Ubisoft Milan Recruiting For Aaa Game

May 21, 2025

Rayman Returns Ubisoft Milan Recruiting For Aaa Game

May 21, 2025 -

Few Strong Storms Possible Tuesday Night Very Low Risk

May 21, 2025

Few Strong Storms Possible Tuesday Night Very Low Risk

May 21, 2025 -

Colder Weather Incoming Expect Rain Throughout The Week

May 21, 2025

Colder Weather Incoming Expect Rain Throughout The Week

May 21, 2025