$5B+ Pours Into Bitcoin ETFs: Understanding The Market's Directional Bets

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

$5 Billion+ Floods into Bitcoin ETFs: Decoding the Market's Bullish Signals

The cryptocurrency market is buzzing with excitement as over $5 billion has poured into Bitcoin exchange-traded funds (ETFs) in recent weeks. This massive influx of capital signifies a significant shift in investor sentiment, bolstering the narrative of a potential Bitcoin bull run. But what's driving this surge, and what does it mean for the future of Bitcoin and the broader crypto market? Let's delve into the details.

The Rise of Bitcoin ETFs and Institutional Adoption:

The approval of the first Bitcoin futures ETFs in the US marked a pivotal moment for Bitcoin's mainstream adoption. This paved the way for institutional investors, who previously faced significant hurdles in directly investing in Bitcoin, to gain regulated exposure to the cryptocurrency market. The recent surge in ETF investments underscores the growing confidence of these large players. This institutional interest is a key driver behind the price appreciation we've witnessed.

Why the Sudden Influx? Several Factors at Play:

Several factors contribute to this significant investment surge:

- Regulatory Clarity: The increasing regulatory clarity surrounding cryptocurrencies, particularly in the US, is bolstering investor confidence. While regulations are still evolving, the fact that major financial regulators are actively engaging with the crypto space is a positive sign.

- Reduced Volatility (Relatively Speaking): Compared to the wild swings of previous years, Bitcoin has exhibited a degree of price stability, making it a more attractive investment for risk-averse institutional investors. This relative stability, however, should be viewed within the context of Bitcoin's inherent volatility.

- Inflation Hedge Narrative: With persistent inflation concerns globally, many investors see Bitcoin as a potential hedge against inflation, similar to gold. This perception is fueling demand, especially amongst those seeking alternative investment options.

- Halving Event Anticipation: The upcoming Bitcoin halving event, which reduces the rate of new Bitcoin creation, is often associated with increased price appreciation. This anticipation is further driving investor interest.

What Does This Mean for Bitcoin's Future?

While the influx of capital into Bitcoin ETFs is undeniably bullish, it's crucial to maintain a balanced perspective. Bitcoin's price remains volatile, and predicting its future trajectory with certainty is impossible. However, the sustained institutional investment signifies a growing acceptance of Bitcoin as a legitimate asset class.

Potential Risks to Consider:

It's essential to acknowledge potential risks:

- Regulatory Uncertainty: While regulatory clarity is improving, the regulatory landscape remains dynamic, and unforeseen changes could impact the market.

- Market Manipulation: The crypto market is susceptible to manipulation, and large-scale price swings are possible.

- Geopolitical Factors: Global economic and geopolitical events can significantly influence Bitcoin's price.

Navigating the Market:

For investors considering exposure to Bitcoin, ETFs offer a regulated and relatively accessible entry point. However, thorough research and diversification remain crucial. Remember, investing in cryptocurrencies carries inherent risks, and you should only invest what you can afford to lose.

Conclusion:

The significant investment in Bitcoin ETFs signifies a major shift in the market. While the future remains uncertain, the increased institutional adoption and regulatory progress paint a picture of growing mainstream acceptance. However, investors must proceed with caution, acknowledging the inherent risks associated with cryptocurrency investments. Stay informed, diversify your portfolio, and always conduct thorough research before making any investment decisions. Learn more about Bitcoin and other cryptocurrencies by exploring reputable financial resources and consulting with a qualified financial advisor.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on $5B+ Pours Into Bitcoin ETFs: Understanding The Market's Directional Bets. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Two Teens Charged With Vandalism After Church Defecation And Urination Incident In Santa Rosa

May 21, 2025

Two Teens Charged With Vandalism After Church Defecation And Urination Incident In Santa Rosa

May 21, 2025 -

Jones Vs Ufc Dispute Erupts Over Withheld Aspinall Injury Information

May 21, 2025

Jones Vs Ufc Dispute Erupts Over Withheld Aspinall Injury Information

May 21, 2025 -

Assassins Creed Valhalla Why Ubisoft Restricts Animal Killing

May 21, 2025

Assassins Creed Valhalla Why Ubisoft Restricts Animal Killing

May 21, 2025 -

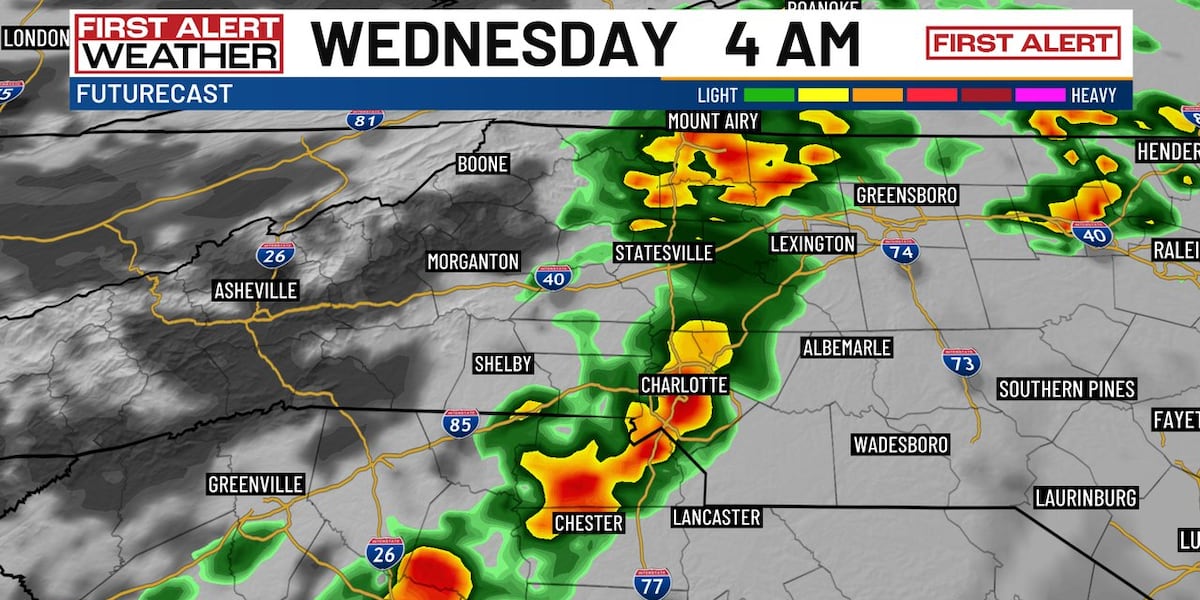

Charlotte Residents Urged To Prepare Overnight Storms And Cold Snap Approaching

May 21, 2025

Charlotte Residents Urged To Prepare Overnight Storms And Cold Snap Approaching

May 21, 2025 -

Restraint And Reflection Analyzing The Muted Tone Of The Phoenician Scheme

May 21, 2025

Restraint And Reflection Analyzing The Muted Tone Of The Phoenician Scheme

May 21, 2025