$5B+ Poured Into Bitcoin ETFs: Understanding The Risk And Reward

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

$5 Billion+ Poured into Bitcoin ETFs: Understanding the Risk and Reward

The cryptocurrency market is buzzing. Over $5 billion has flooded into Bitcoin exchange-traded funds (ETFs) since the first spot Bitcoin ETF, the Invesco Physical Bitcoin ETF, launched in Canada. This massive influx of capital signifies a growing institutional confidence in Bitcoin, but it also highlights the inherent risks associated with this volatile asset class. Understanding both the potential rewards and the significant risks is crucial for any investor considering exposure to Bitcoin through ETFs.

What are Bitcoin ETFs and Why the Surge in Investment?

Bitcoin ETFs offer investors a regulated and convenient way to gain exposure to Bitcoin without needing to directly purchase and manage the cryptocurrency itself. This accessibility is a major factor driving the recent surge in investment. Previously, investing in Bitcoin involved navigating the complexities of cryptocurrency exchanges, managing private keys, and dealing with potential security risks. ETFs streamline this process, making Bitcoin investment more palatable to a broader range of investors, including institutions.

The approval of the first US spot Bitcoin ETF is widely anticipated to further fuel this growth. The SEC's review process has been heavily scrutinized, but a green light could potentially unlock even greater capital inflows into the Bitcoin market.

The Allure of Bitcoin: Potential Rewards

The attraction to Bitcoin ETFs stems from the potential for significant returns. Bitcoin's price has historically shown periods of explosive growth, attracting investors seeking high-growth opportunities. However, it's crucial to remember that past performance is not indicative of future results.

- Decentralization: Bitcoin's decentralized nature, operating independently of central banks and governments, appeals to investors seeking an alternative asset class.

- Scarcity: The limited supply of Bitcoin (21 million coins) is often cited as a driver of its potential long-term value.

- Inflation Hedge: Some investors view Bitcoin as a hedge against inflation, believing its limited supply will protect its value during periods of economic uncertainty.

Navigating the Risks: The Potential Downsides

While the potential rewards are substantial, investing in Bitcoin ETFs comes with significant risks:

- Volatility: Bitcoin's price is notoriously volatile, subject to dramatic swings in short periods. This volatility can lead to substantial losses, especially for investors with shorter time horizons.

- Regulatory Uncertainty: The regulatory landscape surrounding cryptocurrencies is constantly evolving. Changes in regulations could negatively impact the price and accessibility of Bitcoin ETFs.

- Security Risks: Although ETFs mitigate some security risks associated with direct Bitcoin ownership, the underlying asset remains vulnerable to hacking and other security breaches.

- Market Manipulation: The relatively small size of the Bitcoin market compared to traditional markets makes it potentially more susceptible to market manipulation.

Diversification is Key: A Balanced Investment Strategy

Investing in Bitcoin ETFs should be part of a well-diversified investment portfolio. It's crucial not to allocate a disproportionate amount of your investment capital to Bitcoin, given its high volatility. Consider your risk tolerance and financial goals before investing.

Conclusion: Informed Decisions are Crucial

The influx of billions into Bitcoin ETFs signals a growing interest in this asset class. However, investors must carefully weigh the potential rewards against the significant risks before investing. Thorough research, understanding your risk tolerance, and consulting with a qualified financial advisor are essential steps before making any investment decisions. Don't chase hype; make informed choices based on a comprehensive understanding of the market. Learn more about investing in cryptocurrencies by exploring resources from reputable financial institutions and regulatory bodies. Remember, responsible investing is key to achieving your long-term financial goals.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on $5B+ Poured Into Bitcoin ETFs: Understanding The Risk And Reward. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

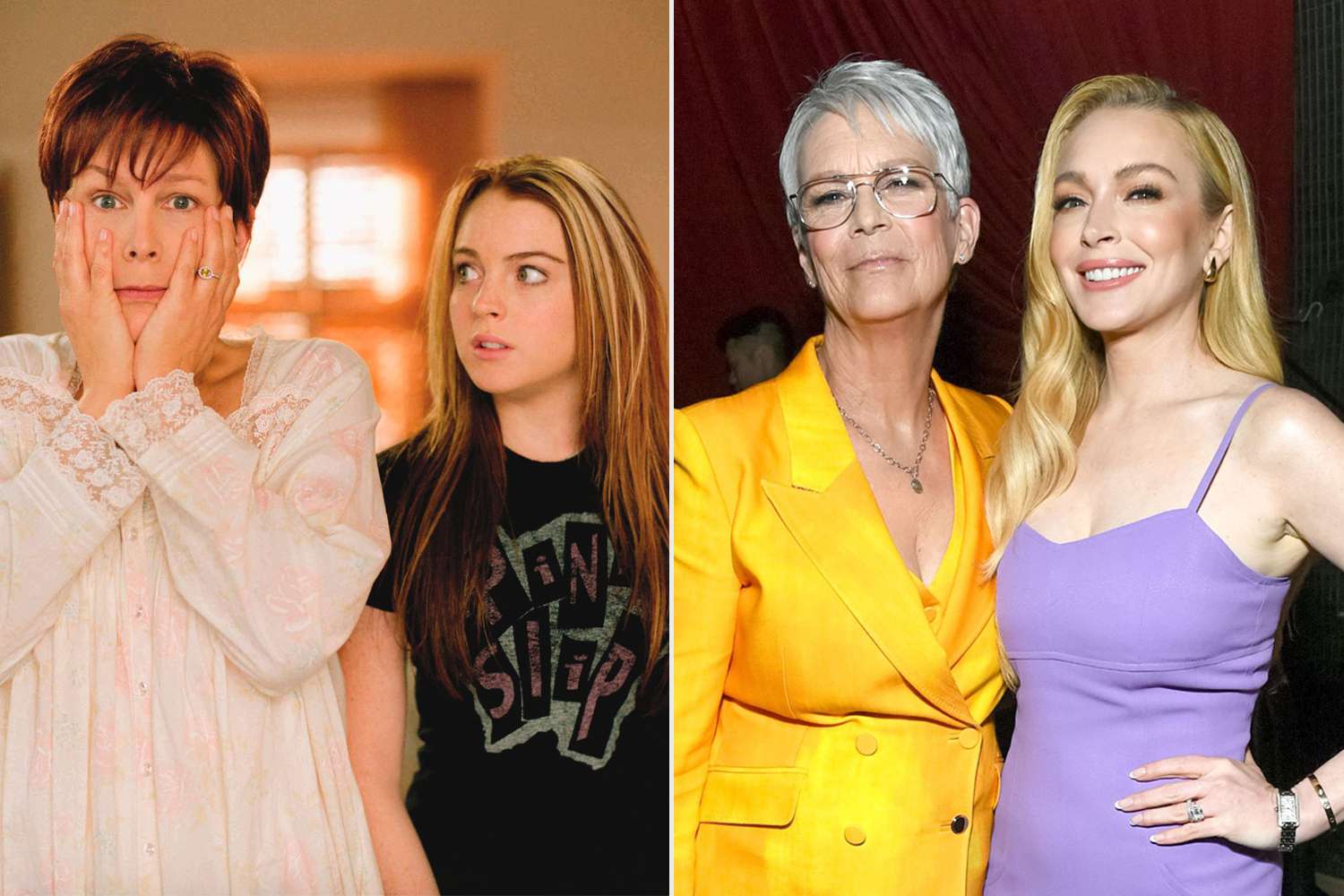

Jamie Lee Curtis And Lindsay Lohan Honest Friendship Revealed

May 20, 2025

Jamie Lee Curtis And Lindsay Lohan Honest Friendship Revealed

May 20, 2025 -

War 2 Teaser Unveiled Kabirs Fierce Return And Clash With Jr Ntr

May 20, 2025

War 2 Teaser Unveiled Kabirs Fierce Return And Clash With Jr Ntr

May 20, 2025 -

Russia Ukraine Peace Talks Trumps Announcement And Potential Implications

May 20, 2025

Russia Ukraine Peace Talks Trumps Announcement And Potential Implications

May 20, 2025 -

Analysis Putins Actions Underscore Trumps Reduced Global Leverage

May 20, 2025

Analysis Putins Actions Underscore Trumps Reduced Global Leverage

May 20, 2025 -

Jamie Lee Curtis Opens Up About Her Bond With Lindsay Lohan Years After Freaky Friday Exclusive

May 20, 2025

Jamie Lee Curtis Opens Up About Her Bond With Lindsay Lohan Years After Freaky Friday Exclusive

May 20, 2025