$5B+ Poured Into Bitcoin ETFs: Understanding The Driving Forces Behind This Investment Trend

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

$5 Billion+ Poured into Bitcoin ETFs: Decoding the Surge in Institutional Investment

The cryptocurrency market has witnessed a significant surge in institutional investment, with over $5 billion flowing into Bitcoin exchange-traded funds (ETFs) in recent months. This unprecedented influx of capital signifies a growing acceptance of Bitcoin as a legitimate asset class and highlights several key driving forces behind this trend. This article delves into the factors propelling this investment boom and analyzes its potential impact on the future of Bitcoin and the broader cryptocurrency market.

The Rise of Bitcoin ETFs: A Gateway for Institutional Investors

The approval of the first Bitcoin futures ETF in the US marked a pivotal moment, paving the way for easier access to Bitcoin exposure for institutional investors. Previously, direct investment in Bitcoin involved navigating complex and often risky exchanges. ETFs, however, offer a more regulated and familiar investment vehicle, making it significantly easier for large-scale investors like pension funds, hedge funds, and asset management firms to allocate capital to Bitcoin. This simplified access is a primary driver behind the recent surge in investment.

Diversification and Portfolio Hedging: Bitcoin's Growing Appeal

Many institutional investors are viewing Bitcoin as a valuable tool for portfolio diversification. Its low correlation with traditional assets like stocks and bonds makes it an attractive hedge against inflation and market downturns. The perceived scarcity of Bitcoin, with a fixed supply of 21 million coins, further adds to its appeal as a store of value in an era of increasing monetary expansion. This diversification strategy is a crucial element fueling the demand for Bitcoin ETFs.

Growing Regulatory Clarity and Institutional Adoption

Increased regulatory clarity in key markets, particularly in the US, has also played a significant role. While regulatory frameworks are still evolving, the gradual acceptance and establishment of guidelines have instilled greater confidence among institutional investors. This, coupled with the increasing adoption of Bitcoin by major corporations, further legitimizes Bitcoin as a viable investment asset.

Technological Advancements and Network Security

Bitcoin's underlying technology, blockchain, continues to evolve, with improvements in scalability and transaction speeds. The network's robust security and proven track record of resilience also contribute to the growing trust in Bitcoin as a reliable investment. These technological advancements reinforce the long-term potential of Bitcoin and encourage institutional investors to allocate capital.

Concerns and Future Outlook

While the influx of capital into Bitcoin ETFs is significant, it's crucial to acknowledge potential risks. The cryptocurrency market remains volatile, and Bitcoin's price is susceptible to rapid fluctuations. Regulatory uncertainty and potential future policy changes could also impact the market.

Despite these challenges, the trend of institutional investment in Bitcoin ETFs is likely to continue. The growing acceptance of Bitcoin as a legitimate asset class, combined with increased regulatory clarity and technological advancements, suggests a positive outlook for Bitcoin's long-term growth.

What this means for you: The surge in investment in Bitcoin ETFs indicates a significant shift in the perception of cryptocurrencies. While individual investment decisions should always be based on thorough research and risk tolerance, the increasing institutional adoption highlights the potential for continued growth in the cryptocurrency market. Consider consulting a financial advisor before making any investment decisions.

Keywords: Bitcoin ETF, Bitcoin investment, institutional investors, cryptocurrency investment, Bitcoin price, blockchain technology, regulatory clarity, portfolio diversification, hedge against inflation, cryptocurrency market.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on $5B+ Poured Into Bitcoin ETFs: Understanding The Driving Forces Behind This Investment Trend. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Fall Of Favre Director Discusses Brett Favres Complex Legacy In New Netflix Documentary

May 21, 2025

Fall Of Favre Director Discusses Brett Favres Complex Legacy In New Netflix Documentary

May 21, 2025 -

Big Changes Coming New Peaky Blinders Series Greenlit By Creator

May 21, 2025

Big Changes Coming New Peaky Blinders Series Greenlit By Creator

May 21, 2025 -

Ellen De Generes Post Loss Social Media Appearance Excites Fans

May 21, 2025

Ellen De Generes Post Loss Social Media Appearance Excites Fans

May 21, 2025 -

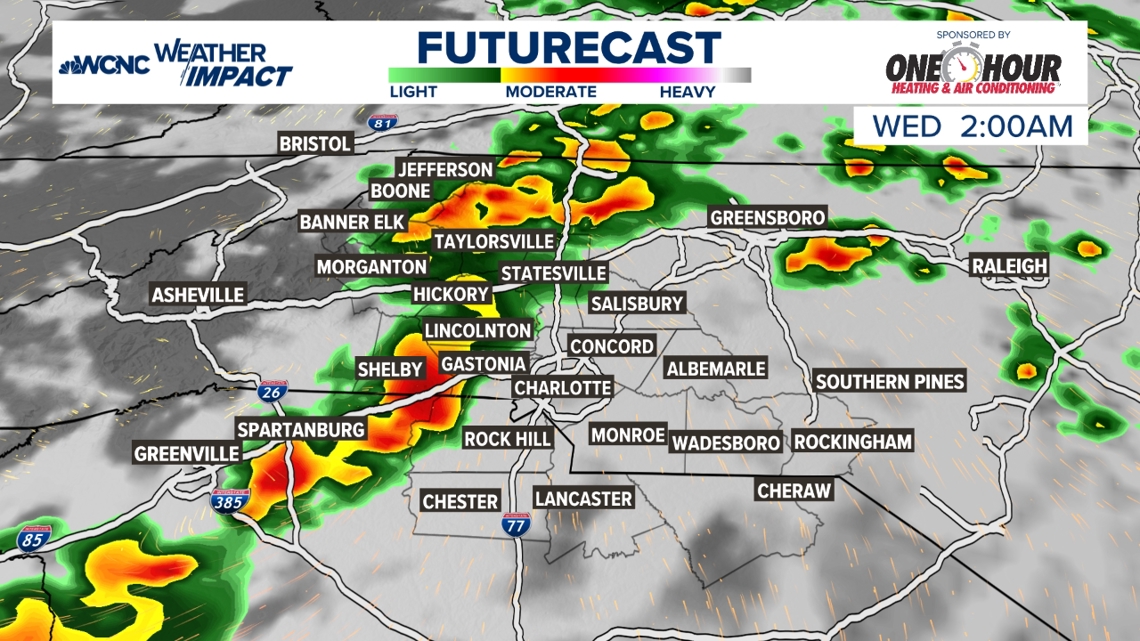

Tuesday Night Storm Forecast Low Probability Of Intense Weather

May 21, 2025

Tuesday Night Storm Forecast Low Probability Of Intense Weather

May 21, 2025 -

Heartbreak For Ellen De Generes Family Loss Announced On Social Media

May 21, 2025

Heartbreak For Ellen De Generes Family Loss Announced On Social Media

May 21, 2025