$5B+ Inflows Into Bitcoin ETFs: Understanding The Market Trend

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

$5B+ Inflows into Bitcoin ETFs: Understanding the Market Trend

The cryptocurrency market is buzzing with excitement as Bitcoin exchange-traded funds (ETFs) have witnessed a staggering influx of over $5 billion in investments. This monumental surge signifies a growing institutional confidence in Bitcoin and marks a pivotal moment in the digital asset's journey towards mainstream adoption. But what's driving this massive inflow, and what does it mean for the future of Bitcoin and the broader crypto market?

The Institutional Embrace of Bitcoin ETFs

The recent surge in investment isn't just a fleeting trend; it represents a significant shift in how institutional investors view Bitcoin. Traditionally, institutional participation in the crypto market was limited due to regulatory uncertainty and the complexities of direct Bitcoin ownership. Bitcoin ETFs, however, offer a familiar and regulated pathway for institutions to gain exposure to Bitcoin without the complexities of managing private keys or navigating the intricacies of cryptocurrency exchanges. This accessibility is a key driver behind the current wave of investment.

Factors Fueling the $5 Billion+ Inflow:

Several factors contribute to this remarkable inflow into Bitcoin ETFs:

-

Regulatory Approvals: The approval of Bitcoin ETFs by major regulatory bodies, like the SEC in the US, has played a crucial role. This regulatory clarity legitimizes Bitcoin as an investable asset and encourages institutional participation. The reduced regulatory risk significantly lowers the barrier to entry for large investors.

-

Inflation Hedge: With persistent inflation in many global economies, Bitcoin, often touted as a hedge against inflation, is increasingly attractive to investors seeking to preserve their purchasing power. Its limited supply and decentralized nature make it a compelling alternative to traditional assets.

-

Technological Advancements: Ongoing advancements in Bitcoin's underlying technology, such as the Lightning Network, are improving its scalability and transaction speed, making it a more practical and efficient payment system. This strengthens the long-term viability of Bitcoin as a store of value and a medium of exchange.

-

Growing Institutional Adoption: Beyond ETFs, we're seeing a broader trend of institutional adoption of Bitcoin. Large corporations are adding Bitcoin to their treasury reserves, demonstrating growing acceptance of the cryptocurrency as a legitimate asset class. This growing institutional interest fuels further investor confidence.

What the Future Holds:

The $5 billion+ inflow into Bitcoin ETFs is a powerful indicator of a maturing and increasingly institutionalized cryptocurrency market. This trend is likely to continue, driven by further regulatory approvals, increasing institutional adoption, and the ongoing evolution of Bitcoin's technology.

However, it's crucial to remember that the cryptocurrency market remains volatile. While the influx into ETFs reflects positive sentiment, investors should always exercise caution and conduct thorough research before investing in any cryptocurrency, including Bitcoin. Diversification remains key to managing risk within any investment portfolio.

Looking Ahead:

The future of Bitcoin ETFs remains bright, with further potential for growth and adoption. As more regulatory clarity emerges globally and institutional investors continue to explore this asset class, we can anticipate further inflows and increased market capitalization. This continued growth will likely solidify Bitcoin's position as a major player in the global financial landscape.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in cryptocurrencies involves significant risk and may result in the loss of capital.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on $5B+ Inflows Into Bitcoin ETFs: Understanding The Market Trend. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

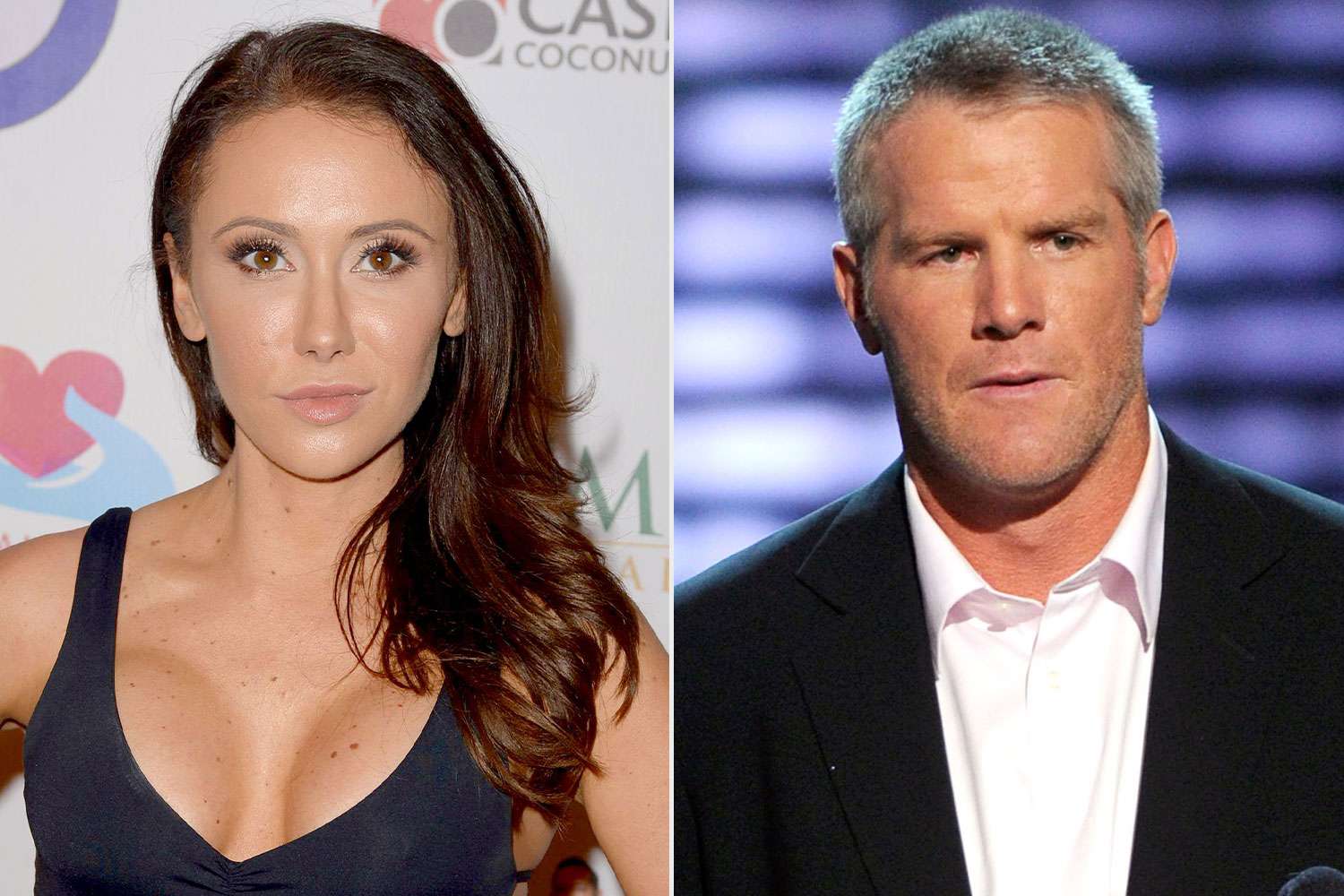

The Lasting Scars Jenn Sterger Reflects On Brett Favre Scandal

May 20, 2025

The Lasting Scars Jenn Sterger Reflects On Brett Favre Scandal

May 20, 2025 -

Bali Seeks International Help To Improve Tourist Behavior

May 20, 2025

Bali Seeks International Help To Improve Tourist Behavior

May 20, 2025 -

Joel And Ellies Evolving Dynamic A Comparative Analysis Of The Last Of Us Game And Season 2

May 20, 2025

Joel And Ellies Evolving Dynamic A Comparative Analysis Of The Last Of Us Game And Season 2

May 20, 2025 -

Walmarts Price Hike Warning A Direct Response To Trumps Tariffs

May 20, 2025

Walmarts Price Hike Warning A Direct Response To Trumps Tariffs

May 20, 2025 -

First Glimpse Of War 2 Hrithik Roshan Jr Ntr And Kiara Advani

May 20, 2025

First Glimpse Of War 2 Hrithik Roshan Jr Ntr And Kiara Advani

May 20, 2025