$5B+ Inflows Into Bitcoin ETFs: A Sign Of Market Confidence?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

$5B+ Inflows into Bitcoin ETFs: A Sign of Institutional Confidence?

The cryptocurrency market is buzzing after witnessing over $5 billion in inflows into Bitcoin exchange-traded funds (ETFs) in recent weeks. This surge raises a crucial question: is this a genuine sign of growing institutional confidence in Bitcoin, or just a temporary market fluctuation?

The recent influx of capital into Bitcoin ETFs marks a significant shift in the narrative surrounding the leading cryptocurrency. For years, Bitcoin's volatility and regulatory uncertainty deterred many institutional investors. However, the approval of several Bitcoin ETFs in major markets, including the United States, has opened the floodgates for a new wave of investment. This accessibility, coupled with the perceived safety and regulatory compliance offered by ETFs, is likely a key driver of this massive inflow.

<br>

What's Driving the Bitcoin ETF Boom?

Several factors contribute to the current wave of investment in Bitcoin ETFs:

- Increased Regulatory Clarity: The approval of Bitcoin ETFs by regulatory bodies like the SEC significantly reduces the risk for institutional investors, making Bitcoin a more palatable asset class. This regulatory clarity is a game-changer, fostering greater trust and attracting a broader range of investors.

- Institutional Adoption: Large financial institutions are increasingly diversifying their portfolios to include crypto assets. Bitcoin ETFs offer a convenient and regulated pathway for these institutions to gain exposure to the cryptocurrency market.

- Inflation Hedge Potential: In times of economic uncertainty and high inflation, Bitcoin is viewed by some as a potential hedge against inflation, an alternative store of value. This perception is driving investors towards Bitcoin as a part of a diversified investment strategy.

- Technological Advancements: The ongoing development and improvement of the Bitcoin network, particularly in areas like scalability and energy efficiency, enhance its long-term viability and appeal to investors.

<br>

Is this a Sustainable Trend?

While the recent influx of capital is undeniably impressive, it's crucial to remain cautious. The cryptocurrency market is inherently volatile, and short-term price fluctuations can significantly impact investment flows. Several factors could influence the sustainability of this trend:

- Regulatory Landscape: Future regulatory changes, both positive and negative, could dramatically influence investor sentiment and capital inflows. Ongoing regulatory scrutiny remains a key factor.

- Market Sentiment: General market sentiment towards both cryptocurrencies and the broader economy can significantly affect investment decisions. A sudden downturn in the overall market could lead to capital outflows.

- Competition: The emergence of competing digital assets and innovative blockchain technologies could divert investor attention and capital away from Bitcoin.

<br>

Looking Ahead:

The $5 billion+ inflow into Bitcoin ETFs is a significant development, suggesting a growing level of institutional confidence in Bitcoin. However, it's too early to definitively declare this a permanent shift. The sustainability of this trend hinges on several factors, including regulatory stability, overall market sentiment, and the continued development of the Bitcoin ecosystem. It's essential for investors to conduct thorough research and understand the risks involved before investing in any cryptocurrency. This surge, however, certainly indicates a potential paradigm shift in the way institutional investors view Bitcoin, moving it from a niche asset to a more mainstream investment opportunity.

Further Reading:

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in cryptocurrencies involves significant risk, and you could lose some or all of your investment.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on $5B+ Inflows Into Bitcoin ETFs: A Sign Of Market Confidence?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

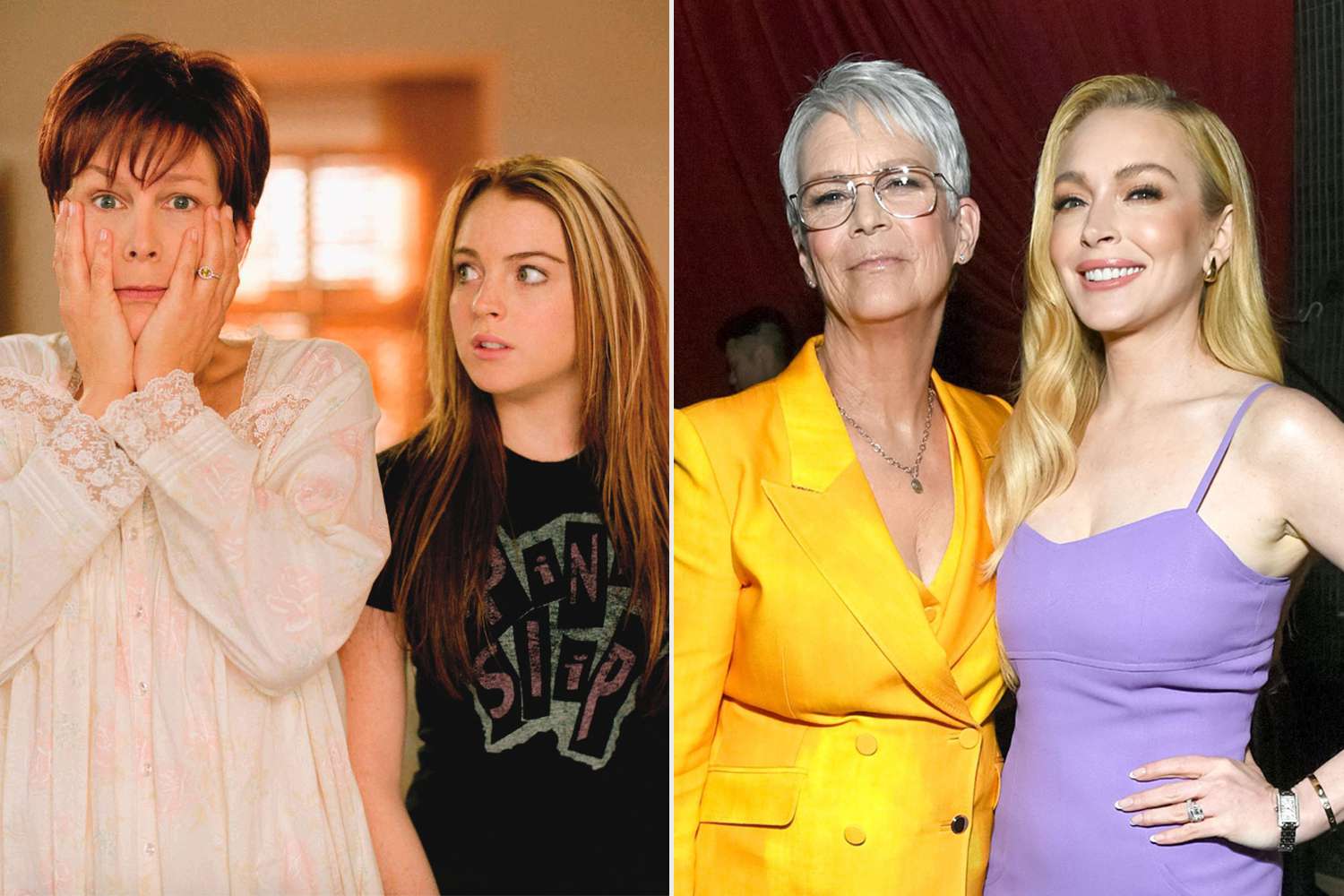

Jamie Lee Curtis And Lindsay Lohan Their Post Freaky Friday Friendship

May 20, 2025

Jamie Lee Curtis And Lindsay Lohan Their Post Freaky Friday Friendship

May 20, 2025 -

Homeland Security And Reality Tv Exploring The Citizenship Application Process

May 20, 2025

Homeland Security And Reality Tv Exploring The Citizenship Application Process

May 20, 2025 -

Tariffs And Retail Trumps Response To Walmarts Price Concerns

May 20, 2025

Tariffs And Retail Trumps Response To Walmarts Price Concerns

May 20, 2025 -

U S Treasury Yields Fall As Federal Reserve Hints At Single 2025 Rate Reduction

May 20, 2025

U S Treasury Yields Fall As Federal Reserve Hints At Single 2025 Rate Reduction

May 20, 2025 -

The Untold Story Behind The Threats A J Perez On The Brett Favre Documentary

May 20, 2025

The Untold Story Behind The Threats A J Perez On The Brett Favre Documentary

May 20, 2025