$449 Million Powerball Winner: Calculating Your Take-Home Prize After Taxes

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

<h1>$449 Million Powerball Winner: Calculating Your Take-Home Prize After Taxes</h1>

Winning the lottery is a dream for many, and a recent Powerball winner just had that dream come true, pocketing a staggering $449 million. But before visions of private jets and beachfront property dance in your head, let's get down to the nitty-gritty: how much of that $449 million will actually end up in the winner's bank account after taxes? It's a question many are asking, and understanding the process is crucial for anyone hoping to hit the jackpot someday.

<h2>The Lump Sum vs. Annuity Decision</h2>

Lottery winners typically face a crucial first decision: take the winnings as a lump sum payment or receive them as an annuity over several years. While the advertised jackpot is usually the annuity value, the lump sum is significantly less. In this case, the $449 million Powerball winner likely opted for the lump sum, meaning they received a considerably smaller amount upfront. This smaller amount is then subject to federal and potentially state taxes.

<h2>Federal Taxes on Lottery Winnings</h2>

The Internal Revenue Service (IRS) considers lottery winnings as taxable income. This means a significant portion of the winnings will be immediately taxed at the winner's marginal tax rate. The highest federal income tax bracket currently sits at 37%, meaning a substantial chunk of the lump sum will go directly to the federal government. The exact amount will depend on the winner's other income and deductions.

<h3>State Taxes: A Variable Factor</h3>

Beyond federal taxes, many states also levy taxes on lottery winnings. The specific tax rate varies significantly depending on the state where the ticket was purchased. Some states have no state income tax, while others have rates that can reach as high as 13%. This means our Powerball winner could face an additional substantial tax burden depending on their location.

<h2>Calculating the Take-Home Pay: A Complex Equation</h2>

Precisely calculating the take-home pay after federal and state taxes requires considering several factors:

- Winner's Tax Bracket: The higher the winner's overall income (including the lottery winnings), the higher their tax bracket and therefore, the higher the tax burden.

- State of Residence: The state's income tax rate is a major determining factor in the final take-home amount.

- Tax Deductions and Credits: While unlikely to significantly reduce the overall tax liability on such a large sum, legitimate tax deductions and credits could offer some minor relief.

- Tax Advisors: It is crucial for a lottery winner to consult with experienced tax professionals to navigate the complex tax landscape and ensure they are complying with all relevant laws.

<h2>Beyond Taxes: Other Financial Considerations</h2>

While taxes are a major concern, lottery winners should also consider other financial implications:

- Investment Strategies: How to wisely invest the remaining funds to ensure long-term financial security is crucial. This might involve seeking advice from financial advisors specializing in high-net-worth individuals.

- Estate Planning: Proper estate planning is essential to protect the assets and ensure they are distributed according to the winner's wishes.

- Protecting Your Privacy: Sudden wealth can bring unwanted attention. Lottery winners need to consider strategies to safeguard their privacy and security.

<h2>Conclusion: A Life-Changing Win, But with Important Caveats</h2>

Winning $449 million in the Powerball is undoubtedly life-changing. However, it's crucial to understand the significant impact of taxes and other financial considerations. Seeking professional advice from tax advisors and financial planners is paramount to ensuring the winnings are managed wisely and contribute to long-term financial well-being. Remember, the advertised jackpot is rarely the amount you'll actually receive. Thorough planning is key to making the most of this incredible opportunity.

Disclaimer: This article provides general information and should not be considered financial or legal advice. Consult with qualified professionals for personalized guidance.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on $449 Million Powerball Winner: Calculating Your Take-Home Prize After Taxes. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

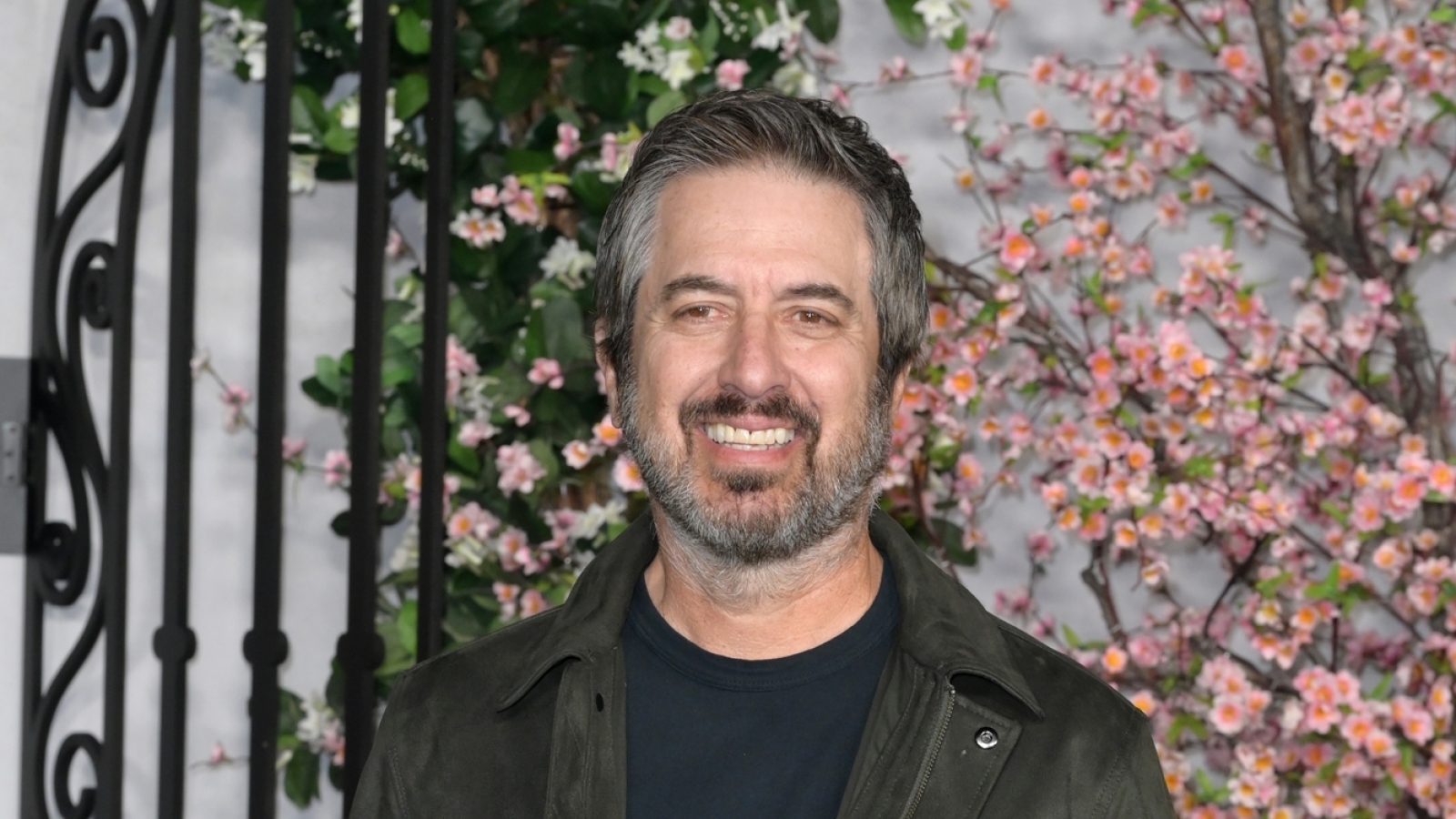

Kevin James Redefines Sitcom Characters After Everybody Loves Raymond

Aug 07, 2025

Kevin James Redefines Sitcom Characters After Everybody Loves Raymond

Aug 07, 2025 -

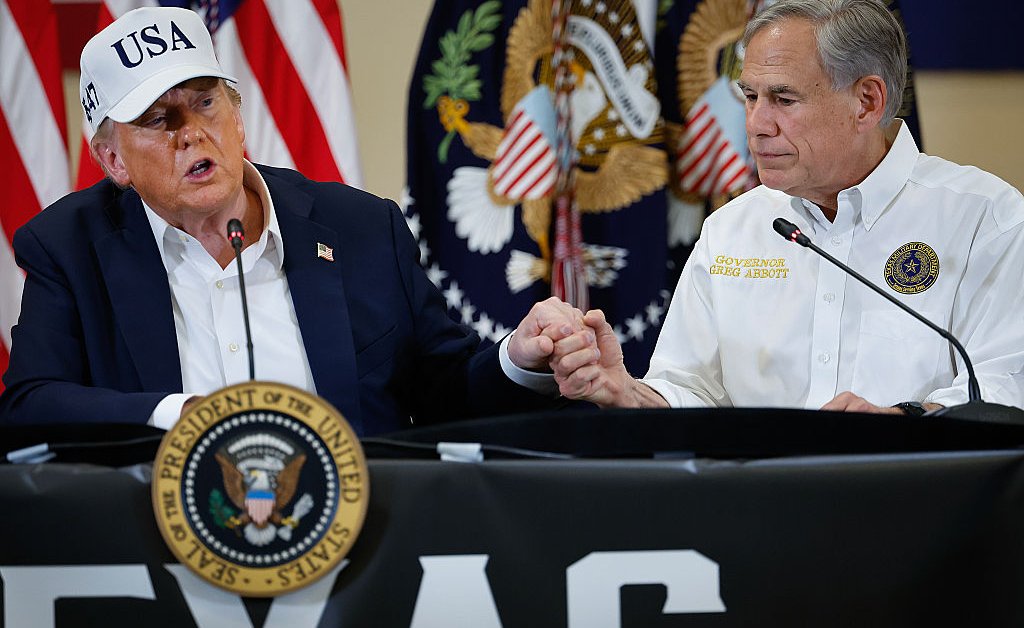

Texas Gerrymandering The Impact On Democrats And The 2022 Midterms

Aug 07, 2025

Texas Gerrymandering The Impact On Democrats And The 2022 Midterms

Aug 07, 2025 -

The Impact Of Texas Controversial Redistricting Plan On The 2022 Midterms

Aug 07, 2025

The Impact Of Texas Controversial Redistricting Plan On The 2022 Midterms

Aug 07, 2025 -

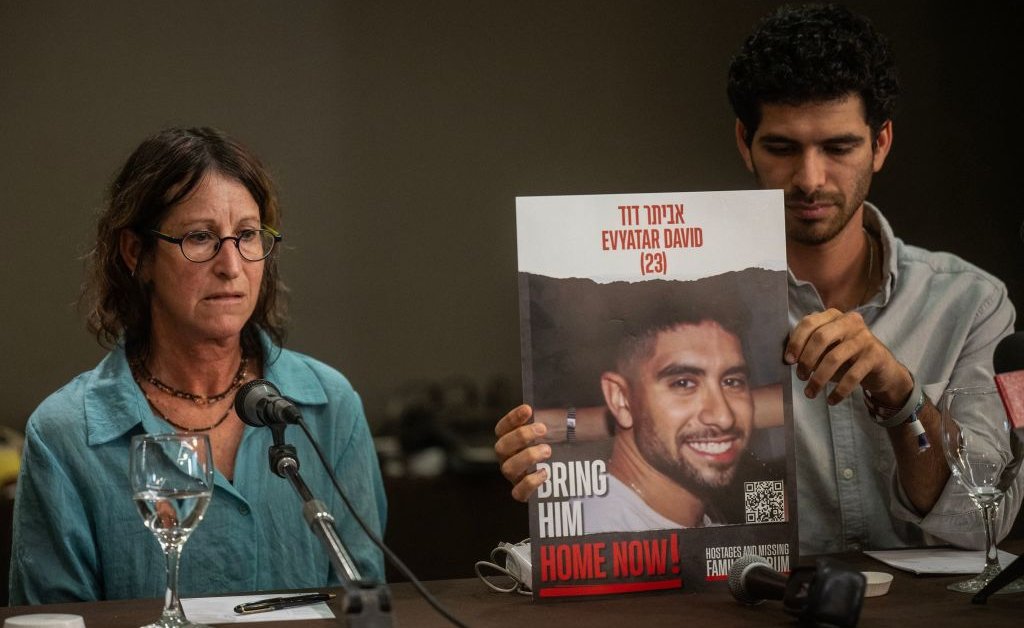

Gaza Hostage Crisis Evyatar David Shown In Hamas Video

Aug 07, 2025

Gaza Hostage Crisis Evyatar David Shown In Hamas Video

Aug 07, 2025 -

Review Platonic Season Two Is It Worth Watching

Aug 07, 2025

Review Platonic Season Two Is It Worth Watching

Aug 07, 2025