$449 Million Powerball: How Much Will You Keep After Taxes?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

$449 Million Powerball: How Much Will You Really Keep After Taxes?

The lottery's siren song is powerful. A $449 million Powerball jackpot is enough to make anyone daydream about early retirement, luxury cars, and a life free from financial worries. But before you start planning your tropical getaway, let's talk about the elephant in the room: taxes. That whopping $449 million prize isn't what you'll actually walk away with. So, how much will you really keep after taxes? Let's break it down.

Understanding Federal Taxes on Lottery Winnings

The IRS considers lottery winnings as taxable income. This means a significant chunk will be deducted at the source before you even receive your winnings. The federal tax rate on lottery winnings depends on your total income and filing status, but you're looking at a hefty bite. For the 2023 tax year, the highest individual income tax bracket is 37%, meaning a substantial portion of your $449 million jackpot will be immediately subject to this rate.

State Taxes: A Variable Factor

The picture gets even more complex when you factor in state taxes. Unlike federal taxes, state taxes on lottery winnings vary significantly depending on your state of residence. Some states, like California, don't tax lottery winnings at all, while others levy significant taxes. For example, New York has a relatively high tax rate on lottery winnings. Before you celebrate, be sure to research your state's specific tax laws regarding lottery prizes. This will significantly impact your final payout.

Calculating Your Take-Home Pay: A Simplified Example

Let's assume, for simplification, you choose the lump-sum payment option (most winners do). This option will reduce the overall jackpot amount, but it avoids years of annuity payments and potential complications. The lump-sum payment is typically around 60% of the advertised jackpot. In this case, that's approximately $269.4 million.

Now, let's assume a combined federal and state tax rate of 45% (this is a hypothetical average; your actual rate will depend on your state and federal tax bracket). A 45% tax rate on $269.4 million leaves you with approximately $148.17 million.

Here's a breakdown:

- Advertised Jackpot: $449 Million

- Lump Sum Payment (Estimate): $269.4 Million

- Hypothetical Combined Tax Rate (45%): $121.23 Million (approximately)

- Estimated Take-Home Pay: $148.17 Million (approximately)

Important Considerations:

- Consult a Tax Professional: This is crucial. The above calculation is a simplified example. You absolutely need to consult a qualified tax advisor and financial planner to understand the full implications of your winnings and develop a sound financial strategy.

- Tax Withholding: The lottery will withhold a percentage of your winnings for federal and state taxes. However, you'll still likely owe additional taxes when you file your return.

- Investment Strategies: Your newfound wealth requires careful planning. Working with a financial advisor can help you make informed decisions about investments and long-term financial security.

Winning the Lottery: A Life-Changing Event

Winning the lottery is undeniably a life-changing event. However, it's essential to approach it with careful planning and expert advice. Don't let the excitement overshadow the crucial need for sound financial management. Understanding the tax implications beforehand is the first step toward securing your financial future. Remember to consult professionals to navigate this complex landscape and make the most of your incredible win.

Call to Action: Have you ever dreamed of winning the lottery? Share your thoughts and financial planning strategies in the comments below!

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on $449 Million Powerball: How Much Will You Keep After Taxes?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Din Thomass Disaster Claim A Former Ufc Champion Weighs In On Khamzat Chimaev

Aug 07, 2025

Din Thomass Disaster Claim A Former Ufc Champion Weighs In On Khamzat Chimaev

Aug 07, 2025 -

The Hottest Tv Shows Debuting In July 2025

Aug 07, 2025

The Hottest Tv Shows Debuting In July 2025

Aug 07, 2025 -

Unexpected Power Analyzing Baseballs Sudden Offensive Surge

Aug 07, 2025

Unexpected Power Analyzing Baseballs Sudden Offensive Surge

Aug 07, 2025 -

Mariners Julio Rodriguez Makes History Passans Analysis And Future Outlook

Aug 07, 2025

Mariners Julio Rodriguez Makes History Passans Analysis And Future Outlook

Aug 07, 2025 -

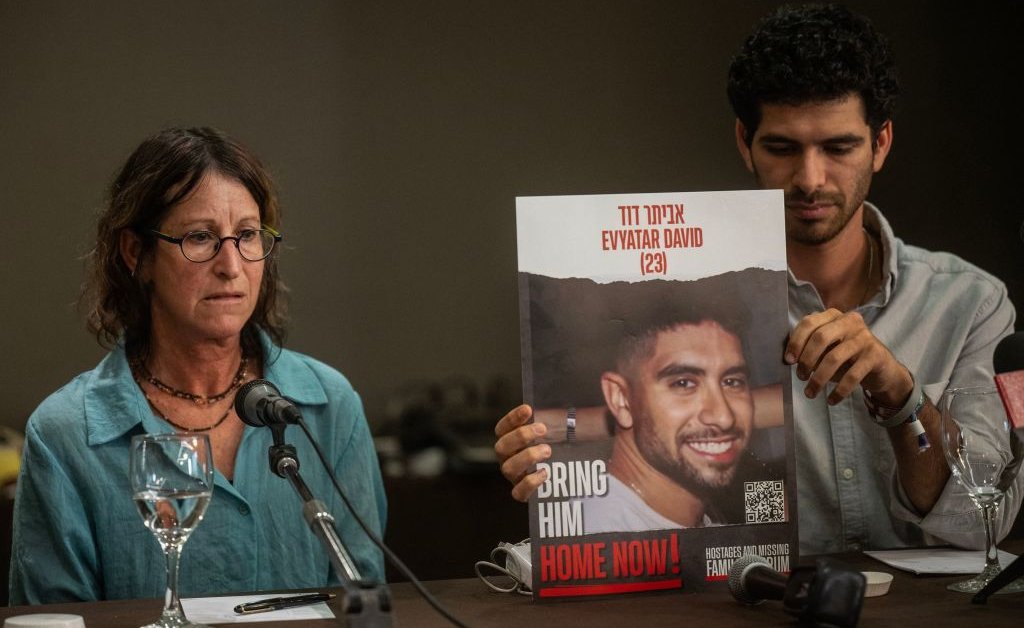

Confirmation Hamas Releases Video Of Captured Israeli Evyatar David

Aug 07, 2025

Confirmation Hamas Releases Video Of Captured Israeli Evyatar David

Aug 07, 2025

Latest Posts

-

Rodgers Delivers Brutal Truth To Steelers Receiver

Aug 07, 2025

Rodgers Delivers Brutal Truth To Steelers Receiver

Aug 07, 2025 -

How Ray Romanos Everybody Loves Raymond Changed Kevin Jamess Approach To Comedy

Aug 07, 2025

How Ray Romanos Everybody Loves Raymond Changed Kevin Jamess Approach To Comedy

Aug 07, 2025 -

Steelers Wideout Faces Rodgers Unfiltered Honesty

Aug 07, 2025

Steelers Wideout Faces Rodgers Unfiltered Honesty

Aug 07, 2025 -

From Laughter To Panic The Unexpected Fallout Of Weapons In A Small Town

Aug 07, 2025

From Laughter To Panic The Unexpected Fallout Of Weapons In A Small Town

Aug 07, 2025 -

July 2025 Your Guide To The Hottest New Tv Shows

Aug 07, 2025

July 2025 Your Guide To The Hottest New Tv Shows

Aug 07, 2025