401(k) Cash Out Fuels Oregonian's Solo Sailing Trip To Hawaii

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

401(k) Cash Out Fuels Oregonian's Solo Sailing Trip to Hawaii: A Risky Retirement Gamble?

An Oregonian's decision to cash out their 401(k) to fund a solo sailing trip to Hawaii has sparked a debate about financial risk and retirement planning. The story of Mark Johnson, a 55-year-old Portland resident, has gone viral, highlighting the increasingly common, yet often perilous, practice of raiding retirement savings for non-retirement expenses. Johnson’s journey, while adventurous, raises crucial questions about the long-term consequences of such financial decisions.

While the allure of a solo voyage across the Pacific is undeniable, the implications of depleting retirement funds are significant. Experts warn that this type of action could severely jeopardize long-term financial security, especially given the inherent risks associated with early withdrawal penalties and the loss of potential investment growth.

The Allure of the Open Sea vs. The Security of Retirement Savings

Johnson's story is captivating. He meticulously planned his trip for two years, selling possessions and meticulously preparing his sailboat. But the crucial funding source – his 401(k) – is what has garnered the most attention and criticism. He cashed out approximately $75,000, a significant portion of his retirement nest egg, to finance the months-long adventure. He openly admits the financial risk, stating in a recent interview, "It’s a gamble, I know. But this trip has been a lifelong dream."

This decision, however, is far from unique. Many Americans are facing financial pressures that tempt them to dip into their retirement savings. A recent study by [link to reputable financial source, e.g., the Bureau of Labor Statistics] shows a concerning trend of increased early 401(k) withdrawals. However, financial advisors strongly caution against this practice.

The High Cost of Early 401(k) Withdrawals: More Than Just Taxes

Cashing out a 401(k) before retirement age typically results in significant penalties. These penalties can include:

- Early withdrawal penalties: Often 10% of the withdrawn amount, in addition to regular income tax.

- Loss of future investment growth: The money withdrawn loses the potential for compounding interest and market appreciation over time. This can have a drastic impact on the overall retirement fund.

- Reduced Social Security benefits: In some cases, early withdrawals can impact the amount of Social Security benefits received later in life.

Alternative Financial Strategies for Achieving Dreams

While Johnson's story is compelling, it also serves as a cautionary tale. Before resorting to drastic measures like cashing out a 401(k), individuals should explore alternative financing options, such as:

- Personal loans: These offer a structured repayment plan and often lower interest rates than credit cards.

- Home equity loans: If homeowners have significant equity, they can consider tapping into this resource, though it does carry inherent risks.

- Part-time employment: Increasing income through part-time work allows individuals to save for their dreams without compromising their retirement funds.

Planning for Retirement: A Long-Term Perspective

Secure retirement planning is crucial. It's recommended to consult with a financial advisor to develop a personalized strategy that considers both short-term goals and long-term financial security. Understanding investment options, diversification, and risk tolerance are essential components of a healthy retirement plan. Remember, resources like [link to reputable financial planning website] offer valuable information and tools to help navigate the complexities of retirement savings.

While Mark Johnson's adventurous spirit is admirable, his decision to cash out his 401(k) serves as a potent reminder of the importance of carefully considering the long-term financial consequences before making such a significant decision. Prioritizing retirement savings is essential for a secure future.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on 401(k) Cash Out Fuels Oregonian's Solo Sailing Trip To Hawaii. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Majray Psr Bazygwsh Tbryzy W Dywarhay Mrgbar

May 26, 2025

Majray Psr Bazygwsh Tbryzy W Dywarhay Mrgbar

May 26, 2025 -

Iga Swiatek Sinner Alcaraz Lead Day Two Action At Roland Garros 2025

May 26, 2025

Iga Swiatek Sinner Alcaraz Lead Day Two Action At Roland Garros 2025

May 26, 2025 -

Analyzing Trumps Anti Eu Stance The Implications Of A 50 Tariff

May 26, 2025

Analyzing Trumps Anti Eu Stance The Implications Of A 50 Tariff

May 26, 2025 -

Grftar Shdn Psr 14 Salh Byn Dw Dywar Jzyyat Emlyat Njat

May 26, 2025

Grftar Shdn Psr 14 Salh Byn Dw Dywar Jzyyat Emlyat Njat

May 26, 2025 -

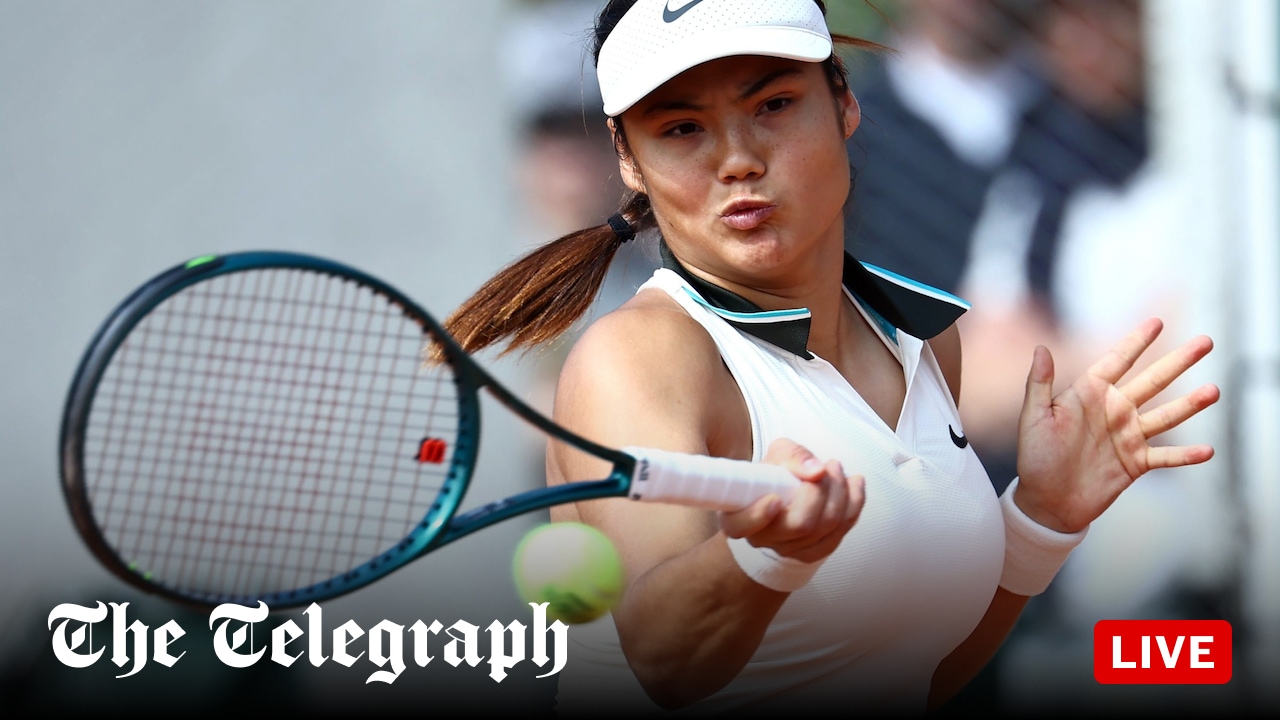

French Open 2024 Live Score And Updates For Raducanu Vs Wang Xinyu

May 26, 2025

French Open 2024 Live Score And Updates For Raducanu Vs Wang Xinyu

May 26, 2025