401(k) Cash Out Fuels Oregon Man's 2,000-Mile Hawaii Sailing Adventure

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

401(k) Cash Out Fuels Oregon Man's 2,000-Mile Hawaii Sailing Adventure: A Risky Gamble or Dream Come True?

Oregon resident, Mark Johnson, recently embarked on a daring 2,000-mile sailing voyage to Hawaii, fueled by a controversial decision: cashing out his 401(k). His story raises questions about financial risk, the pursuit of dreams, and the potential pitfalls of early retirement withdrawals.

The allure of the open ocean, the thrill of adventure, and the breathtaking beauty of Hawaii proved too strong for Mark Johnson, a 55-year-old Oregonian. He traded the familiar comfort of his landlocked life for the unpredictable embrace of the Pacific, funding his ambitious sailing trip with a significant portion of his 401(k) savings. This bold move has sparked a debate amongst financial advisors and sparked widespread interest online.

Johnson's journey began last month from the Oregon coast, heading towards the Hawaiian archipelago in a 35-foot sailboat. He documented his voyage on social media, sharing stunning photos and videos of his solo adventure. While the imagery is breathtaking, the financial implications of his decision are far from picturesque.

The High-Stakes Gamble of Cashing Out a 401(k)

Cashing out a 401(k) before retirement age typically comes with significant tax penalties and the loss of potential long-term growth. This is particularly true for someone approaching retirement age like Johnson. Financial experts generally advise against such drastic measures, emphasizing the importance of long-term investment strategies.

- Tax Penalties: Early withdrawals from a 401(k) are often subject to a 10% early withdrawal penalty, in addition to regular income tax.

- Lost Investment Growth: The power of compound interest is crucial for long-term financial security. Cashing out forfeits the potential for significant growth over the years.

- Reduced Retirement Savings: This dramatically reduces the funds available for retirement, potentially leading to financial hardship in later years.

The Dream vs. The Reality: Weighing the Risks

While Johnson's adventure is undeniably captivating, it highlights the critical balance between pursuing personal dreams and securing long-term financial stability. His decision raises important questions:

- Is it worth the risk? For many, the answer is a resounding no. The potential financial consequences far outweigh the short-term gratification of a dream trip.

- Alternative funding options: Exploring alternative funding options, such as personal loans or smaller savings withdrawals, might have been more prudent.

- Long-term consequences: Johnson's decision will have long-lasting implications for his retirement plans, possibly necessitating adjustments and sacrifices in the future.

This isn't to say that pursuing one's dreams is inherently wrong. However, it's crucial to make informed decisions, considering the potential ramifications and exploring safer alternatives. Before making any significant financial decisions, consulting a qualified financial advisor is always recommended. Learn more about responsible retirement planning .

The Ongoing Journey and Future Implications

Johnson's voyage is ongoing, and his social media updates continue to garner significant attention. Whether his adventure will ultimately be deemed a success or a costly mistake remains to be seen. His story serves as a cautionary tale about the importance of careful financial planning and the need to weigh personal aspirations against long-term financial security. The long-term impact of his decision on his retirement and overall financial well-being will be a story to follow.

What are your thoughts on Mark Johnson's decision? Share your opinions in the comments below.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on 401(k) Cash Out Fuels Oregon Man's 2,000-Mile Hawaii Sailing Adventure. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Joe Burrows Complaint Prompts Nfl Scheduling Changes

May 27, 2025

Joe Burrows Complaint Prompts Nfl Scheduling Changes

May 27, 2025 -

Economic Opportunities From Climate Action Insights From Brazils Finance Chief

May 27, 2025

Economic Opportunities From Climate Action Insights From Brazils Finance Chief

May 27, 2025 -

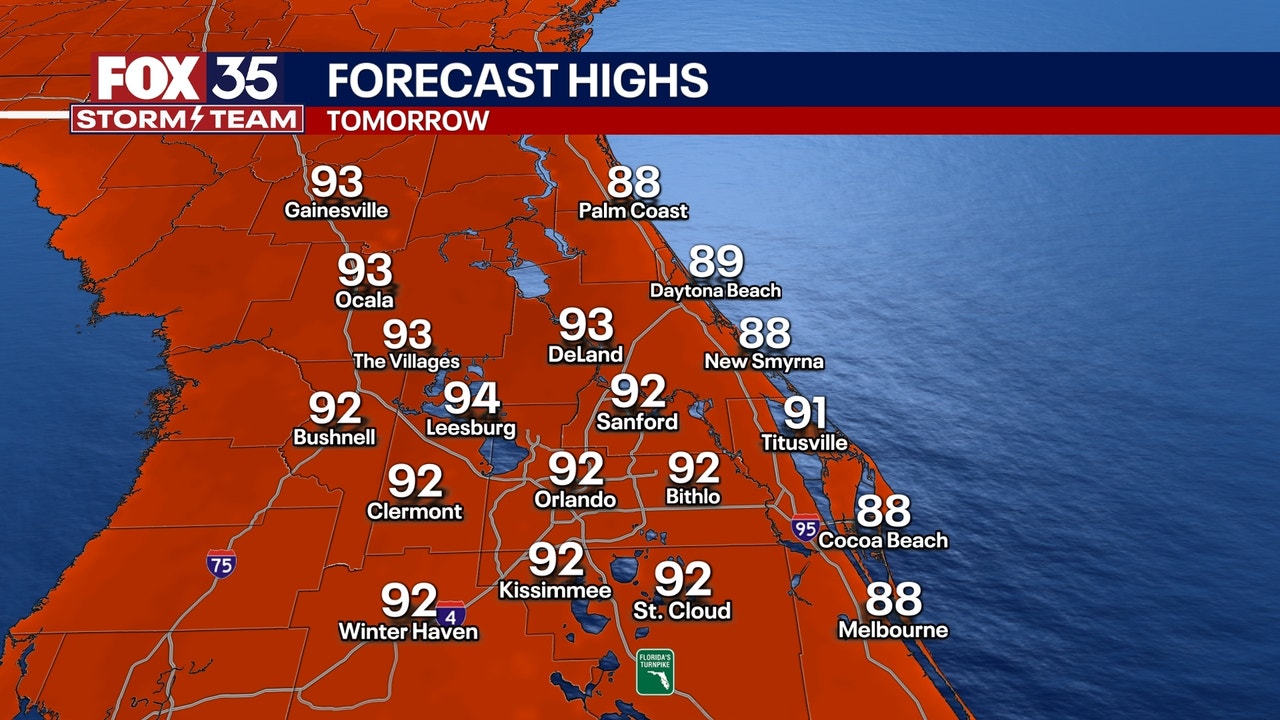

Orlando Heatwave High Temperatures And Increased Rain Chances This Week

May 27, 2025

Orlando Heatwave High Temperatures And Increased Rain Chances This Week

May 27, 2025 -

French Open 2025 Who Will Reign Supreme Analyzing The Top Seeds

May 27, 2025

French Open 2025 Who Will Reign Supreme Analyzing The Top Seeds

May 27, 2025 -

Betting Odds And Match Preview Haddad Maia Vs Baptiste At Roland Garros 2025

May 27, 2025

Betting Odds And Match Preview Haddad Maia Vs Baptiste At Roland Garros 2025

May 27, 2025