4% Fall In Roblox Stock: Analyzing The Market Reaction

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

4% Fall in Roblox Stock: Analyzing the Market Reaction

Roblox Corporation (RBLX), the popular online gaming platform, experienced a significant setback on [Date of Stock Drop], with its stock price plunging by 4%. This sharp decline sent ripples through the market, prompting analysts and investors to scrutinize the underlying causes and potential future implications. This article delves into the reasons behind this drop, examines market reactions, and explores what this means for Roblox's future.

The Plunge: What Triggered the 4% Drop?

While a single definitive cause hasn't been pinpointed, several factors likely contributed to the stock's downturn. These include:

-

Disappointing Earnings Report (If Applicable): If the stock drop followed an earnings report, highlight specific shortcomings. Did the company miss revenue projections? Were user engagement metrics lower than anticipated? Were there concerns about slowing growth? Analyzing these specifics provides crucial context. (Example: “Roblox’s Q[Quarter] earnings report revealed a slower-than-expected growth in daily active users, triggering investor concerns about the platform's long-term trajectory.”)

-

Wider Tech Stock Sell-Off (If Applicable): The broader tech sector often experiences correlated movements. If a general market downturn impacted tech stocks, including Roblox, mention this correlation. (Example: “The recent sell-off in the broader technology sector, driven by [reason for sell-off, e.g., rising interest rates], likely exacerbated the pressure on Roblox’s stock price.”)

-

Increased Competition (Always Relevant): The gaming industry is fiercely competitive. Highlighting new entrants or the success of competitors can explain investor anxieties. (Example: “The rising popularity of [Competitor Name] and its innovative features might be putting pressure on Roblox’s user base and market share.”)

-

Economic Uncertainty (Always Relevant): Macroeconomic factors, such as inflation or recessionary fears, can significantly impact investor sentiment towards growth stocks like Roblox. (Example: “Growing concerns about a potential recession have led investors to shift towards more defensive investment strategies, impacting growth-oriented companies like Roblox.”)

Market Reaction and Analyst Opinions:

Following the 4% drop, market analysts offered varying perspectives. Some highlighted the temporary nature of the dip, emphasizing Roblox's strong user base and long-term growth potential. Others expressed more cautious optimism, suggesting a period of consolidation might be necessary before further significant growth can be achieved. Specific quotes from prominent analysts can add credibility and depth to the analysis. (Example: "Analyst [Analyst Name] at [Investment Firm] stated that 'while the recent dip is concerning, Roblox's strong fundamentals and potential for future growth remain intact.'")

Looking Ahead: What Does This Mean for Roblox?

The 4% drop serves as a reminder that even seemingly robust companies face challenges in dynamic markets. However, it's crucial to consider the long-term perspective. Roblox's vast user base, particularly amongst younger demographics, and its ongoing investments in new features and technologies still position it as a significant player in the metaverse space. The company’s ability to adapt to changing market conditions and maintain user engagement will be critical in determining its future trajectory.

Keywords: Roblox, RBLX, stock price, stock market, market reaction, gaming, metaverse, earnings report, competition, economic uncertainty, investor sentiment, tech stocks, stock drop, analysis.

Call to Action: Stay informed about the latest developments in the gaming and technology sectors by subscribing to our newsletter or following us on social media. [Link to newsletter signup/social media]

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on 4% Fall In Roblox Stock: Analyzing The Market Reaction. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

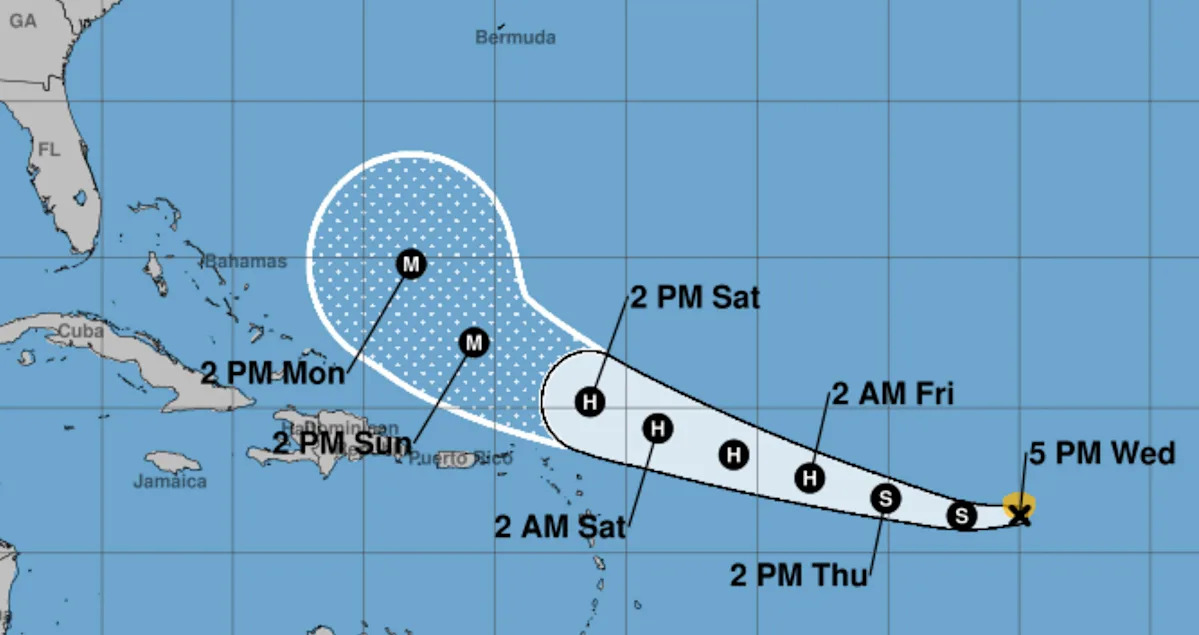

Latest Updates Tropical Storm Erins Projected Path And Hurricane Strength

Aug 15, 2025

Latest Updates Tropical Storm Erins Projected Path And Hurricane Strength

Aug 15, 2025 -

Check Oregon Lottery Numbers Powerball And Pick 4 August 13 2024

Aug 15, 2025

Check Oregon Lottery Numbers Powerball And Pick 4 August 13 2024

Aug 15, 2025 -

Dgca Issues Notice To Indi Go Over Simulator Training Deficiencies

Aug 15, 2025

Dgca Issues Notice To Indi Go Over Simulator Training Deficiencies

Aug 15, 2025 -

Adhd Drugs And Risk Reduction A Study On Criminal Behavior Substance Use And Accidents

Aug 15, 2025

Adhd Drugs And Risk Reduction A Study On Criminal Behavior Substance Use And Accidents

Aug 15, 2025 -

August 10 2025 Mn Lottery Results Pick 3 And Northstar 5

Aug 15, 2025

August 10 2025 Mn Lottery Results Pick 3 And Northstar 5

Aug 15, 2025

Latest Posts

-

Breaking 16 Palestinians Dead Following Israeli Raids In Gaza

Aug 15, 2025

Breaking 16 Palestinians Dead Following Israeli Raids In Gaza

Aug 15, 2025 -

Is The Las Vegas Strip In Decline Fewer Tourists Lower Tips Raise Concerns

Aug 15, 2025

Is The Las Vegas Strip In Decline Fewer Tourists Lower Tips Raise Concerns

Aug 15, 2025 -

Fortnite Servers Back Online After Outage Login Issues Resolved

Aug 15, 2025

Fortnite Servers Back Online After Outage Login Issues Resolved

Aug 15, 2025 -

Tenev On Robinhood Rto Lessons Learned And Future Improvements

Aug 15, 2025

Tenev On Robinhood Rto Lessons Learned And Future Improvements

Aug 15, 2025 -

Trump Administration Reviews Smithsonian Exhibitions For Policy Alignment

Aug 15, 2025

Trump Administration Reviews Smithsonian Exhibitions For Policy Alignment

Aug 15, 2025