4%+ Drop In Lucid Stock: Investors React To Recent News

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

4%+ Drop in Lucid Stock: Investors React to Recent News

Lucid Group (LCID) stock experienced a significant downturn on [Date], plunging over 4% following the release of [mention specific news, e.g., disappointing Q3 earnings, production setbacks, or a negative analyst report]. This sharp decline reflects investor concerns about the electric vehicle (EV) maker's future prospects and highlights the volatility inherent in the burgeoning EV market.

The stock's fall comes on the heels of [briefly explain the relevant news and its implications]. This news directly impacted investor sentiment, leading to a sell-off and pushing the stock price down to [mention the closing price]. This represents a considerable loss for investors who had previously been optimistic about Lucid's growth potential.

What triggered the drop?

Several factors likely contributed to the dramatic drop in Lucid's stock price. These include:

-

[Factor 1, e.g., Lower-than-expected production numbers]: Lucid reported producing [number] vehicles in [period], falling short of analysts' expectations of [number]. This indicates potential challenges in scaling production to meet growing demand, a critical factor for any automaker.

-

[Factor 2, e.g., Increased competition in the EV market]: The EV market is becoming increasingly competitive, with established players like Tesla and newer entrants constantly vying for market share. Lucid's struggles to keep pace with production goals could exacerbate its challenges in this fiercely competitive landscape.

-

[Factor 3, e.g., Concerns about the company's financial health]: [Mention any concerns about debt, cash burn rate, or profitability]. This could raise concerns about Lucid's long-term viability, especially in a tightening economic climate.

-

[Factor 4, e.g., Analyst downgrades]: Following the news, several analysts downgraded their ratings on Lucid stock, citing [reasons for downgrades]. These downgrades often trigger further selling pressure, amplifying the initial decline.

Investor Reactions and Market Outlook

The market's reaction to the news has been swift and decisive. Many investors are expressing concerns about Lucid's ability to execute its long-term strategy. The decline underscores the importance of consistent production, strong financial performance, and effective competition management for EV companies.

Looking Ahead: What's Next for Lucid?

The future of Lucid stock remains uncertain. The company will need to address the issues that led to the recent downturn to regain investor confidence. This could involve:

- Improving production efficiency: Streamlining manufacturing processes and addressing supply chain bottlenecks are crucial for meeting production targets.

- Strengthening its financial position: Lucid needs to demonstrate a clear path towards profitability and sustainable growth.

- Differentiating its products: The company must continue to innovate and offer compelling features to stand out in the increasingly competitive EV market.

The coming weeks and months will be crucial for Lucid. The company's ability to navigate these challenges will ultimately determine whether it can recover from this recent setback and regain investor confidence. It will be essential to monitor the company's announcements and performance closely for further insight.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in the stock market involves risk, and you could lose money.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on 4%+ Drop In Lucid Stock: Investors React To Recent News. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

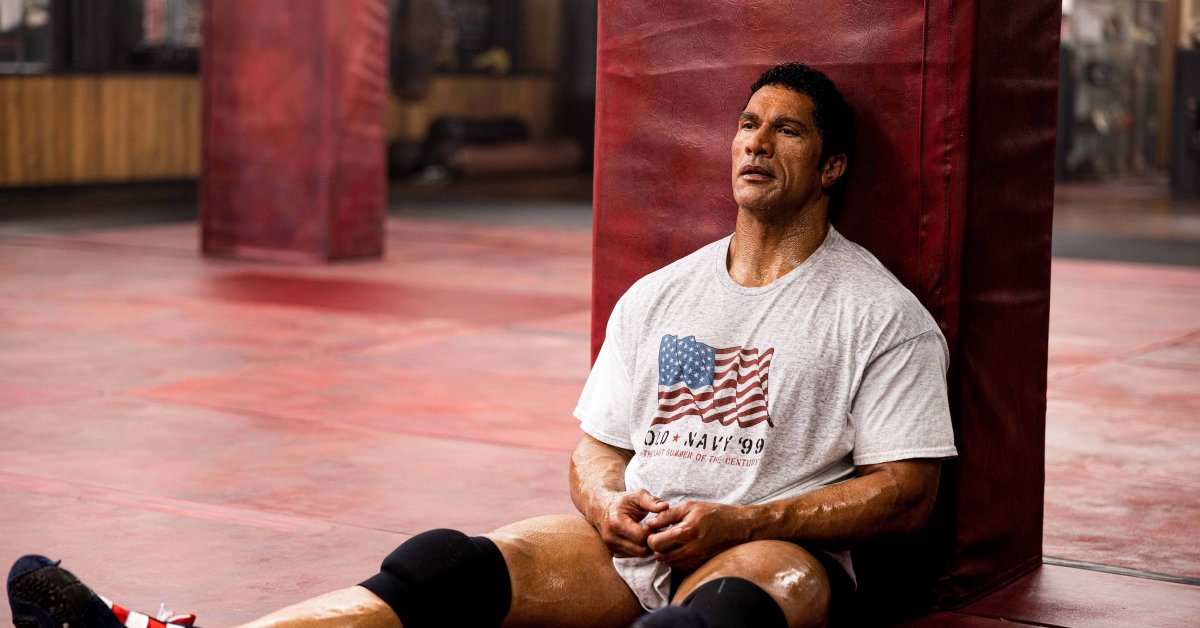

The Smashing Machine Dwayne Johnsons Latest Role Explores The Grit Of Combat Sports

Sep 03, 2025

The Smashing Machine Dwayne Johnsons Latest Role Explores The Grit Of Combat Sports

Sep 03, 2025 -

Afzaysh Qymt Tla W Skh Qymt Ha Dr Bazar Amrwz 11 Shhrywr 1404

Sep 03, 2025

Afzaysh Qymt Tla W Skh Qymt Ha Dr Bazar Amrwz 11 Shhrywr 1404

Sep 03, 2025 -

Lucid Group Lcid Stock Brokerage Price Targets And Outlook

Sep 03, 2025

Lucid Group Lcid Stock Brokerage Price Targets And Outlook

Sep 03, 2025 -

Nba 2 K26 Review Early Impressions And First Look

Sep 03, 2025

Nba 2 K26 Review Early Impressions And First Look

Sep 03, 2025 -

Major Legal Blow To Trump Most Tariffs Ruled Illegal

Sep 03, 2025

Major Legal Blow To Trump Most Tariffs Ruled Illegal

Sep 03, 2025

Latest Posts

-

Official Wednesday Season 2 Part 2 Release Date Announcement On Netflix

Sep 04, 2025

Official Wednesday Season 2 Part 2 Release Date Announcement On Netflix

Sep 04, 2025 -

Wednesday Season 2 Lady Gaga Performs New Song The Dead Dance At Exclusive Gala

Sep 04, 2025

Wednesday Season 2 Lady Gaga Performs New Song The Dead Dance At Exclusive Gala

Sep 04, 2025 -

Metal Eden Official Cgi Launch Trailer Released

Sep 04, 2025

Metal Eden Official Cgi Launch Trailer Released

Sep 04, 2025 -

Exclusive Georgie Farmer And Joy Sunday Discuss Wednesday Season 2 On Netflix

Sep 04, 2025

Exclusive Georgie Farmer And Joy Sunday Discuss Wednesday Season 2 On Netflix

Sep 04, 2025 -

This Influencers Departure From Church A Story Of Faith And Change

Sep 04, 2025

This Influencers Departure From Church A Story Of Faith And Change

Sep 04, 2025