35% Drop In INTC: Analyzing Intel's Stock Performance And Future

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

35% Drop in INTC: Analyzing Intel's Stock Performance and Future

Intel (INTC) has experienced a significant downturn, with its stock price plummeting by 35% in the last year. This dramatic fall has sent shockwaves through the tech industry, prompting investors and analysts to scrutinize the company's performance and forecast its future trajectory. This article delves into the reasons behind this decline, examines current market analysis, and explores potential scenarios for Intel's recovery.

The Steep Descent: Understanding the 35% Drop

The 35% drop in INTC's stock price isn't a single event but a culmination of several interconnected factors. These include:

-

Increased Competition: The rise of competitors like AMD, particularly in the high-performance CPU market, has significantly impacted Intel's market share. AMD's Ryzen processors have proven to be strong contenders, challenging Intel's dominance. This intensified competition has forced Intel to react, impacting profitability and investor confidence.

-

Manufacturing Challenges: Intel has faced delays and difficulties in its transition to smaller manufacturing nodes (process technology). This has hindered its ability to produce cutting-edge processors efficiently and cost-effectively, giving AMD a competitive advantage. Falling behind in this crucial area has been a major blow to their reputation and market position.

-

Shifting Market Dynamics: The overall semiconductor market is experiencing fluctuations, with supply chain disruptions and macroeconomic uncertainties impacting demand. This broader economic context has added pressure to Intel's already challenging situation.

-

Investor Sentiment: The combination of these factors has negatively impacted investor sentiment. Concerns about Intel's ability to regain its competitive edge have led to a sell-off, contributing significantly to the 35% drop.

Market Analysis and Expert Opinions:

Several analysts have weighed in on Intel's current situation. Some remain cautiously optimistic, pointing to Intel's vast resources and ongoing investments in research and development. They believe Intel's extensive experience and established infrastructure could enable a comeback. However, others express more significant concerns, highlighting the need for more aggressive strategies to combat competition and address manufacturing challenges.

The consensus seems to be that Intel's future hinges on its ability to successfully execute its turnaround strategy. This includes investing heavily in advanced manufacturing processes, focusing on innovation in key product areas, and potentially exploring strategic partnerships or acquisitions.

Intel's Response and Future Outlook:

Intel has acknowledged the challenges and is actively working on a turnaround plan. This involves significant investments in new manufacturing facilities and technologies, aiming to regain its technological leadership. Their focus on expanding into new markets, like the automotive sector, is also a key part of their strategy.

However, the path to recovery will be challenging and requires considerable time and effort. The success of Intel's turnaround will largely depend on its execution of these strategic initiatives and its ability to adapt to the evolving market landscape. The coming years will be crucial in determining whether Intel can successfully navigate these challenges and regain its position as a leading semiconductor company.

Investing in INTC: A Cautious Approach

Given the volatility and uncertainty surrounding Intel's stock, investors should adopt a cautious approach. Thorough due diligence, including careful analysis of financial reports and future projections, is essential before making any investment decisions. Consulting with a financial advisor is highly recommended. [Link to a reputable financial advice website].

Keywords: INTC, Intel, stock price, stock market, semiconductor, AMD, Ryzen, competition, manufacturing, technology, investment, analysis, future outlook, market analysis, stock performance, chip shortage, turnaround strategy.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on 35% Drop In INTC: Analyzing Intel's Stock Performance And Future. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Nba Draft Lottery Projecting Picks And Best Fit Prospects

Jun 11, 2025

Nba Draft Lottery Projecting Picks And Best Fit Prospects

Jun 11, 2025 -

Elon Musk And Scott Bessant Clash At White House Event

Jun 11, 2025

Elon Musk And Scott Bessant Clash At White House Event

Jun 11, 2025 -

Ilkley Open Alex Ealas Road To Victory Begins

Jun 11, 2025

Ilkley Open Alex Ealas Road To Victory Begins

Jun 11, 2025 -

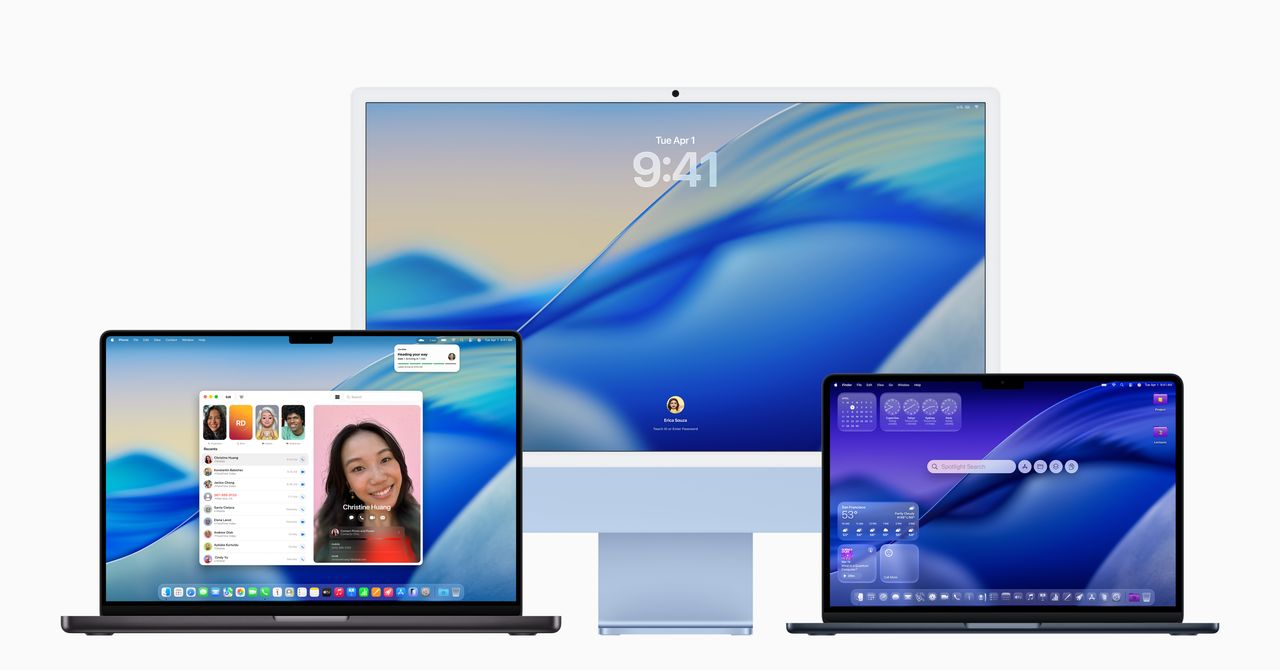

The Intel Mac Era Concludes A Look Back And Ahead

Jun 11, 2025

The Intel Mac Era Concludes A Look Back And Ahead

Jun 11, 2025 -

Jason Momoas Relationship Status 2025 Facts Rumors And Recent Developments

Jun 11, 2025

Jason Momoas Relationship Status 2025 Facts Rumors And Recent Developments

Jun 11, 2025