3.85% Holds: Reserve Bank's Decision On Interest Rates

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

3.85% Holds: Reserve Bank Remains Cautious on Interest Rates

The Reserve Bank (RBA) has sent shockwaves through the Australian financial market today, announcing a hold on interest rates, keeping the cash rate steady at 3.85%. This unexpected decision marks a pause in the aggressive tightening cycle that has characterized monetary policy over the past year, leaving economists and homeowners alike scrambling to understand the implications.

The RBA's statement cited a need for further assessment of the impact of previous rate hikes on inflation and the broader economy. This cautious approach suggests a shift in strategy, moving away from the rapid increases seen earlier in the year. While inflation remains stubbornly high, the RBA acknowledges signs of easing price pressures and a potential slowdown in economic growth.

Why the Hold? Deciphering the RBA's Reasoning

The decision to hold at 3.85% rather than opting for another increase, as many analysts predicted, hinges on several key factors:

- Easing Inflationary Pressures: While inflation remains above the RBA's target band, there are early indications that the pace of price increases is slowing. Recent data suggests a moderation in consumer spending and a softening of the housing market, both contributing to a less inflationary environment.

- Economic Slowdown Concerns: The RBA is clearly concerned about the potential for an economic slowdown. Rising interest rates inevitably impact consumer spending and business investment, and the Bank appears hesitant to push the economy into a recession.

- Lag Effects of Previous Rate Hikes: The full impact of previous interest rate increases takes time to filter through the economy. The RBA is likely giving these lag effects more consideration before making further adjustments.

- Global Economic Uncertainty: Global economic headwinds, including geopolitical instability and persistent supply chain disruptions, add another layer of complexity to the RBA's decision-making process. A more cautious approach allows for better monitoring of these external factors.

What This Means for Homeowners and Businesses

The decision to hold rates offers temporary relief to homeowners grappling with rising mortgage repayments. However, it's crucial to remember that this is only a pause, not a reversal. Further rate adjustments remain highly probable depending on future economic data and inflation trends.

Businesses, meanwhile, will welcome the short-term stability. However, ongoing economic uncertainty and the potential for future rate hikes necessitate careful financial planning and risk management.

Looking Ahead: What to Expect Next

The RBA's statement emphasizes a data-dependent approach. Future rate decisions will hinge on incoming economic data, particularly inflation figures and employment statistics. Analysts are divided on the next move, with some predicting further rate hikes later in the year, while others anticipate a prolonged period of stability. Closely monitoring key economic indicators will be crucial for navigating the evolving landscape. For up-to-date information and expert analysis, consider subscribing to reputable financial news sources like [link to reputable financial news source].

Keywords: Reserve Bank of Australia, RBA, interest rates, cash rate, 3.85%, inflation, economic growth, monetary policy, Australian economy, housing market, mortgage rates, economic slowdown, financial news, interest rate decision.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on 3.85% Holds: Reserve Bank's Decision On Interest Rates. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

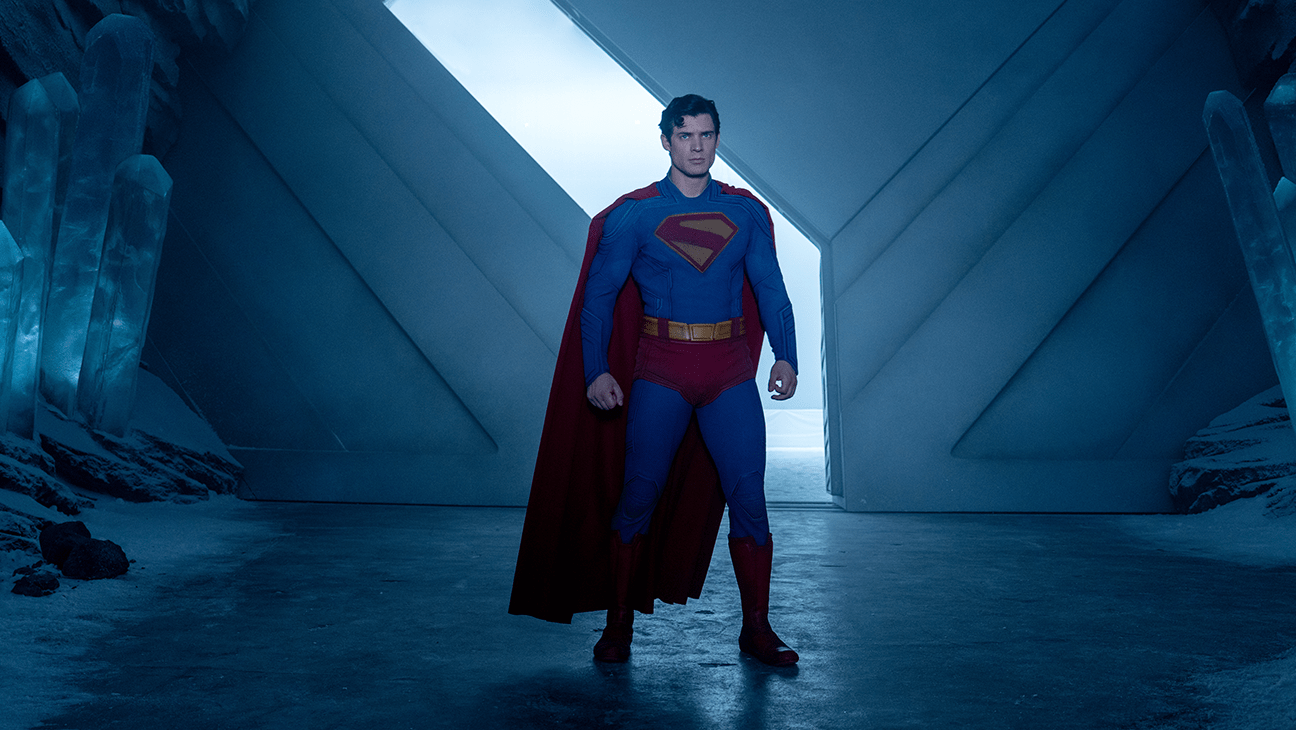

Superman First Reactions Point To A Promising Dc Studios Reboot

Jul 09, 2025

Superman First Reactions Point To A Promising Dc Studios Reboot

Jul 09, 2025 -

Inglourious Basterds 2009 Review Exploring Themes Of Revenge And Resistance

Jul 09, 2025

Inglourious Basterds 2009 Review Exploring Themes Of Revenge And Resistance

Jul 09, 2025 -

Space X Starlink Launch Live Coverage Of Falcon 9 Mission From Cape Canaveral

Jul 09, 2025

Space X Starlink Launch Live Coverage Of Falcon 9 Mission From Cape Canaveral

Jul 09, 2025 -

Inglourious Basterds Exploring Themes Of Revenge And War

Jul 09, 2025

Inglourious Basterds Exploring Themes Of Revenge And War

Jul 09, 2025 -

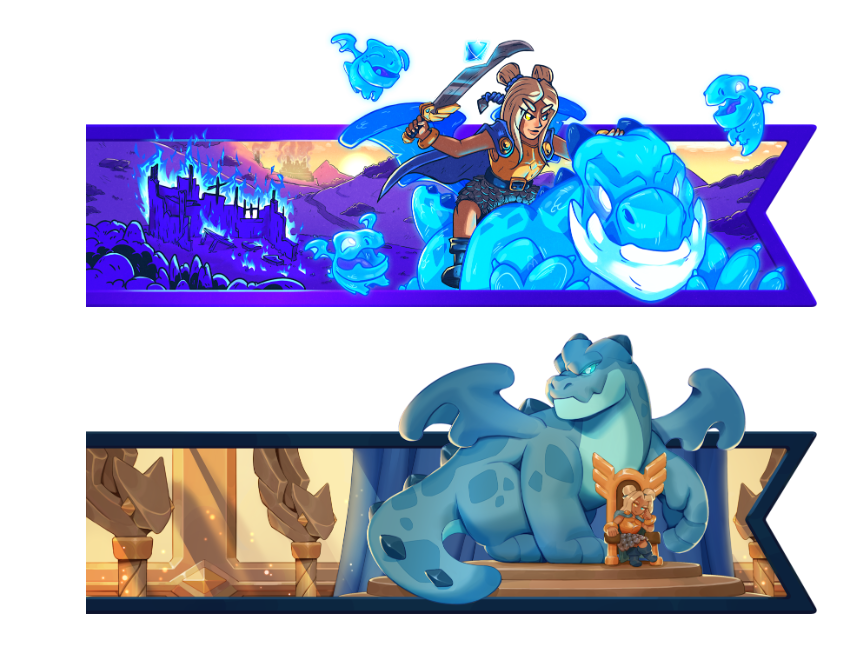

The Free Spirit Empress How To Get Clash Royales New Legendary Card And Dominate

Jul 09, 2025

The Free Spirit Empress How To Get Clash Royales New Legendary Card And Dominate

Jul 09, 2025

Latest Posts

-

End Of The Line Philadelphia Union Strike Resolved Live Updates

Jul 09, 2025

End Of The Line Philadelphia Union Strike Resolved Live Updates

Jul 09, 2025 -

Examining Us Complicity The Iran Israel Conflict And American Involvement

Jul 09, 2025

Examining Us Complicity The Iran Israel Conflict And American Involvement

Jul 09, 2025 -

Former Nhl Player Nick Tarnasky Caught In Heated Golf Course Altercation

Jul 09, 2025

Former Nhl Player Nick Tarnasky Caught In Heated Golf Course Altercation

Jul 09, 2025 -

Home Run Derby Yankees Rout Mariners Following Rain Delay

Jul 09, 2025

Home Run Derby Yankees Rout Mariners Following Rain Delay

Jul 09, 2025 -

Red Bull Announces Horners Exit Mekies Takes The Helm

Jul 09, 2025

Red Bull Announces Horners Exit Mekies Takes The Helm

Jul 09, 2025