$255 Billion In Assets: Robinhood Reports Record Growth In Trading And Crypto Activities

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

$255 Billion in Assets: Robinhood Reports Record Growth in Trading and Crypto Activities

Robinhood, the popular commission-free trading app, announced record growth in both its trading and cryptocurrency activities, boasting a staggering $255 billion in assets under custody. This significant surge underscores the platform's continued dominance in attracting retail investors and its increasing role in the burgeoning cryptocurrency market. The announcement sent ripples through the financial tech sector, highlighting the ongoing evolution of online investment platforms.

The impressive figures, released in [Insert Date of Release], showcase a significant increase compared to previous quarters. While the exact year-over-year percentage growth wasn't specified in the initial press release, analysts are attributing the boom to several key factors.

Driving Forces Behind Robinhood's Explosive Growth

Several contributing factors fueled Robinhood's remarkable growth in assets under custody:

-

Increased Retail Investor Participation: The pandemic-induced market volatility and the rise of individual investing through accessible platforms like Robinhood have significantly contributed to this growth. More people than ever are actively participating in the stock market, driving up trading volume and asset holdings.

-

Cryptocurrency Adoption: Robinhood's foray into cryptocurrency trading has proven to be a significant catalyst. The increasing mainstream adoption of cryptocurrencies, coupled with Robinhood's user-friendly interface, has attracted a large number of new investors to the platform, further boosting its assets under custody. The recent surge in Bitcoin and other altcoin prices also played a significant role.

-

Expansion of Product Offerings: Robinhood’s continuous expansion of its product offerings, including options trading and a growing selection of cryptocurrencies, has broadened its appeal to a wider range of investors with diverse investment strategies. This diversification has significantly contributed to its overall growth.

-

Improved User Experience: Robinhood's commitment to a seamless and intuitive user experience continues to be a major draw for both novice and experienced investors. Its easy-to-navigate app and straightforward trading process make investing more accessible than ever before.

Challenges and Future Outlook

Despite the impressive figures, Robinhood isn't without its challenges. Regulatory scrutiny of the cryptocurrency market remains a significant concern. Increased competition from established brokerages and new fintech players also presents a hurdle.

However, the company appears well-positioned for continued growth. Its focus on technological innovation, user experience, and expansion into new markets suggests a bright future. The continued growth of the retail investor market and the evolving cryptocurrency landscape are expected to further contribute to Robinhood's success.

The Broader Implications

Robinhood's success underscores the broader shift towards democratized finance. Platforms like Robinhood are making investment opportunities more accessible to a wider demographic, potentially reshaping the financial landscape. This trend is likely to continue, driving further innovation and competition in the fintech sector.

Keywords: Robinhood, assets under custody, trading, cryptocurrency, stock market, retail investors, fintech, financial technology, investment platform, commission-free trading, crypto adoption, market volatility

Call to Action: Want to stay updated on the latest news in the fintech and cryptocurrency markets? [Link to relevant newsletter signup or social media page].

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on $255 Billion In Assets: Robinhood Reports Record Growth In Trading And Crypto Activities. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Air India Flight Disaster Full Report On The London Crash And Victim Information

Jun 14, 2025

Air India Flight Disaster Full Report On The London Crash And Victim Information

Jun 14, 2025 -

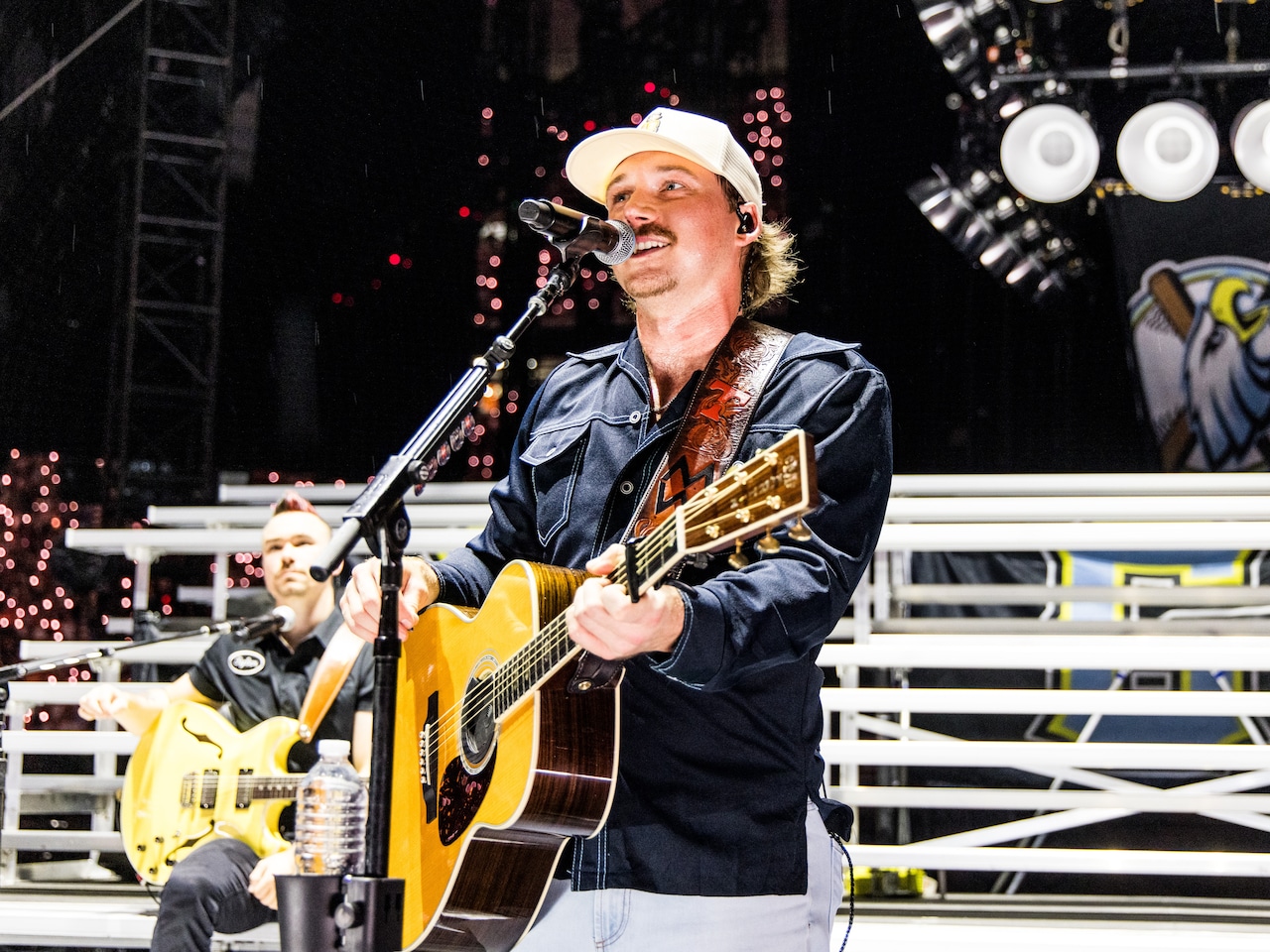

Houston Morgan Wallen Concert Affordable Tickets For June 20th And 21st Show

Jun 14, 2025

Houston Morgan Wallen Concert Affordable Tickets For June 20th And 21st Show

Jun 14, 2025 -

Onofre Dos Santos Defende Tecnologia Para Validar Eleicoes Em Angola

Jun 14, 2025

Onofre Dos Santos Defende Tecnologia Para Validar Eleicoes Em Angola

Jun 14, 2025 -

Heart Attack Survivor Barry Sanders Launches Documentary To Raise Awareness

Jun 14, 2025

Heart Attack Survivor Barry Sanders Launches Documentary To Raise Awareness

Jun 14, 2025 -

Barry Sanders Health Scare Nfl Hall Of Famer Discusses Heart Attack Experience

Jun 14, 2025

Barry Sanders Health Scare Nfl Hall Of Famer Discusses Heart Attack Experience

Jun 14, 2025