$255 Billion In Assets: Robinhood Reports Massive Growth In Trading Volume And Crypto

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

$255 Billion in Assets: Robinhood Rides the Crypto Wave to Record Growth

Robinhood, the popular commission-free trading app, announced staggering growth in its second quarter earnings report, boasting a massive $255 billion in assets under custody. This surge is largely attributed to a significant increase in trading volume, particularly in the volatile but increasingly popular cryptocurrency market. The report signals a bullish trend for both Robinhood and the broader adoption of digital assets.

Record Trading Volumes Fuel Explosive Growth

The company's Q2 report showcased impressive numbers across the board. While specific cryptocurrency trading figures weren't broken down in detail, the overall increase in trading activity directly points to the significant contribution of crypto investments. Analysts believe this surge is fueled by several factors, including:

- Increased Retail Investor Interest: The accessibility of crypto trading through platforms like Robinhood has attracted a wider range of retail investors, driving up transaction volumes.

- Bitcoin's Price Fluctuations: Bitcoin's price volatility, while risky, continues to draw investors seeking potentially high returns. This volatility translates to increased trading activity as investors buy and sell based on market fluctuations.

- Growing Crypto Adoption: The overall acceptance and adoption of cryptocurrencies as a legitimate asset class are further contributing to the rising trading volumes. More institutional investors are also entering the space, adding to the overall market liquidity.

Beyond Crypto: A Holistic Growth Strategy

While crypto trading undoubtedly played a major role in Robinhood's success, the company's growth wasn't solely reliant on digital assets. The report highlighted increased activity across other asset classes, including stocks and options. This diversified growth strategy demonstrates Robinhood's ability to cater to a broad spectrum of investor needs and preferences.

Challenges and Future Outlook

Despite the impressive figures, Robinhood faces ongoing challenges. Increased regulatory scrutiny of the cryptocurrency market remains a potential hurdle. The company also needs to continuously innovate and adapt to remain competitive in a rapidly evolving financial technology landscape. Furthermore, maintaining investor trust after past controversies is crucial for long-term success.

The Crypto Craze Continues:

The success of Robinhood underscores the growing mainstream acceptance of cryptocurrencies. This trend is likely to continue, further fueling the growth of platforms providing accessible crypto trading options. However, it's crucial for investors to approach the crypto market with caution, understanding the inherent risks involved before making any investment decisions. Consult with a qualified financial advisor before investing in any cryptocurrency.

Looking Ahead:

Robinhood's Q2 results paint a positive picture for the company's future, highlighting the potential of accessible investing platforms and the burgeoning cryptocurrency market. The continued growth in trading volume and assets under custody suggests that Robinhood is well-positioned to capitalize on the increasing demand for digital asset trading. However, navigating regulatory complexities and maintaining investor confidence will remain crucial for sustaining this momentum.

Keywords: Robinhood, cryptocurrency, crypto trading, trading volume, assets under custody, Q2 earnings, financial technology, fintech, Bitcoin, retail investors, investment, digital assets, regulatory scrutiny, market volatility, stock market, options trading.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on $255 Billion In Assets: Robinhood Reports Massive Growth In Trading Volume And Crypto. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

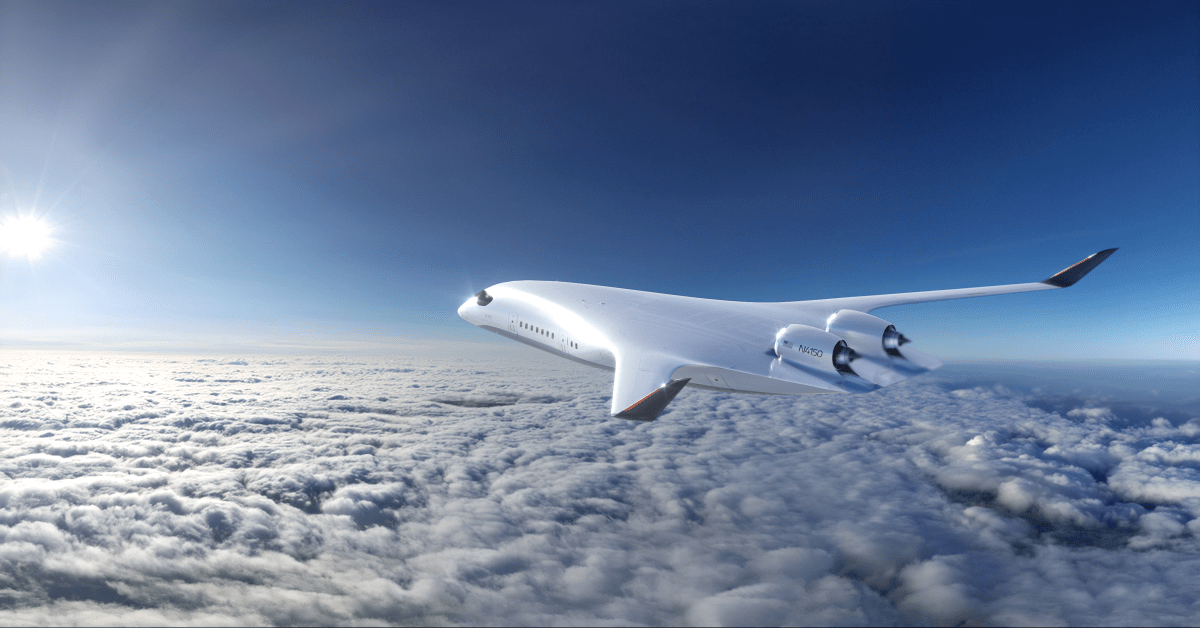

Could This Company Solve The Problem Of Carbon Emissions In Air Travel

Jun 14, 2025

Could This Company Solve The Problem Of Carbon Emissions In Air Travel

Jun 14, 2025 -

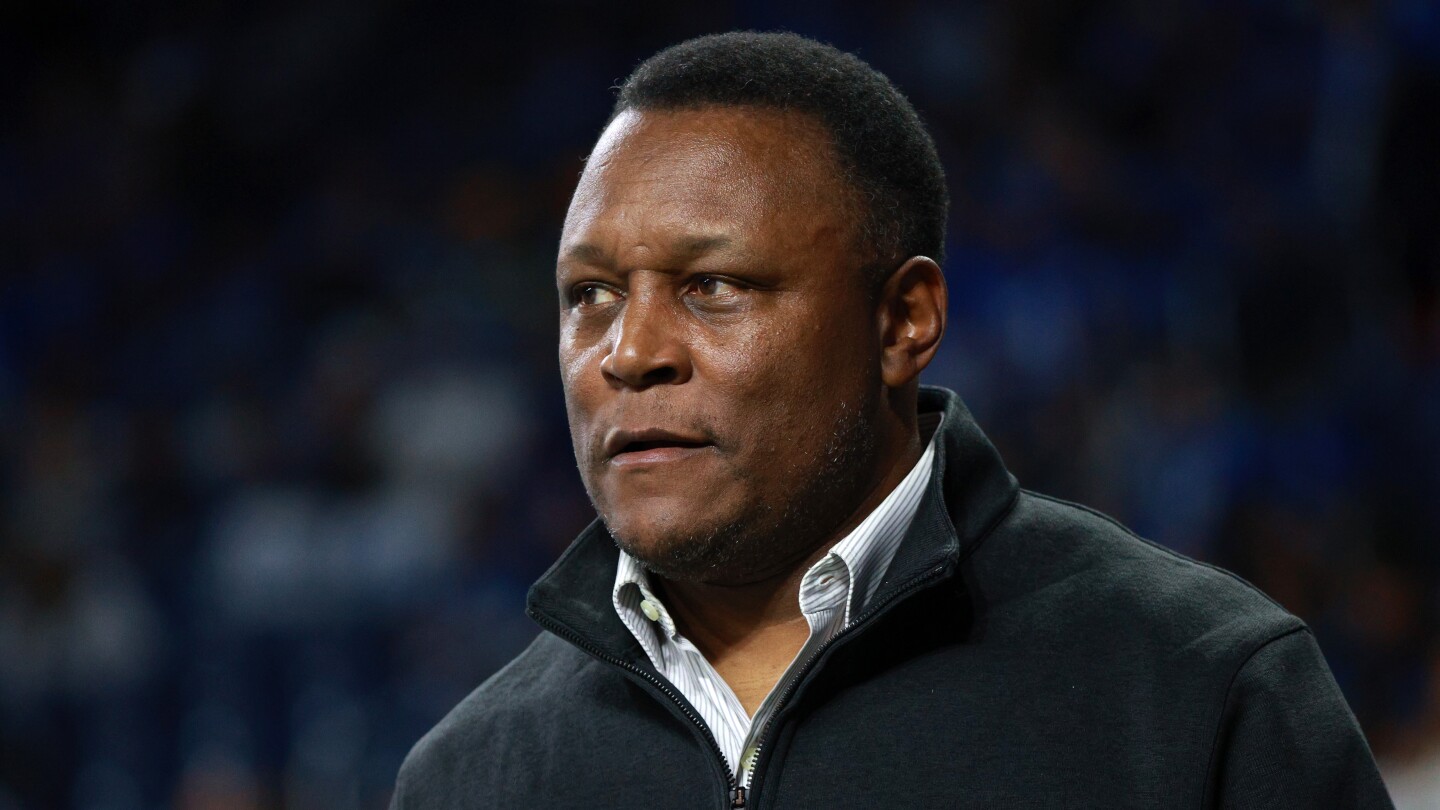

Former Nfl Star Barry Sanders Post Heart Attack Advocacy

Jun 14, 2025

Former Nfl Star Barry Sanders Post Heart Attack Advocacy

Jun 14, 2025 -

Former Teammate Kittle Speaks Out In Support Of Deebo Samuel After Viral Incident

Jun 14, 2025

Former Teammate Kittle Speaks Out In Support Of Deebo Samuel After Viral Incident

Jun 14, 2025 -

Barry Sanders On Heart Health New Documentary Aims To Raise Awareness

Jun 14, 2025

Barry Sanders On Heart Health New Documentary Aims To Raise Awareness

Jun 14, 2025 -

49ers Kittle Rallies Behind Deebo Samuel Amidst Social Media Criticism

Jun 14, 2025

49ers Kittle Rallies Behind Deebo Samuel Amidst Social Media Criticism

Jun 14, 2025