$25.94 Average Price Target For Lucid Group (LCID): A Brokerage Consensus

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

$25.94 Average Price Target for Lucid Group (LCID): A Brokerage Consensus – Is This Electric Vehicle Maker Poised for a Surge?

Lucid Group (LCID), the luxury electric vehicle (EV) manufacturer, is making headlines again, not for its impressive technology or sleek designs, but for a notable surge in its average price target amongst brokerages. With a consensus price target hovering around $25.94, investors are buzzing – but is this a realistic expectation, and should you be paying attention?

The recent increase in the average price target signifies a growing confidence in Lucid's future prospects amongst financial analysts. This isn't just hype; several factors contribute to this positive outlook. Let's delve into the key drivers behind this bullish sentiment.

H2: Factors Fueling the Rise in Lucid's Price Target:

-

Strong Production Ramp-up: Lucid has been steadily increasing its vehicle production, demonstrating its ability to meet growing demand. While challenges remain, the company's progress in manufacturing efficiency is a significant positive indicator. This contrasts with some other EV startups that have struggled to scale production.

-

Luxury Market Positioning: Lucid's focus on the luxury EV segment positions it to capture a higher profit margin compared to mass-market competitors. The Air sedan, with its impressive range and technological features, targets a discerning clientele willing to pay a premium.

-

Government Incentives and Subsidies: The ongoing push for EV adoption globally, including government incentives and subsidies, creates a favorable environment for electric vehicle manufacturers like Lucid. These incentives can significantly boost sales and profitability.

-

Technological Innovation: Lucid's technological prowess, particularly its battery technology and advanced driver-assistance systems (ADAS), offer a competitive edge in the market. Continuous innovation is crucial in the rapidly evolving EV landscape.

-

Growing Investor Interest: The increased price target is also a reflection of growing investor confidence in the company's long-term vision and strategic execution. This translates to increased trading volume and overall market capitalization.

H2: Cautious Optimism: Challenges Remain for LCID

Despite the positive sentiment, it's crucial to acknowledge the challenges facing Lucid.

-

Competition: The EV market is becoming increasingly competitive, with established automakers and new entrants vying for market share. Lucid needs to maintain its innovative edge to stay ahead.

-

Supply Chain Issues: The global supply chain continues to present challenges for many industries, including the automotive sector. Securing the necessary components for production remains a critical factor.

-

Profitability: While Lucid is making progress, achieving consistent profitability remains a key hurdle. Balancing growth with profitability is a delicate act for any EV manufacturer.

H2: What Does This Mean for Investors?

The $25.94 average price target should be considered one factor among many when evaluating Lucid Group. It's important to conduct thorough due diligence, analyzing financial statements, market trends, and competitive landscapes before making any investment decisions. This price target represents a potential upside, not a guaranteed return.

H3: Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in the stock market involves inherent risks, and past performance does not guarantee future results. Consult with a qualified financial advisor before making any investment decisions.

H2: Looking Ahead:

Lucid's journey is far from over. The company's success will depend on its ability to navigate the challenges mentioned above while capitalizing on the opportunities within the burgeoning EV market. The $25.94 average price target offers a glimpse of potential future growth, but only time will tell if Lucid can deliver on these expectations. Keep an eye on their production numbers, technological advancements, and financial performance for a clearer picture of their trajectory.

Keywords: Lucid Group, LCID, electric vehicle, EV, stock price, price target, brokerage consensus, investment, luxury EV, automotive industry, stock market, investment advice, financial analysis, market trends.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on $25.94 Average Price Target For Lucid Group (LCID): A Brokerage Consensus. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Tensions Rise Chicago Mayors Plan To Counter Trumps Military Action

Sep 02, 2025

Tensions Rise Chicago Mayors Plan To Counter Trumps Military Action

Sep 02, 2025 -

Trumps Tariffs A Court Ruling And The Path Forward

Sep 02, 2025

Trumps Tariffs A Court Ruling And The Path Forward

Sep 02, 2025 -

Lightfoot Vs Trump Chicagos Response To Federal Troop Deployment

Sep 02, 2025

Lightfoot Vs Trump Chicagos Response To Federal Troop Deployment

Sep 02, 2025 -

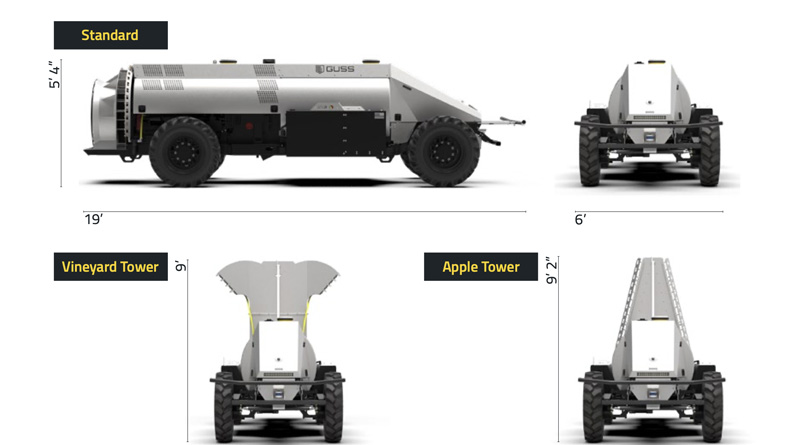

Mini Guss A Case Study In Autonomous Spraying For Vineyards And Orchards

Sep 02, 2025

Mini Guss A Case Study In Autonomous Spraying For Vineyards And Orchards

Sep 02, 2025 -

Urgent Ceasefire Call Israelis Stage Day Of Struggle Protests

Sep 02, 2025

Urgent Ceasefire Call Israelis Stage Day Of Struggle Protests

Sep 02, 2025

Latest Posts

-

Qymt Amrwz Tla Dlar W Skh 11 Shhrywr 1404 Aya Rwnd Sewdy Adamh Dard

Sep 03, 2025

Qymt Amrwz Tla Dlar W Skh 11 Shhrywr 1404 Aya Rwnd Sewdy Adamh Dard

Sep 03, 2025 -

Analyst Consensus Lucid Group Lcid Stock Price Forecast At 25 94

Sep 03, 2025

Analyst Consensus Lucid Group Lcid Stock Price Forecast At 25 94

Sep 03, 2025 -

New I Phone 17 Models A Detailed Look At The Anticipated Features Of The I Phone 17 I Phone 17 Air And I Phone 17 Pro

Sep 03, 2025

New I Phone 17 Models A Detailed Look At The Anticipated Features Of The I Phone 17 I Phone 17 Air And I Phone 17 Pro

Sep 03, 2025 -

11 Shhrywr 1404 Ryzsh Qymt Tla W Skh Brrsy Dlayl

Sep 03, 2025

11 Shhrywr 1404 Ryzsh Qymt Tla W Skh Brrsy Dlayl

Sep 03, 2025 -

Play Helldivers 2 With The New Halo Odst Warbond

Sep 03, 2025

Play Helldivers 2 With The New Halo Odst Warbond

Sep 03, 2025