24 Analyst Projections: The Future Of Uber Technologies Stock

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

24 Analyst Projections: Navigating the Uncertain Future of Uber Technologies Stock

Uber Technologies (UBER) has experienced a rollercoaster ride since its IPO, leaving investors constantly questioning its future trajectory. While the ride-sharing giant continues to dominate its core market, challenges remain, sparking a flurry of analyst predictions about the company's stock performance. This article analyzes 24 recent analyst projections, revealing a range of opinions and highlighting the key factors driving these diverse forecasts.

A Divergence of Opinions: Bullish vs. Bearish Sentiments

The 24 analyst projections we've analyzed showcase a fascinating divergence of opinions regarding UBER's stock. While some analysts maintain a bullish outlook, citing the company's expansion into new markets and technological advancements like autonomous driving, others express more cautious, even bearish, sentiments. These differing views highlight the inherent uncertainty surrounding Uber's long-term prospects.

Key Factors Shaping Analyst Projections:

Several critical factors consistently emerge in these analyst projections, influencing their overall assessment of UBER's stock:

- Competition: The intense competition in the ride-sharing market, particularly from Lyft and regional players, remains a significant concern. Analysts are closely monitoring market share dynamics and pricing strategies.

- Profitability: Uber's path to profitability continues to be a central theme. Analysts are scrutinizing the company's operational efficiency, cost-cutting measures, and revenue growth across its various segments, including ride-sharing, food delivery (Uber Eats), and freight.

- Regulatory Landscape: The evolving regulatory landscape across different geographies presents both opportunities and challenges. Changes in regulations regarding driver classification, licensing, and operating permits directly impact Uber's operational costs and profitability.

- Technological Innovation: Uber's investment in autonomous driving technology is a key factor influencing investor sentiment. While the long-term potential is significant, the timeline for widespread adoption and the associated costs remain uncertain.

- Economic Conditions: Macroeconomic factors, including inflation, interest rates, and overall economic growth, also influence analyst projections. A recessionary environment could negatively impact consumer spending on ride-sharing and food delivery services.

H2: Breaking Down the Projections:

While specific price targets vary widely (ranging from conservative to highly optimistic), the majority of analysts agree on the need for Uber to demonstrate consistent profitability and efficient scaling. Several projections highlight the importance of successfully navigating the regulatory landscape and maintaining a competitive edge through technological innovation. A significant portion of the analysts are focusing on the long-term potential of Uber's various business segments, not just its core ride-sharing operations.

H3: What it Means for Investors:

The diversity of analyst projections underscores the inherent risk associated with investing in UBER. Investors should conduct thorough due diligence, considering their individual risk tolerance and investment horizon. Diversification is crucial, and relying solely on analyst predictions without independent research can be detrimental.

H2: Looking Ahead:

The future of Uber Technologies stock remains intertwined with its ability to navigate the complex challenges outlined above. Consistent profitability, strategic expansion, successful technological integration, and a favorable regulatory environment are all crucial elements for future success. Keeping a close eye on these key performance indicators (KPIs) is vital for both analysts and investors seeking to understand the company's trajectory.

Call to Action: Stay informed about the latest developments by regularly checking reputable financial news sources and conducting your own in-depth research before making any investment decisions. Understanding the nuances of analyst projections is just one piece of the puzzle. Remember to consult a financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on 24 Analyst Projections: The Future Of Uber Technologies Stock. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Unpacking The Finale Nathan Fielders Complex Stunt In The Rehearsal Season 2

May 27, 2025

Unpacking The Finale Nathan Fielders Complex Stunt In The Rehearsal Season 2

May 27, 2025 -

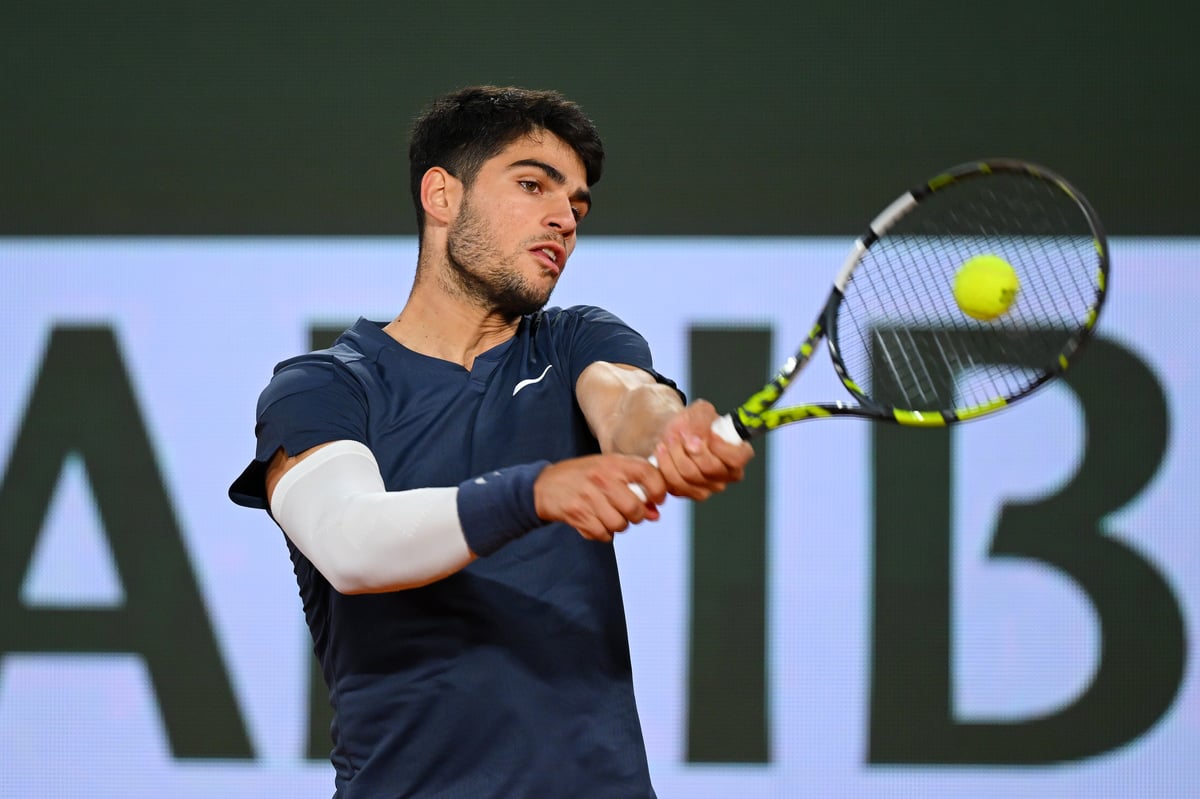

French Open Womens Draw Day 2 Key Matches And Winning Predictions

May 27, 2025

French Open Womens Draw Day 2 Key Matches And Winning Predictions

May 27, 2025 -

Roland Garros 2025 Where To Watch In The Uk Tv And Online

May 27, 2025

Roland Garros 2025 Where To Watch In The Uk Tv And Online

May 27, 2025 -

Oregonians Cross Ocean Voyage 2 000 Miles One Cat And A 401 K

May 27, 2025

Oregonians Cross Ocean Voyage 2 000 Miles One Cat And A 401 K

May 27, 2025 -

Oklo Inc Oklo Wedbush Ups Price Target Maintaining Positive Outlook

May 27, 2025

Oklo Inc Oklo Wedbush Ups Price Target Maintaining Positive Outlook

May 27, 2025