21% Revenue Surge: Nio's Q1 2024 Financial Report Highlights

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

21% Revenue Surge: Nio's Q1 2024 Financial Report Highlights Strong Growth and Future Outlook

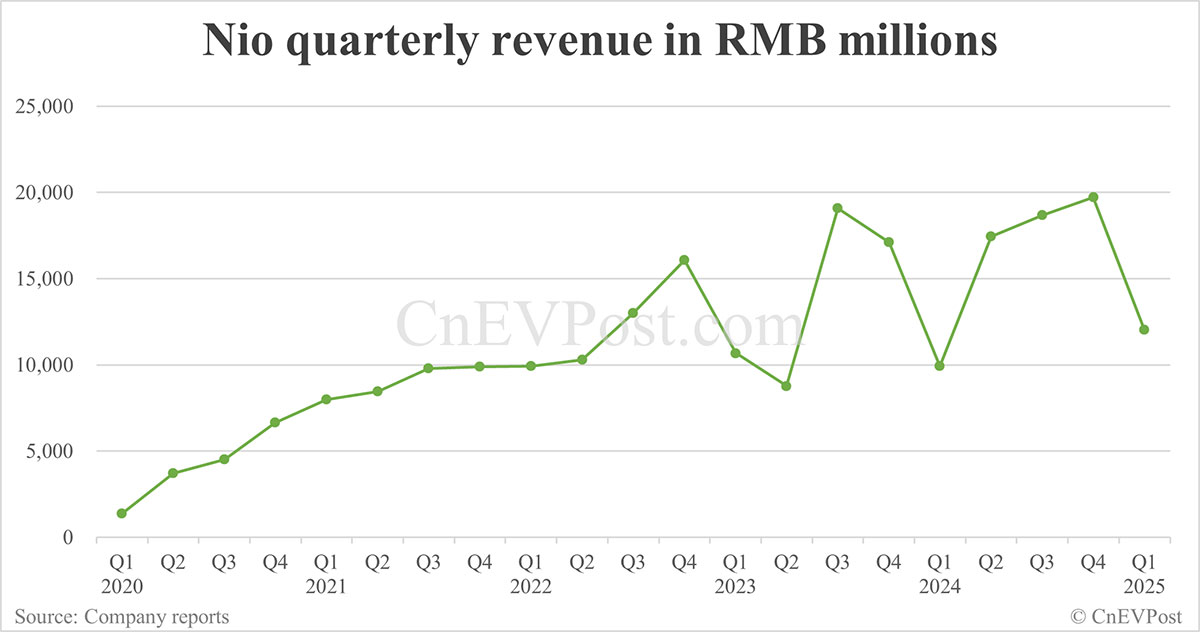

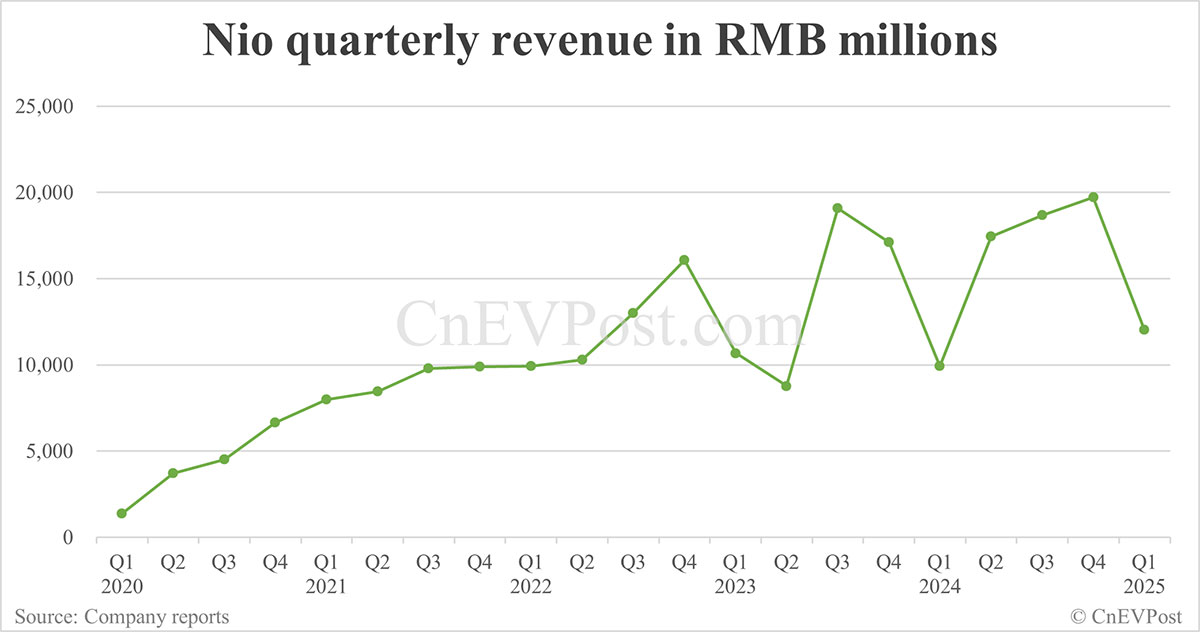

Nio, the Chinese electric vehicle (EV) manufacturer, announced its first-quarter 2024 financial report, revealing a significant 21% year-over-year revenue surge. This impressive performance underscores Nio's continued growth trajectory in a fiercely competitive EV market. The report, released [Insert Date of Release], exceeded analyst expectations and offers a glimpse into the company's ambitious plans for the future.

Key Highlights from Nio's Q1 2024 Financial Report:

-

Revenue Growth: The 21% increase in revenue, reaching [Insert Revenue Figure], marks a substantial achievement for Nio, demonstrating strong demand for its vehicles. This surpasses previous quarter's performance and signals positive momentum for the company.

-

Vehicle Deliveries: Nio delivered [Insert Number] vehicles in Q1 2024, representing a [Insert Percentage]% increase compared to the same period last year. This robust delivery figure is a key driver of the company's revenue growth and reflects the increasing popularity of Nio's EV models. The strong sales figures also highlight the effectiveness of Nio's marketing and sales strategies.

-

Gross Profit Margin: The gross profit margin improved to [Insert Percentage]%, indicating enhanced efficiency in production and cost management. This is a crucial metric that showcases Nio's ability to balance growth with profitability.

-

Expansion and Innovation: Nio continues to invest heavily in research and development, aiming to further enhance its technological leadership in the EV sector. This commitment to innovation is essential for maintaining a competitive edge in the rapidly evolving automotive industry. Further expansion into new markets is also a key focus.

-

Battery as a Service (BaaS): Nio's innovative Battery as a Service (BaaS) program continues to gain traction, offering customers flexible battery subscription options. This unique approach has been a significant contributor to Nio's success and is expected to continue driving growth in the coming quarters. The BaaS model addresses consumer concerns about battery degradation and replacement costs.

Challenges and Future Outlook:

Despite the impressive Q1 results, Nio faces ongoing challenges in the competitive Chinese EV market. Intense competition from established players and new entrants necessitates continuous innovation and strategic adaptation. Furthermore, global economic uncertainties and supply chain disruptions pose potential risks.

However, Nio's strategic focus on technological advancement, expansion into new markets, and its pioneering BaaS program positions the company for sustained long-term growth. The company's optimistic outlook for the remainder of 2024 suggests continued positive momentum.

What This Means for Investors:

The strong Q1 2024 results offer a positive signal for investors. The significant revenue increase and improved gross profit margin indicate a healthy financial position. However, potential investors should also consider the risks associated with the competitive EV market and global economic conditions. Further analysis of Nio's long-term strategy and financial projections is recommended before making any investment decisions.

Looking Ahead:

Nio's Q1 2024 financial report paints a picture of a company experiencing robust growth and demonstrating resilience in a dynamic market. The company's commitment to innovation and its strategic focus on customer experience position it for continued success in the years to come. The coming quarters will be crucial in observing how Nio navigates the ongoing challenges and capitalizes on emerging opportunities in the global EV market. Stay tuned for further updates and analysis.

(Note: Replace bracketed information with actual data from Nio's Q1 2024 financial report.)

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on 21% Revenue Surge: Nio's Q1 2024 Financial Report Highlights. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

England Vs West Indies Cardiff Test Match Summary And Highlights

Jun 03, 2025

England Vs West Indies Cardiff Test Match Summary And Highlights

Jun 03, 2025 -

Harry Brook Praises Joe Roots Development Getting Better With Age

Jun 03, 2025

Harry Brook Praises Joe Roots Development Getting Better With Age

Jun 03, 2025 -

Russia Crimea Link Severed Ukraines Underwater Bridge Attack

Jun 03, 2025

Russia Crimea Link Severed Ukraines Underwater Bridge Attack

Jun 03, 2025 -

The 2 C Imperative A Strategic Roadmap For Corporate Climate Resilience

Jun 03, 2025

The 2 C Imperative A Strategic Roadmap For Corporate Climate Resilience

Jun 03, 2025 -

Scientists Investigate Strange Rhythmic Star

Jun 03, 2025

Scientists Investigate Strange Rhythmic Star

Jun 03, 2025