$200 Million Invested In Ethereum Funds After Successful Pectra Upgrade

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

$200 Million Flood into Ethereum Funds Post-Successful Shanghai Upgrade: A Bullish Sign?

The successful completion of Ethereum's Shanghai upgrade, also known as the Shapella upgrade, has sent ripples of optimism through the crypto market, attracting significant investment into Ethereum-focused funds. Data reveals a staggering $200 million influx into these funds in the days following the upgrade's completion on April 12th, 2023. This substantial investment signifies a strong vote of confidence in Ethereum's future and its evolving capabilities. But what does this mean for the broader cryptocurrency market, and is this a harbinger of further bullish trends?

The Shanghai upgrade was a pivotal moment for Ethereum, enabling the withdrawal of staked ETH for the first time. This long-awaited functionality addressed a major concern for many stakers, allowing them to finally access their locked assets. The smooth execution of the upgrade, free from major glitches or delays, significantly boosted investor confidence. This success arguably marks a significant milestone in Ethereum's journey towards becoming a truly decentralized and scalable network.

Why the Surge in Investment?

Several factors contributed to the surge in investment following the successful upgrade:

- Reduced Risk: The ability to unstake ETH significantly reduced the perceived risk associated with staking. Previously, investors were locked into their positions, potentially facing substantial losses if the price of ETH plummeted. Now, they have greater flexibility and control over their assets.

- Increased Liquidity: The unlocking of staked ETH has increased the overall liquidity of the market, making it easier for investors to buy and sell ETH. This increased liquidity is attractive to both institutional and retail investors.

- Positive Market Sentiment: The successful upgrade fostered a wave of positive sentiment within the cryptocurrency community, boosting confidence in Ethereum's long-term prospects. This positive sentiment is often a major driver of investment.

- Enhanced Staking Rewards: While the ability to unstake is crucial, the continued attractive staking rewards continue to incentivize participation in Ethereum's consensus mechanism. This creates a positive feedback loop, encouraging further investment.

What Does This Mean for the Future of Ethereum?

The $200 million investment surge is a powerful indicator of the growing confidence in Ethereum. It suggests that institutional investors, particularly, are increasingly viewing Ethereum as a robust and reliable investment. This influx of capital could fuel further development and innovation within the Ethereum ecosystem, potentially leading to even greater adoption and growth.

However, it's crucial to remember that the cryptocurrency market remains volatile. While the Shanghai upgrade is a significant positive development, various factors could still impact Ethereum's price and overall market performance.

Looking Ahead: Continued Growth or Market Correction?

While the current trend is positive, it's impossible to predict with certainty the long-term trajectory of Ethereum. Continued monitoring of key metrics, such as network activity, developer activity, and overall market sentiment, will be crucial in assessing the long-term impact of the Shanghai upgrade.

Further Reading:

This significant investment underscores the importance of the Shanghai upgrade and its potential to propel Ethereum's growth. Whether this is the start of a sustained bull run remains to be seen, but the numbers speak for themselves – investors are betting big on Ethereum's future.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on $200 Million Invested In Ethereum Funds After Successful Pectra Upgrade. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

160 13

May 21, 2025

160 13

May 21, 2025 -

Solo Leveling Garners First Award More Accolades Expected

May 21, 2025

Solo Leveling Garners First Award More Accolades Expected

May 21, 2025 -

North Carolina Under Severe Weather Watch Expect Heavy Rain And Potential Flooding Overnight

May 21, 2025

North Carolina Under Severe Weather Watch Expect Heavy Rain And Potential Flooding Overnight

May 21, 2025 -

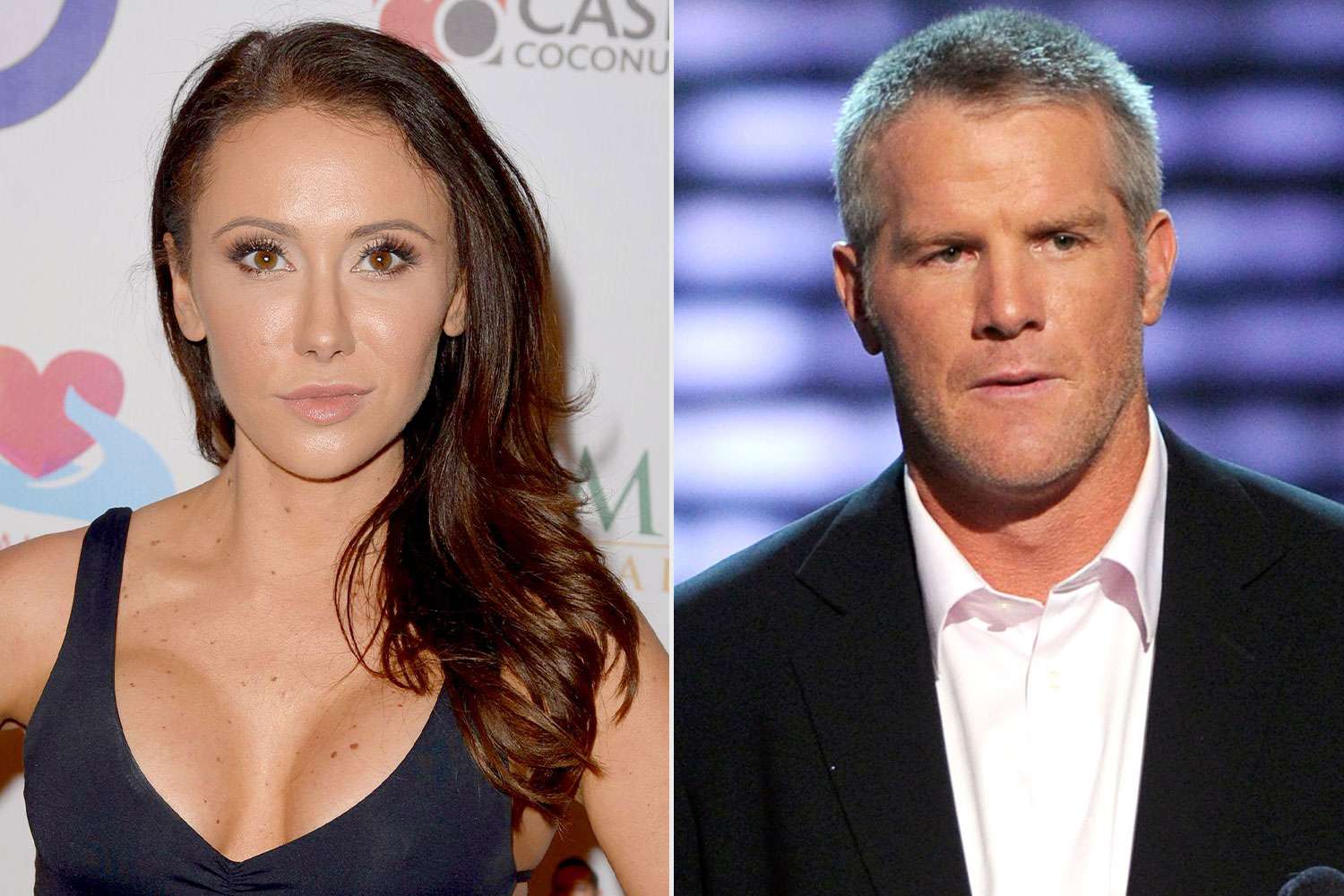

Jenn Sterger Recounts The Brett Favre Scandal A Story Of Betrayal And Neglect

May 21, 2025

Jenn Sterger Recounts The Brett Favre Scandal A Story Of Betrayal And Neglect

May 21, 2025 -

Rain And Cold To Dominate Weather Forecast For The Coming Week

May 21, 2025

Rain And Cold To Dominate Weather Forecast For The Coming Week

May 21, 2025