$200 Million Flows Into Ethereum Funds Following Pectra Upgrade

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

$200 Million Surge into Ethereum Funds After Successful Shanghai Upgrade

The Ethereum network witnessed a significant influx of capital following the successful completion of its Shanghai upgrade, with approximately $200 million flowing into various Ethereum-focused investment funds. This substantial investment surge underscores growing confidence in the network's future and the potential of staked ETH. The upgrade, which enabled the withdrawal of staked Ether (ETH), marked a pivotal moment for the second-largest cryptocurrency by market capitalization.

The Shanghai Upgrade: A Catalyst for Investment

The Shanghai upgrade, finalized on April 12, 2023, was highly anticipated within the crypto community. For months, millions of ETH had been locked in the Ethereum 2.0 staking contract, effectively unavailable to their owners. The ability to unstake and withdraw this ETH removed a major uncertainty, significantly reducing risk for many investors. This unlocked liquidity is now fueling fresh investments into the ecosystem.

This development is a monumental step in Ethereum's evolution, solidifying its position as a leading blockchain platform. The successful execution of such a complex upgrade demonstrates the network's resilience and its ability to adapt and improve over time. This, in turn, boosts investor confidence and encourages further capital inflow.

What Does This Mean for the Future of Ethereum?

The influx of $200 million represents a powerful vote of confidence in Ethereum's long-term prospects. Several factors contributed to this surge:

- Increased Liquidity: The ability to unstake ETH significantly increased liquidity within the market, making it more attractive to investors.

- Reduced Risk: The removal of the staking lock-up period reduced the perceived risk associated with investing in staked ETH.

- Improved Functionality: The Shanghai upgrade also included several other improvements to the Ethereum network, enhancing its overall efficiency and scalability.

- Growing Institutional Interest: The upgrade has attracted increased attention from institutional investors who are increasingly comfortable with the technology and its potential.

Beyond the Numbers: A Deeper Dive into Market Sentiment

While the $200 million figure is impressive, the underlying market sentiment is arguably more significant. The successful upgrade dispelled lingering concerns about the security and stability of the Ethereum network's staking mechanism. This positive sentiment could be a precursor to further substantial investment in the coming months.

Experts predict that this trend will continue as more investors become comfortable with the new possibilities opened up by the Shanghai upgrade. The increased liquidity is expected to stimulate further development and innovation within the Ethereum ecosystem.

Looking Ahead: The Implications for ETH Price and DeFi

The impact of this capital inflow is likely to be felt across several aspects of the Ethereum ecosystem. We can expect to see:

- Potential ETH Price Increase: The increased demand for ETH could lead to a rise in its price. However, market fluctuations are always a possibility.

- Growth in DeFi Activities: Decentralized finance (DeFi) protocols built on Ethereum are likely to benefit from the increased liquidity and activity. This could translate to greater usage and innovation within the DeFi space.

The Shanghai upgrade was more than just a technical update; it was a pivotal moment that demonstrated Ethereum's maturity and potential. The substantial inflow of capital is a strong indication of the market's belief in the long-term success of this groundbreaking blockchain technology. The future looks bright for Ethereum, and this investment surge serves as a compelling testament to its resilience and innovation.

Call to Action: Stay informed about the latest developments in the Ethereum ecosystem by following reputable crypto news sources and joining relevant online communities. Learn more about Ethereum staking and its benefits [link to a reputable Ethereum resource].

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on $200 Million Flows Into Ethereum Funds Following Pectra Upgrade. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Trumps Waning Influence Putins Actions Speak Louder

May 20, 2025

Trumps Waning Influence Putins Actions Speak Louder

May 20, 2025 -

Win Big Top Mlb Betting Splits And Predictions For May 19th

May 20, 2025

Win Big Top Mlb Betting Splits And Predictions For May 19th

May 20, 2025 -

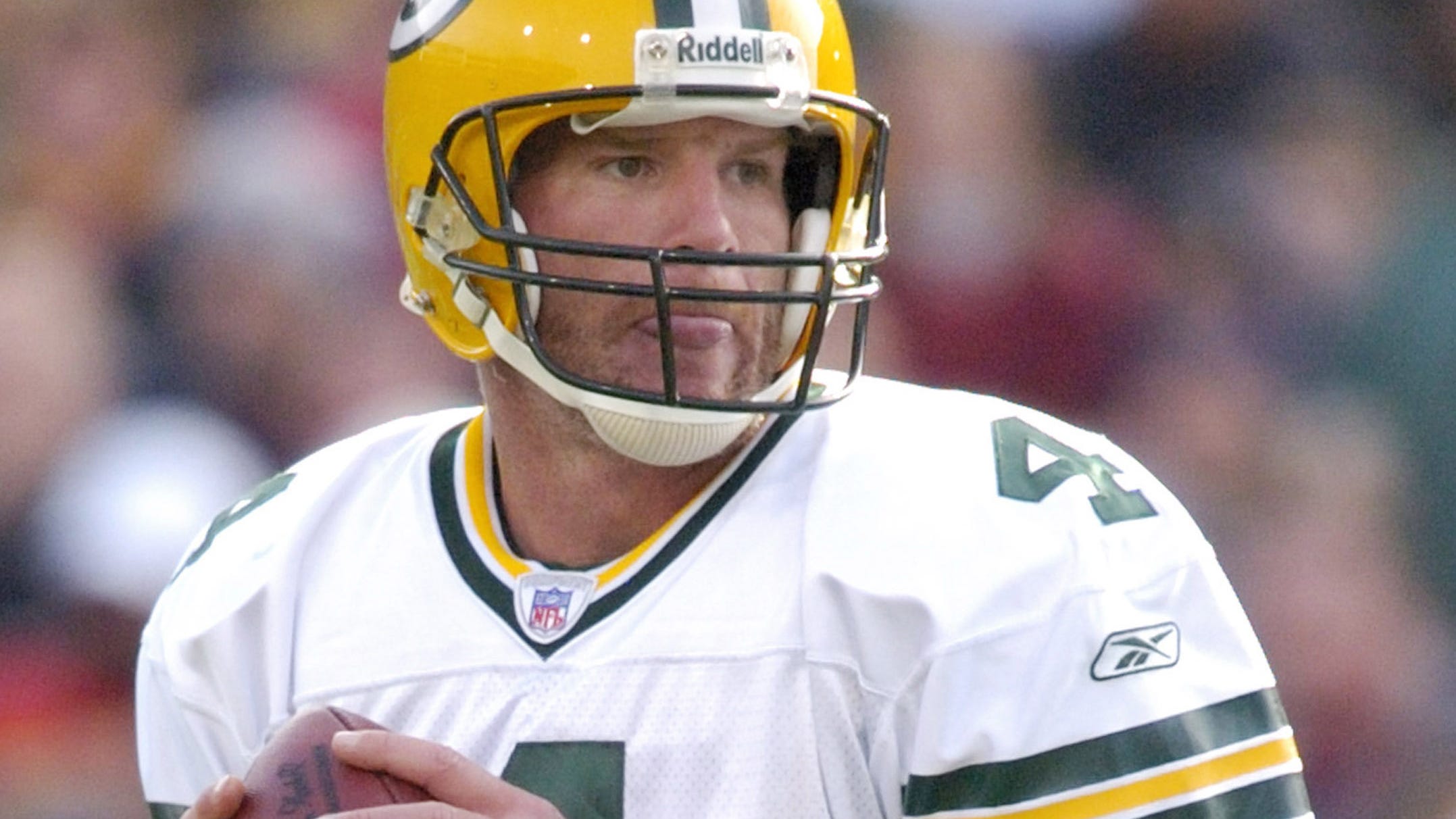

Behind The Scenes Of Fall Of Favre The Directors Perspective On The Documentary

May 20, 2025

Behind The Scenes Of Fall Of Favre The Directors Perspective On The Documentary

May 20, 2025 -

Severe Weather And Tornado Risk Urgent Warnings For Plains Midwest And Southern States

May 20, 2025

Severe Weather And Tornado Risk Urgent Warnings For Plains Midwest And Southern States

May 20, 2025 -

Balis New Rules For Tourists Curbing Misbehavior And Protecting The Island

May 20, 2025

Balis New Rules For Tourists Curbing Misbehavior And Protecting The Island

May 20, 2025