180 Life Sciences (ATNF): A Case Study In Biotech's Crypto Diversification

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

180 Life Sciences (ATNF): A Case Study in Biotech's Crypto Diversification

Introduction: The intersection of biotechnology and cryptocurrency might seem unconventional, but companies like 180 Life Sciences (ATNF) are demonstrating the potential for crypto diversification within the biotech sector. This article delves into 180 Life Sciences' journey, exploring how its strategic decisions reflect a broader trend in the industry and the implications for investors.

180 Life Sciences: A Biotech Pioneer Exploring Crypto Integration

180 Life Sciences (ATNF) is a clinical-stage biotechnology company focused on the development of novel therapies for inflammatory diseases and oncology. While primarily known for its pharmaceutical pipeline, the company has shown a keen interest in exploring the potential applications of cryptocurrency and blockchain technology. This innovative approach distinguishes it from many of its competitors, showcasing a forward-thinking strategy that seeks to mitigate financial risks and potentially unlock new avenues for funding and collaboration.

The Rationale Behind Crypto Diversification in Biotech

The volatile nature of the biotech industry, characterized by high R&D costs, lengthy clinical trials, and regulatory hurdles, necessitates robust financial strategies. Cryptocurrency, despite its own volatility, offers several potential benefits:

-

Hedging Against Market Fluctuations: By diversifying assets into cryptocurrencies, biotech companies can potentially mitigate the impact of downturns in traditional stock markets. This diversification strategy is particularly relevant during periods of economic uncertainty.

-

Access to Alternative Funding Sources: The decentralized nature of cryptocurrencies opens doors to alternative funding sources, including Initial Coin Offerings (ICOs) and Decentralized Finance (DeFi) platforms. This could be particularly useful for smaller biotech companies facing funding challenges.

-

Improved Transparency and Traceability: Blockchain technology can enhance transparency and traceability within the pharmaceutical supply chain, reducing counterfeiting and ensuring the authenticity of drugs.

-

Global Reach and Reduced Transaction Costs: Cryptocurrencies facilitate faster and cheaper cross-border transactions, crucial for companies operating in the global biotech market.

180 Life Sciences' Approach: A Closer Look

While the specifics of 180 Life Sciences' crypto strategy might not be publicly detailed, its exploration of alternative funding and risk mitigation approaches aligns with the broader trend of crypto integration in the biotech sector. Further research into their financial reports and public statements may reveal more specific details. However, the very fact they are operating in this space signifies a pioneering approach.

Challenges and Considerations

Despite the potential benefits, crypto diversification in biotech also presents challenges:

-

Regulatory Uncertainty: The regulatory landscape surrounding cryptocurrencies remains fluid and varies significantly across jurisdictions. Navigating this complexity requires careful legal and financial advice.

-

Volatility Risk: Cryptocurrencies are inherently volatile, and this volatility can impact a company's overall financial stability. Careful risk management is crucial.

-

Lack of widespread adoption: The widespread adoption of cryptocurrencies within the biotech industry is still in its early stages.

The Future of Crypto in Biotech

The integration of cryptocurrency and blockchain technology into the biotechnology sector is still in its nascent stages. However, companies like 180 Life Sciences are demonstrating the potential for innovation and growth. As the regulatory landscape evolves and the technology matures, we can expect to see more biotech companies explore this space, creating new opportunities and challenges for investors and the industry as a whole.

Call to Action: Stay informed about the developments in the intersection of biotechnology and cryptocurrency. Conduct thorough research before making any investment decisions, and consult with financial advisors to assess your risk tolerance. The potential rewards are significant, but so are the risks.

Keywords: 180 Life Sciences, ATNF, Biotech, Cryptocurrency, Crypto Diversification, Blockchain, Investment, Finance, Pharmaceutical, Oncology, Inflammatory Diseases, DeFi, ICO, Risk Management, Regulatory Uncertainty.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on 180 Life Sciences (ATNF): A Case Study In Biotech's Crypto Diversification. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

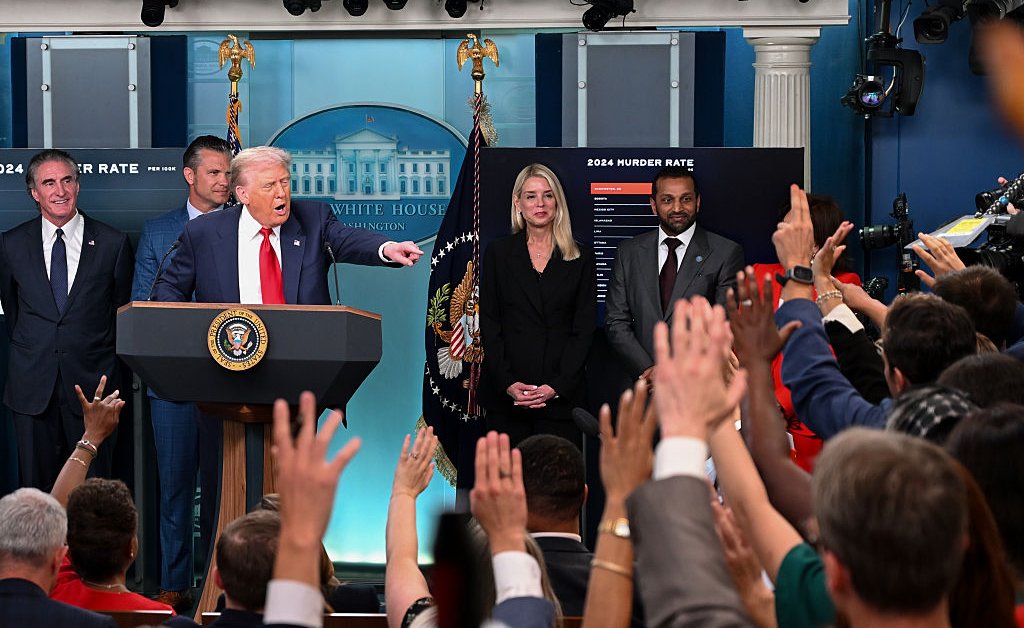

Is Trumps Approach To Dc In 2024 Mirroring His 2020 Playbook

Aug 13, 2025

Is Trumps Approach To Dc In 2024 Mirroring His 2020 Playbook

Aug 13, 2025 -

Lo L Season 3 Halloween Event The Return Of A Fan Favorite

Aug 13, 2025

Lo L Season 3 Halloween Event The Return Of A Fan Favorite

Aug 13, 2025 -

League Of Legends Wasd Control Scheme A 16 Year Journey To Testing

Aug 13, 2025

League Of Legends Wasd Control Scheme A 16 Year Journey To Testing

Aug 13, 2025 -

Where Are They Now 80s Icons Rare Public Appearance Stuns Fans

Aug 13, 2025

Where Are They Now 80s Icons Rare Public Appearance Stuns Fans

Aug 13, 2025 -

The Killers Confession A Documentary Featuring A Detectives Candid Interviews

Aug 13, 2025

The Killers Confession A Documentary Featuring A Detectives Candid Interviews

Aug 13, 2025

Latest Posts

-

37 Years After Reflecting On The Impact Of The 1985 Japan Airlines Crash

Aug 13, 2025

37 Years After Reflecting On The Impact Of The 1985 Japan Airlines Crash

Aug 13, 2025 -

How Spirituality Improves Mental Health Evidence Based Insights

Aug 13, 2025

How Spirituality Improves Mental Health Evidence Based Insights

Aug 13, 2025 -

Extreme Heat Returns To Southern Nevada Prepare For 114 F

Aug 13, 2025

Extreme Heat Returns To Southern Nevada Prepare For 114 F

Aug 13, 2025 -

Strengthening Mental Resilience The Benefits Of A Spiritual Practice

Aug 13, 2025

Strengthening Mental Resilience The Benefits Of A Spiritual Practice

Aug 13, 2025 -

Leak Reveals Resident Evil 4 Remake Could Be Leon Kennedys Send Off Game

Aug 13, 2025

Leak Reveals Resident Evil 4 Remake Could Be Leon Kennedys Send Off Game

Aug 13, 2025