15,775 Robinhood Shares Purchased By Wellington Management: Market Implications For HOOD

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Wellington Management's $1.6M HOOD Purchase: A Bullish Signal for Robinhood?

Wellington Management, a prominent investment firm, recently acquired 15,775 shares of Robinhood (HOOD) stock, sparking renewed interest and debate surrounding the financial technology company's future. This strategic move, valued at approximately $1.6 million based on recent market prices, could signal a positive outlook for HOOD stock, particularly considering Wellington's reputation for thorough due diligence. But what are the broader market implications of this significant investment?

This article delves into the details of this acquisition, exploring its potential impact on Robinhood's stock price and the wider fintech sector. We'll examine Wellington Management's investment strategy, analyze recent performance trends for HOOD, and consider the factors contributing to this surprising purchase.

Wellington Management's Strategic Investment in Robinhood

Wellington Management, known for its long-term investment approach and deep research capabilities, rarely makes headlines for individual stock purchases. This significant investment in Robinhood, therefore, deserves careful scrutiny. While the firm hasn't publicly disclosed its rationale, several interpretations are plausible. One possibility is that Wellington sees undervalued potential in Robinhood's platform and future growth prospects, despite recent challenges.

The firm might be betting on a turnaround for HOOD, anticipating a rebound in user engagement and revenue generation. This suggests confidence in Robinhood's ability to navigate the current competitive landscape and adapt to evolving market conditions. Another angle is that Wellington is taking a long-term view, predicting significant growth in the fintech sector as a whole. This purchase could represent a bet on the future success of the brokerage industry, with Robinhood poised to capitalize on this growth.

Analyzing Robinhood's Recent Performance and Future Outlook

Robinhood's stock performance has been volatile in recent years. The company faced challenges following its highly anticipated IPO, experiencing periods of significant price fluctuations. Recent quarterly reports have shown mixed results, with fluctuating user numbers and revenue streams. However, Robinhood has continued to innovate, introducing new products and services aimed at expanding its user base and boosting revenue.

Several factors could contribute to a potential rebound for HOOD:

- Increased adoption of its crypto trading platform: Robinhood's crypto trading features remain a popular draw for investors.

- Expansion into new financial services: Diversification into areas beyond stock and options trading could attract new customers and revenue streams.

- Improved regulatory compliance: Successfully navigating the increasingly complex regulatory landscape in the fintech sector could boost investor confidence.

Market Implications of Wellington's Investment

Wellington Management's investment could act as a catalyst for increased investor interest in Robinhood. The firm's reputation and thorough due diligence process lends credibility to their decision, potentially influencing other institutional investors to reconsider their positions on HOOD. This could lead to increased trading volume and a potential upward pressure on the stock price. However, it's crucial to remember that this is just one piece of the puzzle, and other market factors will significantly impact HOOD's future performance.

Conclusion: A Cautious Optimism

While Wellington Management's purchase of 15,775 Robinhood shares is a noteworthy development, investors should maintain a balanced perspective. While this could signal positive sentiment for HOOD, it's not a guarantee of future success. The stock's performance will ultimately depend on a multitude of factors, including market conditions, regulatory developments, and Robinhood's ability to execute its strategic plans. Further analysis and monitoring of the company's performance will be crucial in determining the long-term implications of this significant investment.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in the stock market involves risk, and you could lose money. Always conduct thorough research and consider consulting a financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on 15,775 Robinhood Shares Purchased By Wellington Management: Market Implications For HOOD. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Resultados Eleitorais Em Angola Onofre Dos Santos Defende Selo De Autenticidade Com Tecnologia

Jun 14, 2025

Resultados Eleitorais Em Angola Onofre Dos Santos Defende Selo De Autenticidade Com Tecnologia

Jun 14, 2025 -

George Kittle Rallies Behind Deebo Samuel Addressing Recent Criticism

Jun 14, 2025

George Kittle Rallies Behind Deebo Samuel Addressing Recent Criticism

Jun 14, 2025 -

Andrew Mc Cutchen Joey Wentz And The Hall Of Fame Your Pirates News Update

Jun 14, 2025

Andrew Mc Cutchen Joey Wentz And The Hall Of Fame Your Pirates News Update

Jun 14, 2025 -

Sam Burns Friday 65 A Perfect Putt Leads The Charge At U S Open

Jun 14, 2025

Sam Burns Friday 65 A Perfect Putt Leads The Charge At U S Open

Jun 14, 2025 -

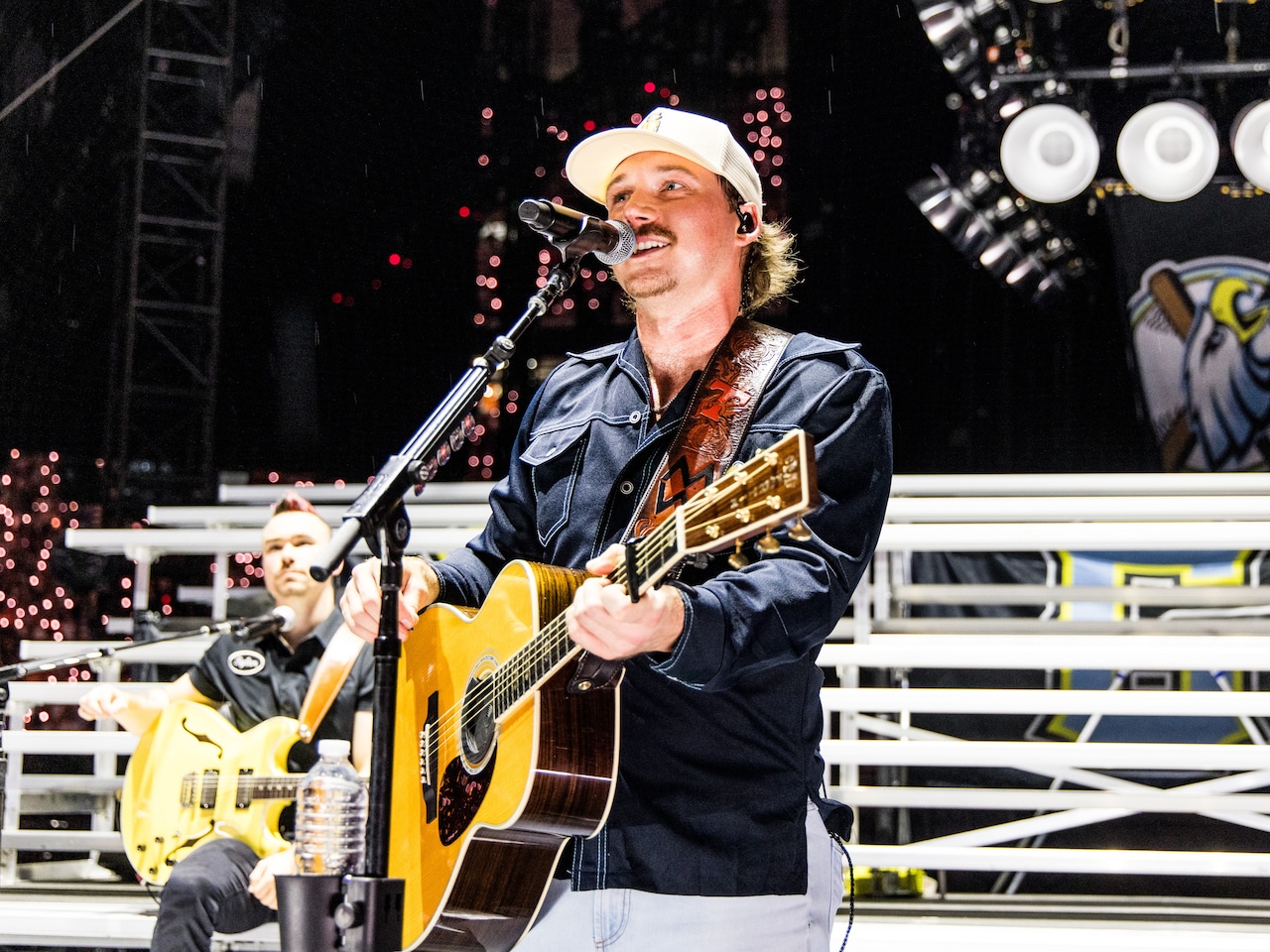

Score Affordable Morgan Wallen Tickets Houston I M The Problem Tour June 20 21

Jun 14, 2025

Score Affordable Morgan Wallen Tickets Houston I M The Problem Tour June 20 21

Jun 14, 2025