15,775 HOOD Shares Purchased: Wellington Management's Investment Strategy

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

15,775 HOOD Shares Purchased: Decoding Wellington Management's Investment Strategy

Wellington Management, a prominent global investment firm, recently made headlines with its purchase of 15,775 shares of Robinhood Markets, Inc. (HOOD). This move sparks considerable interest, prompting questions about the firm's investment strategy and the potential implications for HOOD's future. This article delves into the details, examining the context of this purchase and exploring its possible significance for investors.

Understanding Wellington Management's Approach

Wellington Management is known for its long-term, value-oriented investment philosophy. They employ a rigorous research process, focusing on fundamental analysis to identify undervalued companies with strong potential for growth. Their investments span various sectors, but a consistent thread is their commitment to thorough due diligence and a long-term perspective. This recent HOOD purchase, therefore, suggests a degree of confidence in the company's long-term prospects, despite its recent market volatility.

Why the HOOD Investment? A Look at Potential Factors:

Several factors could be contributing to Wellington Management's decision:

-

Potential for Growth: Robinhood, despite facing challenges, remains a significant player in the online brokerage industry. Its vast user base and potential for expansion into new financial services could attract long-term investors like Wellington. The firm may see the current share price as an attractive entry point, anticipating future growth.

-

Strategic Repositioning: Robinhood has been actively working to diversify its revenue streams and improve its financial performance. This repositioning might have influenced Wellington's assessment of the company's long-term value. Successful execution of its strategic plans could significantly boost HOOD's share price.

-

Market Sentiment Shift: While HOOD's stock has experienced fluctuations, recent developments or market sentiment shifts may have increased Wellington's confidence in the company's ability to recover and perform well. This could represent a strategic bet against prevailing market pessimism.

Analyzing the Implications for HOOD Investors:

The purchase of 15,775 HOOD shares by Wellington Management could be viewed as a vote of confidence. However, it’s crucial to remember that this is just one piece of the puzzle. Investors should conduct their own thorough research before making any investment decisions. Consider factors like:

-

Competition: The online brokerage industry is highly competitive. Robinhood faces stiff competition from established players and new entrants.

-

Regulatory Scrutiny: The financial industry is subject to significant regulatory oversight. Changes in regulations could impact Robinhood's operations and profitability.

-

Overall Market Conditions: The broader economic climate and market trends will undoubtedly affect HOOD's performance.

Conclusion: A Cautious Optimism?

Wellington Management's investment in HOOD suggests a degree of optimism regarding the company's future. However, investors should approach this news with caution and conduct their own due diligence. The purchase, while significant, is only one data point in a complex investment landscape. The long-term success of HOOD will depend on several factors, including its ability to execute its strategic plan, navigate competitive pressures, and adapt to evolving market conditions. Stay informed, diversify your portfolio, and consult with a financial advisor before making any significant investment decisions. For more insights into market trends, check out [link to relevant financial news source].

Keywords: HOOD, Robinhood Markets, Inc., Wellington Management, Investment Strategy, Stock Purchase, Online Brokerage, Stock Market, Investment Analysis, Financial News, Stock Market Trends.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on 15,775 HOOD Shares Purchased: Wellington Management's Investment Strategy. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Channing Tatum Reacts Ryan Reynolds Latest Announcement Explained

Jun 13, 2025

Channing Tatum Reacts Ryan Reynolds Latest Announcement Explained

Jun 13, 2025 -

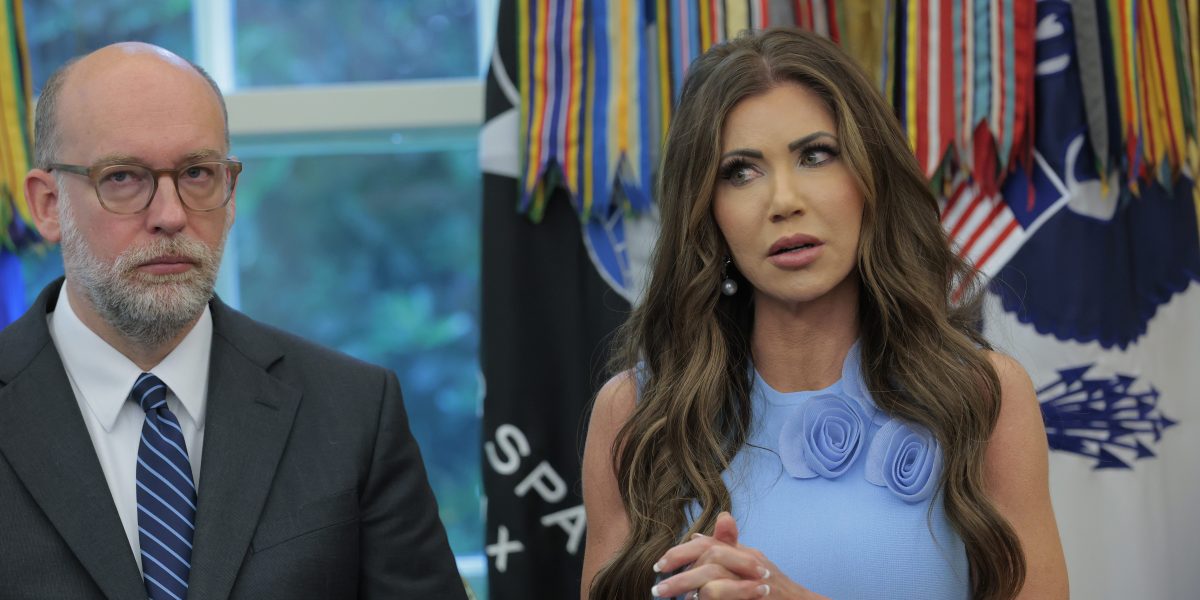

Noems Contradictory Statements On National Guard Deployment During Protests

Jun 13, 2025

Noems Contradictory Statements On National Guard Deployment During Protests

Jun 13, 2025 -

Second Night Of Curfew L A Protests Show No Sign Of Abating

Jun 13, 2025

Second Night Of Curfew L A Protests Show No Sign Of Abating

Jun 13, 2025 -

Hsbc Championships 2025 Dates Draws Past Winners And Tournament History

Jun 13, 2025

Hsbc Championships 2025 Dates Draws Past Winners And Tournament History

Jun 13, 2025 -

Barry Sanders Health Scare A Wake Up Call In New Documentary Film

Jun 13, 2025

Barry Sanders Health Scare A Wake Up Call In New Documentary Film

Jun 13, 2025