10 Stocks To Watch As US And China Resume Trade Negotiations: Jim Cramer's Picks

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

10 Stocks to Watch as US and China Resume Trade Negotiations: Jim Cramer's Picks

The simmering trade war between the US and China has shown signs of thawing, sparking renewed interest in affected sectors. With negotiations resuming, investors are eagerly anticipating a resolution, and the market is buzzing with speculation. Financial guru Jim Cramer has weighed in, offering his picks for 10 stocks poised to benefit significantly from a positive outcome. Are you ready to capitalize on this potential market shift?

Cramer's Rationale: A Cautiously Optimistic Outlook

While acknowledging the inherent uncertainties in international relations, Cramer expresses cautious optimism about the renewed talks. He believes a de-escalation of tensions could unlock significant growth opportunities in several key sectors. His selections reflect this view, focusing on companies directly impacted by the trade war and those expected to flourish in a more stable global economic climate. He emphasizes the importance of diversification and suggests these picks as part of a broader investment strategy, not as a guaranteed path to riches.

The Top 10 Stocks: Jim Cramer's Recommendations

Cramer's list isn't publicly available in a definitive, numbered format. However, based on his recent commentary and market analysis, we can infer likely candidates based on sectors predicted to rebound strongly:

1. Technology Giants (e.g., Apple, Qualcomm): These companies have been significantly impacted by tariffs. A resolution could lead to increased sales and reduced costs. [Link to Apple's investor relations page] [Link to Qualcomm's investor relations page]

2. Agricultural Companies (e.g., Deere & Company): The agricultural sector has been heavily affected by the trade war. A deal could boost soybean and other agricultural exports. [Link to Deere & Company's investor relations page]

3. Retailers (e.g., Target, Walmart): Reduced tariffs on imported goods could lower prices and boost consumer spending, benefiting major retailers. [Link to Target's investor relations page] [Link to Walmart's investor relations page]

4. Manufacturing Companies (e.g., Caterpillar): A more stable trade environment could lead to increased demand for heavy machinery and other manufactured goods. [Link to Caterpillar's investor relations page]

5. Semiconductor Companies (e.g., Micron Technology): The semiconductor industry has been significantly affected by trade tensions. Easing of restrictions could lead to a surge in sales. [Link to Micron Technology's investor relations page]

6. Financial Institutions (e.g., JPMorgan Chase): A more stable global economy generally benefits financial institutions. [Link to JPMorgan Chase's investor relations page]

7. Energy Companies (e.g., ExxonMobil): Global energy markets are sensitive to geopolitical events. A trade deal could contribute to greater stability. [Link to ExxonMobil's investor relations page]

8. Transportation Companies (e.g., FedEx, UPS): Increased trade volume would naturally benefit shipping and logistics companies. [Link to FedEx's investor relations page] [Link to UPS's investor relations page]

9. Consumer Discretionary Companies (e.g., Nike): Reduced tariffs could translate into lower prices and increased consumer spending. [Link to Nike's investor relations page]

10. Industrial Companies (e.g., Boeing): The aerospace sector is significantly impacted by global trade. A resolution could boost aircraft sales and production. [Link to Boeing's investor relations page]

Important Considerations:

- This is not financial advice: The information provided is for informational purposes only and should not be considered investment advice. Always conduct thorough research and consult with a financial advisor before making any investment decisions.

- Risk Assessment: Investing in the stock market always involves risk. The potential benefits of a US-China trade deal are counterbalanced by the ongoing uncertainties.

Conclusion: Navigating the Uncertainties

The resumption of US-China trade negotiations offers a glimmer of hope for investors. While the outcome remains uncertain, keeping a close eye on these sectors and companies – bearing in mind Cramer's cautious optimism – could provide valuable insights into potential market movements. Remember to always diversify your portfolio and manage risk effectively. Stay informed, and stay invested wisely.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on 10 Stocks To Watch As US And China Resume Trade Negotiations: Jim Cramer's Picks. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Jabeur Vs Kvitova In Rome Live Stream Preview And Betting Odds

May 11, 2025

Jabeur Vs Kvitova In Rome Live Stream Preview And Betting Odds

May 11, 2025 -

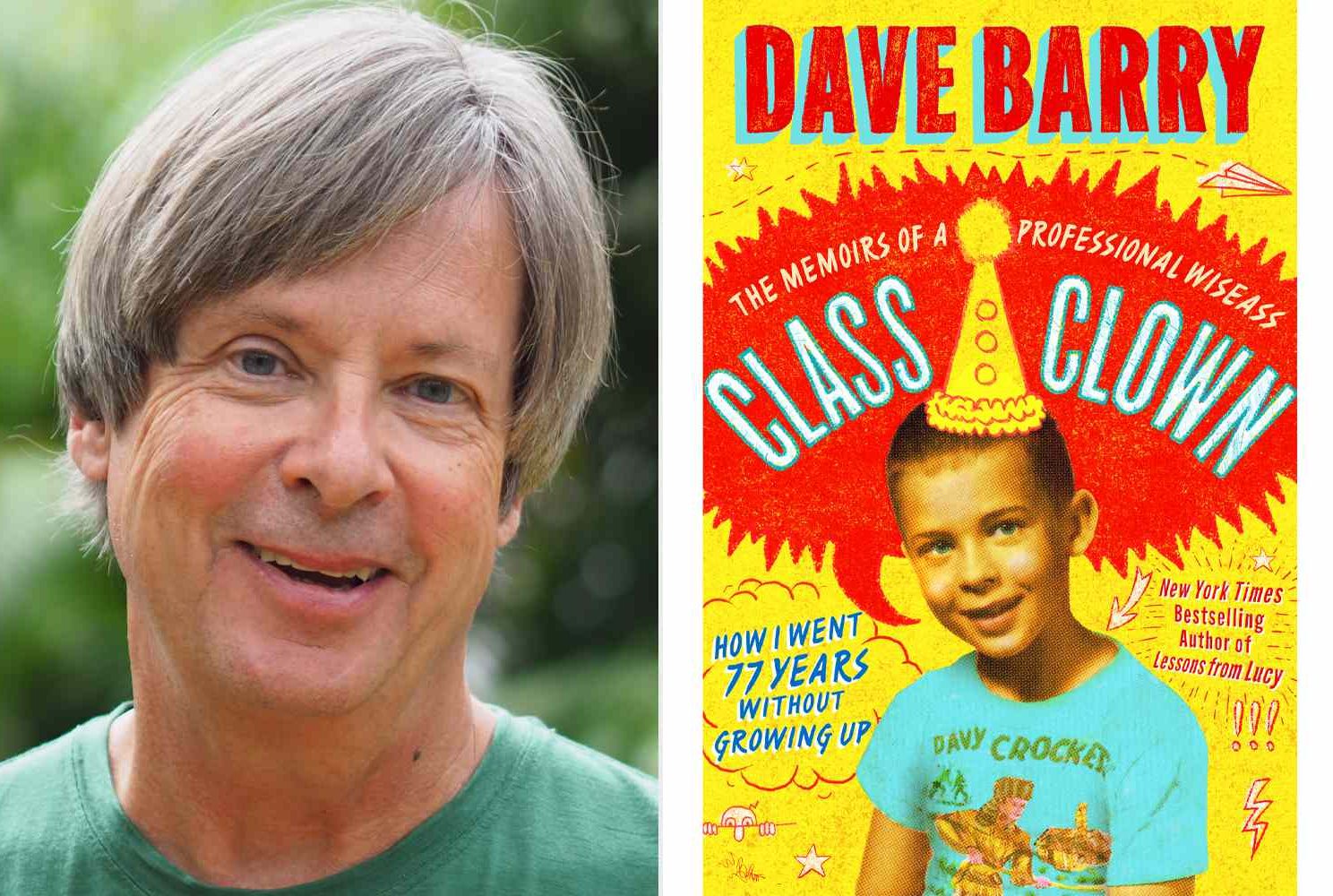

Dont Miss Dave Barry And Angie Corio Live At Keplers On May 12th

May 11, 2025

Dont Miss Dave Barry And Angie Corio Live At Keplers On May 12th

May 11, 2025 -

Watch Ons Jabeur Vs Petra Kvitova In Rome Live Stream And Predictions

May 11, 2025

Watch Ons Jabeur Vs Petra Kvitova In Rome Live Stream And Predictions

May 11, 2025 -

La Realidad De La Industria Petrolera Venezolana El Caso De Los Barcos Varados En Maracaibo

May 11, 2025

La Realidad De La Industria Petrolera Venezolana El Caso De Los Barcos Varados En Maracaibo

May 11, 2025 -

Villanova Celebrates Pope Francis Legacy A Universitys Pride

May 11, 2025

Villanova Celebrates Pope Francis Legacy A Universitys Pride

May 11, 2025