$1 Billion Deal: Subway's Parent Company Expands With Major Chicken Chain Purchase

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

$1 Billion Deal: Subway's Parent Company Makes Major Move with Purchase of Arby's

Roark Capital's acquisition of Arby's marks a significant expansion in the fast-food industry, signifying a powerful consolidation of brands under one roof.

The fast-food landscape just shifted dramatically. Roark Capital, the private equity firm that already owns Subway, has announced a staggering $1 billion deal to acquire Arby's, a prominent player in the roast beef and chicken sandwich market. This acquisition marks a significant expansion for Roark and presents a fascinating case study in the evolving dynamics of the quick-service restaurant (QSR) industry. The deal underscores a clear trend: consolidation and the pursuit of synergistic growth within the competitive fast-food sector.

This isn't just a simple buy-out; it's a strategic maneuver with potentially far-reaching consequences. The combined power of Subway and Arby's creates a formidable force, offering a wider range of menu options and potentially leveraging shared resources for enhanced efficiency and profitability. Analysts predict a ripple effect across the industry, prompting other major players to consider similar strategic alliances or acquisitions.

Why this deal matters:

- Market Domination: The combined reach of Subway and Arby's expands their market share significantly, placing them in a stronger position to compete with industry giants like McDonald's and Burger King.

- Menu Diversification: This acquisition allows for potential menu cross-promotion and innovation. Imagine Arby's signature roast beef on a Subway sub, or Subway's fresh veggies incorporated into Arby's menu. The possibilities are vast and exciting for consumers.

- Operational Synergies: Roark Capital can leverage economies of scale by streamlining operations, procurement, and marketing efforts across both brands. This could lead to cost savings and increased profitability.

- Brand Enhancement: The acquisition could boost the image and brand recognition of both Subway and Arby's, attracting new customer demographics.

What's next for Subway and Arby's?

The immediate future will likely involve integrating the two companies’ operations. This will require careful planning and execution to avoid disruptions to either brand's existing operations. However, the long-term potential is considerable. We can expect to see:

- Increased investment in technology: Expect improvements in online ordering, delivery services, and potentially even AI-driven personalization in marketing and menu development.

- Expansion into new markets: The combined resources could facilitate faster expansion into new geographical territories, both domestically and internationally.

- Focus on sustainable practices: Consumers are increasingly conscious of sustainability. We might see initiatives focused on ethical sourcing, reducing waste, and improving energy efficiency across both brands.

The future of fast food:

This $1 billion deal is a clear indication of the ongoing consolidation in the fast-food industry. Smaller chains are increasingly facing pressure to adapt or be acquired by larger players. This trend is expected to continue, with more mergers and acquisitions likely in the coming years.

Call to action: What are your thoughts on this major acquisition? Share your predictions for the future of Subway and Arby's in the comments below. Are you excited about the potential for menu innovation? Let us know!

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on $1 Billion Deal: Subway's Parent Company Expands With Major Chicken Chain Purchase. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Local Unions And Rep Ro Khanna Condemn Recent Federal Job Cuts

Jun 04, 2025

Local Unions And Rep Ro Khanna Condemn Recent Federal Job Cuts

Jun 04, 2025 -

Federal Layoff Announcement Met With Resistance From Rep Khanna And Local Unions

Jun 04, 2025

Federal Layoff Announcement Met With Resistance From Rep Khanna And Local Unions

Jun 04, 2025 -

The Donald Trump Scott Walker Incident What Went Wrong And Why It Matters

Jun 04, 2025

The Donald Trump Scott Walker Incident What Went Wrong And Why It Matters

Jun 04, 2025 -

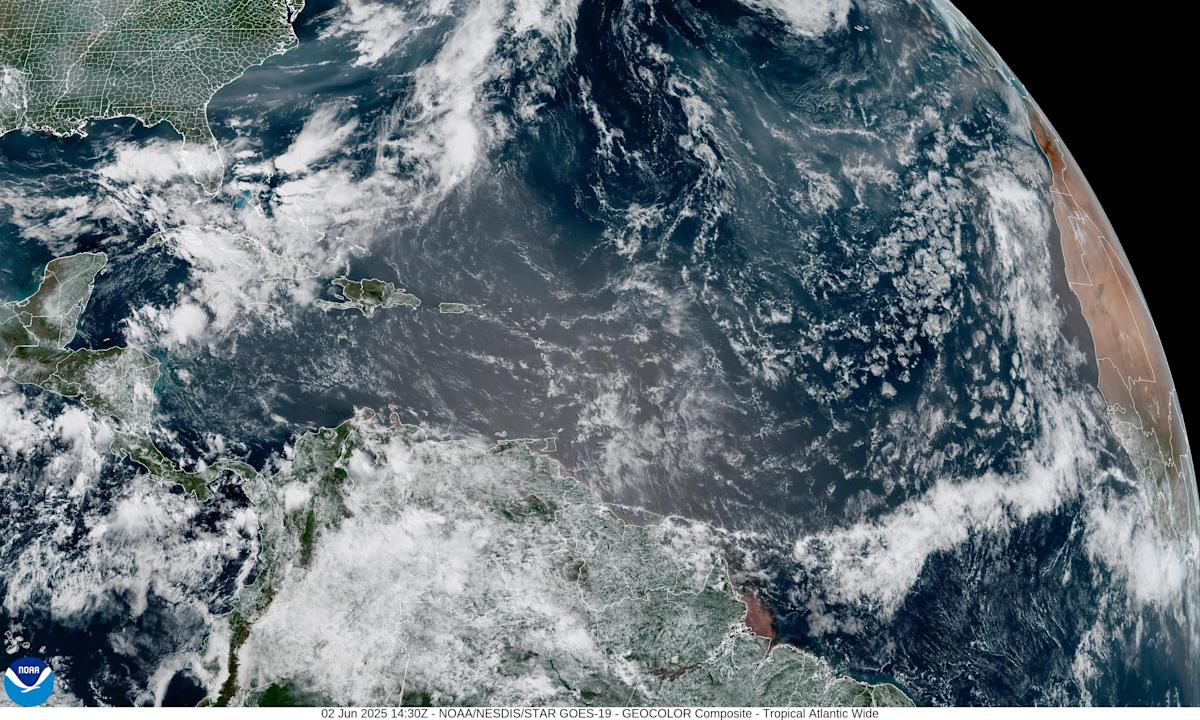

Impacts Of Saharan Dust And Canadian Wildfire Smoke On Floridas Environment

Jun 04, 2025

Impacts Of Saharan Dust And Canadian Wildfire Smoke On Floridas Environment

Jun 04, 2025 -

Asante Blackk Peyton Alex Smith And Simmie Sims Iii Join Snowfall Spinoff Pilot

Jun 04, 2025

Asante Blackk Peyton Alex Smith And Simmie Sims Iii Join Snowfall Spinoff Pilot

Jun 04, 2025