$1 Billion Deal: Subway's Parent Company Expands With Chicken Chain Acquisition

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

$1 Billion Deal: Subway's Parent Company Makes a Big Splash with Chicken Chain Acquisition

Roark Capital's massive investment signals a significant shift in the fast-food landscape.

The fast-food world is buzzing! Roark Capital, the private equity firm that owns Subway, has just announced a staggering $1 billion acquisition of Arby's, shaking up the industry and raising eyebrows across the board. This bold move signals a significant expansion for Roark and potentially reshapes the competitive dynamics within the quick-service restaurant (QSR) sector. The deal, which closed recently, underscores the continued investment in the restaurant industry despite economic uncertainties.

This isn't just any acquisition; it's a strategic power play that merges two iconic brands under one roof, creating a massive fast-food conglomerate. The combined strengths of Subway's extensive global reach and Arby's robust menu, particularly its renowned roast beef and chicken offerings, present significant growth opportunities for Roark.

Why this deal matters:

- Market Domination: The acquisition instantly boosts Roark's market share and expands its portfolio beyond sandwiches. The combined brand recognition and customer base of Subway and Arby's is almost unparalleled.

- Synergies and Cost Savings: Analysts predict significant operational synergies between the two chains. Shared supply chains, marketing campaigns, and technology infrastructure could lead to substantial cost reductions and increased profitability.

- Menu Expansion and Innovation: The potential for menu innovation is immense. Imagine Subway incorporating Arby's popular chicken sandwiches, or Arby's offering Subway's diverse range of salads and veggie options. This cross-pollination could lead to exciting new menu items and attract a broader customer base.

- International Growth: Subway's already extensive global presence provides a ready-made platform for Arby's to expand internationally, potentially unlocking new markets and revenue streams.

The Future of Roark Capital and the Fast-Food Industry:

This billion-dollar deal marks a significant turning point for Roark Capital, showcasing its ambitious growth strategy within the QSR sector. It also raises questions about the future of the fast-food industry, prompting speculation about potential further acquisitions and consolidations. Will this lead to a wave of mergers and acquisitions, reshaping the competitive landscape in the coming years? Only time will tell.

What this means for consumers:

While the long-term impacts remain to be seen, consumers can expect to see some changes. Potential benefits include:

- Expanded Menu Choices: A wider variety of food options may become available at both Subway and Arby's locations.

- Improved Loyalty Programs: The integration of loyalty programs could lead to enhanced rewards and benefits for frequent customers.

- Potential Price Changes: The impact on pricing is unclear, but economies of scale could potentially lead to more competitive pricing in the long run.

The deal raises several crucial questions:

- Will the integration of two such distinct brands be successful?

- How will the combined company maintain brand individuality while capitalizing on synergies?

- What innovative menu items can we expect to see emerge from this merger?

This acquisition is undeniably a game-changer. We'll be closely following the developments and reporting on the impact of this significant deal on the fast-food industry and consumers alike. Stay tuned for further updates!

Keywords: Roark Capital, Subway, Arby's, acquisition, fast food, billion-dollar deal, restaurant industry, mergers and acquisitions, QSR, menu innovation, market share, brand synergy, economic impact, consumer impact.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on $1 Billion Deal: Subway's Parent Company Expands With Chicken Chain Acquisition. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Will Ukraines Drone Strikes Set A New Military Precedent

Jun 04, 2025

Will Ukraines Drone Strikes Set A New Military Precedent

Jun 04, 2025 -

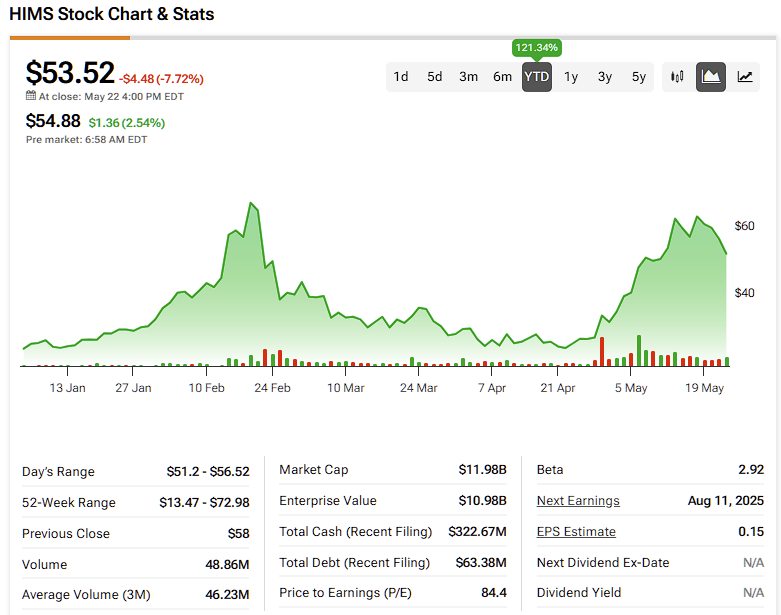

Hims And Hers Hims Stock Understanding The Volatility

Jun 04, 2025

Hims And Hers Hims Stock Understanding The Volatility

Jun 04, 2025 -

Fried Chicken Giant Acquired Private Equity Deal Reaches 1 Billion

Jun 04, 2025

Fried Chicken Giant Acquired Private Equity Deal Reaches 1 Billion

Jun 04, 2025 -

South Loop Stadium Project Chicago Fire Fcs Vision For The Future Of Soccer

Jun 04, 2025

South Loop Stadium Project Chicago Fire Fcs Vision For The Future Of Soccer

Jun 04, 2025 -

Huge Sahara Dust Plume Sweeps Across Caribbean Us In Path

Jun 04, 2025

Huge Sahara Dust Plume Sweeps Across Caribbean Us In Path

Jun 04, 2025