$1 Billion Deal: Subway's Parent Company Expands Into Chicken Restaurant Market

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

$1 Billion Deal: Subway's Parent Company Roasts into the Chicken Restaurant Market

Subway's parent company, Roark Capital, just made a colossal splash in the fast-food world, acquiring the popular chicken restaurant chain, Arby's. In a deal valued at a staggering $1 billion, Roark Capital significantly expands its portfolio and intensifies competition within the already fiercely contested quick-service restaurant (QSR) sector. This acquisition signals a major shift in the fast-food landscape, prompting speculation about potential synergies and future strategies for both brands.

This isn't just another corporate buyout; it's a strategic maneuver with potentially far-reaching consequences. Roark Capital, known for its investments in restaurant brands, clearly sees significant growth potential in the chicken segment. The deal underscores the booming popularity of chicken as a fast-food staple and the increasing demand for diverse menu options.

<h3>Roark Capital's Growing Empire: A Strategic Acquisition</h3>

Roark Capital's acquisition of Arby's isn't a surprise to industry analysts. The private equity firm has a long history of successful investments in the restaurant industry, owning a diverse portfolio including well-known brands like Auntie Anne's, Carvel, and now Arby's. This latest acquisition strategically diversifies their holdings, reducing reliance on any single brand and strengthening their overall market position. The combined strength of Arby's and Subway offers compelling opportunities for cross-promotion, supply chain optimization, and potential menu innovations.

<h3>The Chicken Wars Heat Up: Competition Intensifies</h3>

The fast-food industry is currently experiencing a "chicken war," with major players like KFC, Popeyes, and Chick-fil-A fiercely competing for market share. Arby's, with its existing strong brand recognition and loyal customer base, provides Roark Capital with a powerful entry point into this highly competitive segment. The acquisition could lead to increased competition, forcing other players to innovate and enhance their offerings to remain competitive.

<h3>Potential Synergies and Future Implications</h3>

The integration of Arby's into Roark Capital's portfolio, alongside Subway, presents exciting possibilities for both brands. Some potential synergies include:

- Shared Supply Chains: Consolidating supply chains could lead to cost savings and improved efficiency.

- Cross-Promotional Opportunities: Joint marketing campaigns and bundled offers could attract new customers and boost sales for both brands.

- Menu Innovation: The possibility of menu item collaborations, leveraging the strengths of both brands, is an exciting prospect. Imagine a Subway sandwich featuring Arby's signature sauce!

However, challenges remain. Successfully integrating two distinct brands requires careful planning and execution. Maintaining the unique identities and brand loyalties of both Arby's and Subway will be crucial for the long-term success of this acquisition.

<h3>What's Next for Arby's and Subway?</h3>

This $1 billion deal marks a significant turning point for both Arby's and Subway. While the immediate future remains uncertain, the potential for growth and innovation is undeniable. Roark Capital's strategic expertise and financial resources position both brands for continued success in a dynamic and competitive market. Only time will tell the full impact of this massive acquisition on the fast-food landscape. We'll be watching closely for further developments and updates in the coming months.

Call to Action: What are your thoughts on this major acquisition? Share your predictions for Arby's and Subway in the comments below!

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on $1 Billion Deal: Subway's Parent Company Expands Into Chicken Restaurant Market. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Eurozone Expansion Bulgarias Path To Membership And Economic Outlook

Jun 04, 2025

Eurozone Expansion Bulgarias Path To Membership And Economic Outlook

Jun 04, 2025 -

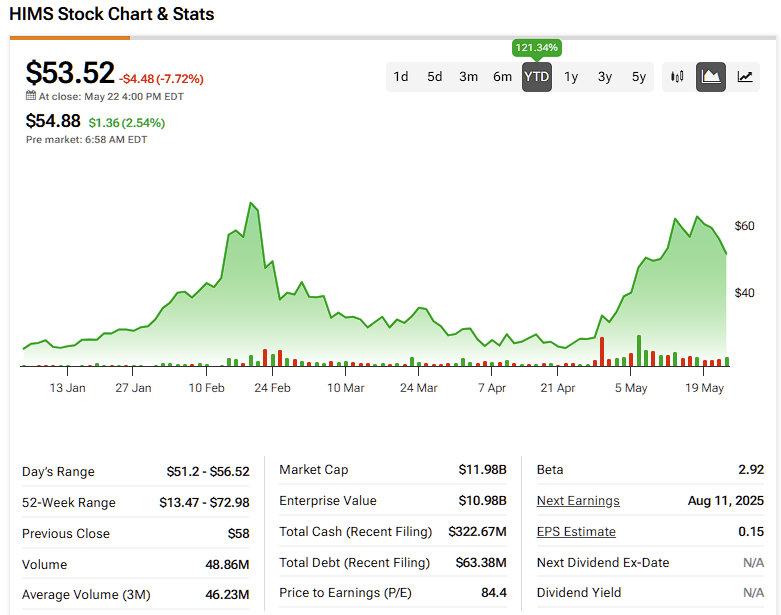

Hims And Hers Hims Understanding The Risks And Rewards Of This Healthcare Stock

Jun 04, 2025

Hims And Hers Hims Understanding The Risks And Rewards Of This Healthcare Stock

Jun 04, 2025 -

Crimean Bridge Hit Ukraine Claims Responsibility For Strike With Underwater Explosives

Jun 04, 2025

Crimean Bridge Hit Ukraine Claims Responsibility For Strike With Underwater Explosives

Jun 04, 2025 -

Team Overhaul Marquezs Assessment Ahead Of Indias Exhibition Game Against Thailand

Jun 04, 2025

Team Overhaul Marquezs Assessment Ahead Of Indias Exhibition Game Against Thailand

Jun 04, 2025 -

Hims Stock 3 02 Surge On May 30th Whats Behind The Rise

Jun 04, 2025

Hims Stock 3 02 Surge On May 30th Whats Behind The Rise

Jun 04, 2025