$1 Billion Acquisition: Private Equity Takes Over Beloved Fried Chicken Brand

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

$1 Billion Acquisition: Private Equity Firm Snaps Up Beloved Fried Chicken Brand, Sparking Industry Debate

The fried chicken industry is sizzling with news of a major acquisition. A little-known private equity firm, Zenith Capital Partners, has announced a staggering $1 billion acquisition of "Crispy Critters," the beloved fried chicken chain known for its unique Southern-style recipes and cult following. This deal marks one of the largest acquisitions in the fast-food sector this year, sending shockwaves through the industry and raising questions about the future of this iconic brand.

The acquisition, finalized last week, has left many long-time Crispy Critters fans wondering about the implications for their favorite fried chicken. Will the recipes change? Will prices increase? Will the unique, family-friendly atmosphere that defines Crispy Critters be altered? These are just some of the concerns swirling amongst loyal customers and industry experts alike.

<h3>Zenith Capital Partners: A Silent Player Makes a Big Move</h3>

Zenith Capital Partners, while successful, is relatively unknown compared to other major players in the private equity world. This secretive nature has fueled speculation about their long-term plans for Crispy Critters. While the firm has released a statement promising to "honor the legacy and quality" of the brand, the lack of specific details has left many feeling uncertain. Their portfolio includes several successful restaurant chains, although none on the scale of Crispy Critters, suggesting a bold expansion strategy. This lack of transparency is a common criticism leveled against private equity firms, often accused of prioritizing short-term profits over long-term brand health. [Link to article about Private Equity Transparency].

<h3>What Does This Mean for Crispy Critters Customers?</h3>

The immediate impact on customers remains to be seen. Zenith Capital Partners has emphasized their commitment to maintaining the current menu and operational style, but the reality may differ. History shows that private equity acquisitions often lead to cost-cutting measures and a shift in focus towards maximizing profits. This could translate to:

- Increased prices: Higher operational costs and investor demands may lead to menu price increases.

- Changes to recipes: In an effort to reduce costs, some ingredients might be substituted with cheaper alternatives, potentially impacting the quality and taste.

- Franchisee concerns: Existing franchisees may face pressure to meet new performance targets set by the private equity firm.

These potential negative consequences have sparked widespread online discussions and concerns among Crispy Critters devotees. Many are expressing their apprehension on social media, using the hashtag #SaveCrispyCritters.

<h3>The Future of Fast Food and Private Equity</h3>

This acquisition highlights the growing influence of private equity in the fast-food sector. The industry is ripe for consolidation, with many smaller chains becoming attractive targets for large investment firms. This trend often leads to increased competition and potential disruption of smaller, independent brands. [Link to article on Private Equity in Fast Food]. The long-term impact of Zenith Capital Partners' acquisition on Crispy Critters, and the broader fast-food landscape, will be a story worth following closely.

<h3>What's Next?</h3>

The next few months will be crucial in determining the future of Crispy Critters under its new ownership. Zenith Capital Partners' actions will determine whether they are truly committed to preserving the brand's legacy or prioritizing short-term financial gains. Only time will tell if this billion-dollar deal will be a recipe for success or a case study in how private equity can negatively impact beloved brands. We'll continue to provide updates as the story unfolds. Stay tuned!

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on $1 Billion Acquisition: Private Equity Takes Over Beloved Fried Chicken Brand. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

England Vs West Indies Womens Cricket Odi 2 Live Score Updates

Jun 04, 2025

England Vs West Indies Womens Cricket Odi 2 Live Score Updates

Jun 04, 2025 -

Crimea Bridge Explosion Damage Assessment And Reactions

Jun 04, 2025

Crimea Bridge Explosion Damage Assessment And Reactions

Jun 04, 2025 -

Chinese Ev Maker Nios Q1 Earnings Preview Can Delivery Growth Offset Tariff Worries

Jun 04, 2025

Chinese Ev Maker Nios Q1 Earnings Preview Can Delivery Growth Offset Tariff Worries

Jun 04, 2025 -

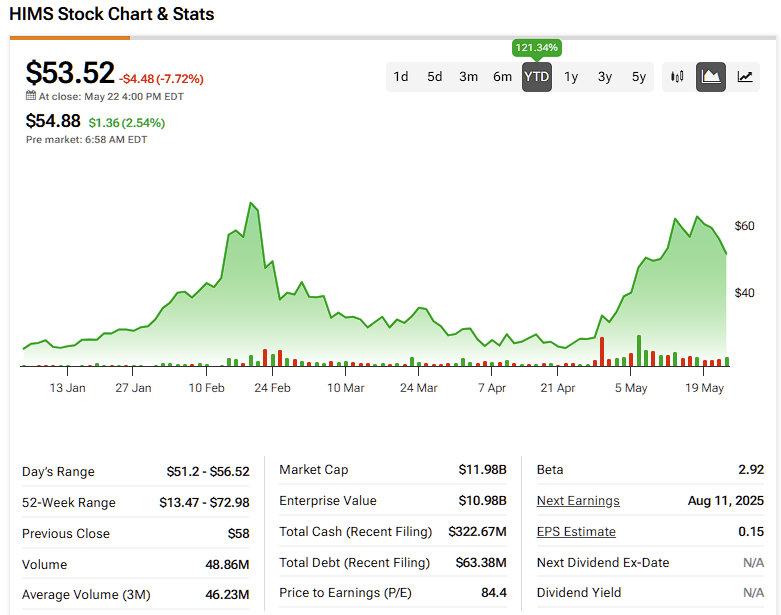

Hims And Hers Hims Understanding The Risks And Rewards Of This Healthcare Stock

Jun 04, 2025

Hims And Hers Hims Understanding The Risks And Rewards Of This Healthcare Stock

Jun 04, 2025 -

Exploring The Influence Of Tech Moguls On Jesse Armstrongs Mountainhead In Succession

Jun 04, 2025

Exploring The Influence Of Tech Moguls On Jesse Armstrongs Mountainhead In Succession

Jun 04, 2025